Asics: We want to 'win in running' in 2019

It’s been a weird few years in the U.S. sneaker market.

“Performance” sneakers—shoes worn to play sports or exercise in—have seen steady declines, while the athleisure trend has chugged onward and fueled “lifestyle” sneakers worn for everyday comfort and fashion. Adidas, with its popular retro lines, has been boosted by the trend, while Under Armour has been particularly hurt due to the decline in performance basketball sneakers.

As NPD Group sneaker analyst Matt Powell wrote in May, “We are soon to begin the fourth year of soft sales for performance footwear... sales have essentially flatlined since the banner year of 2015.”

Amid all this doom and gloom, Asics America CEO Gene McCarthy still has high hopes for the brand. “This year,” he tells Yahoo Finance, “it’s ‘win in running.’ Not place, not show. Win in running.”

That’s ambitious, considering that almost no one is really “winning” in running right now. As Powell wrote in May: “Performance running declined in the mid-singles as new initiatives from many brands did not move the needle.” And Asics reported double-digit sales declines in the U.S. in every quarter last year.

To turn things around, Asics has just signed two new athlete endorsers: U.S. women’s marathoners Emma Bates and Allie Kieffer. “Having them on board,” McCarthy says, “and not just having them wear our product but having them always on 24/7 as part of the brand, I think is the way to go.”

In fact, even at a time when traditional athlete endorsements are generally seen as less effective, McCarthy says Asics is doubling down on athlete and celebrity endorsements, citing the success of recent examples like its partnership with the D.J. Steve Aoki, which ended last year.

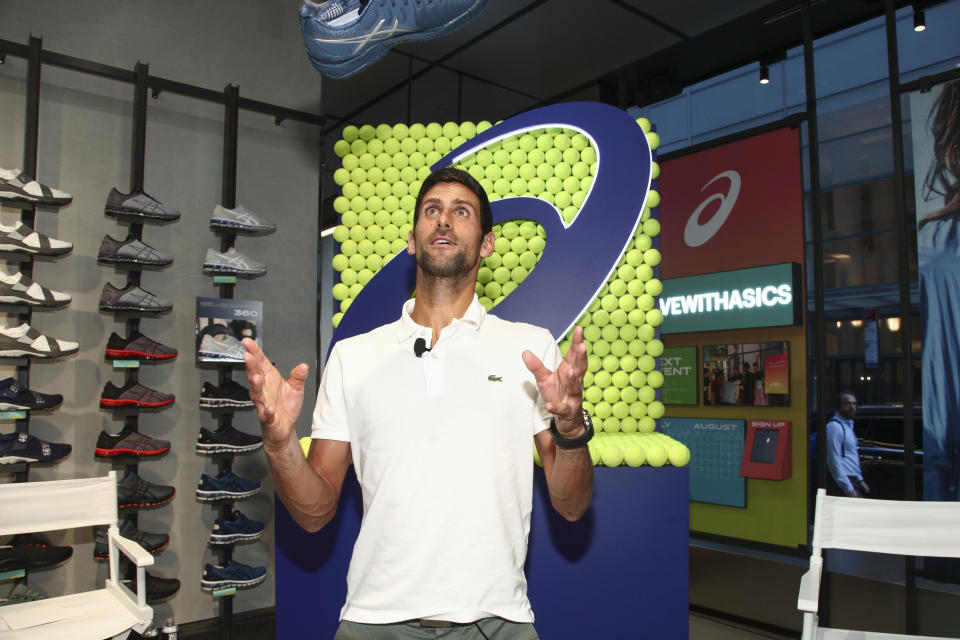

Asics in 2016 also ended its 25-year run as a sponsor of the New York City Marathon, and McCarthy says, “We’d rather focus on being associated with some of the best athletes in the world—and not only how they do on the field, or on the track, or on the roads, but also how they do off. How do they communicate, and can they be the right brand ambassadors for us?” Another one of those ambassadors is tennis star Novak Djokovic.

Asics, many American devotees may not know, is a Japanese conglomerate, publicly traded on the Tokyo Stock Exchange. The stock is down 17% over the past 12 months.

McCarthy became Asics America CEO in 2015. “When I joined this brand, there was a treasure chest of products that had been with the brand for a long time that any other brand would wish they had, like the Kayano,” he says. “So you’re going to see a lot of great storytelling... reminding people that when you think of running, you think of us.” This month, Asics launched the Gel Nimbus 21 running line in the U.S. And McCarthy says Asics wants to go beyond targeting hardcore runners.

“I think there’s a new audience out there where they’re not ‘runners,’ they are people who run,” he says. “Particularly millennials. And they’re not familiar with this brand, and that’s the hard work that we have ahead of us.”

—

Daniel Roberts is the sports business writer at Yahoo Finance. Follow him on Twitter at @readDanwrite.

Read more:

Nike store foot traffic spiked 17% in the week after Kaepernick ad

The case for — and against — Under Armour selling itself

The athlete endorsement model is broken

Asics CEO: Some sneaker brands are following ‘recipe for death’

Yahoo Finance

Yahoo Finance