ASGN Inc (ASGN) Q1 2024 Earnings: Aligns with EPS Projections Amidst Revenue Decline

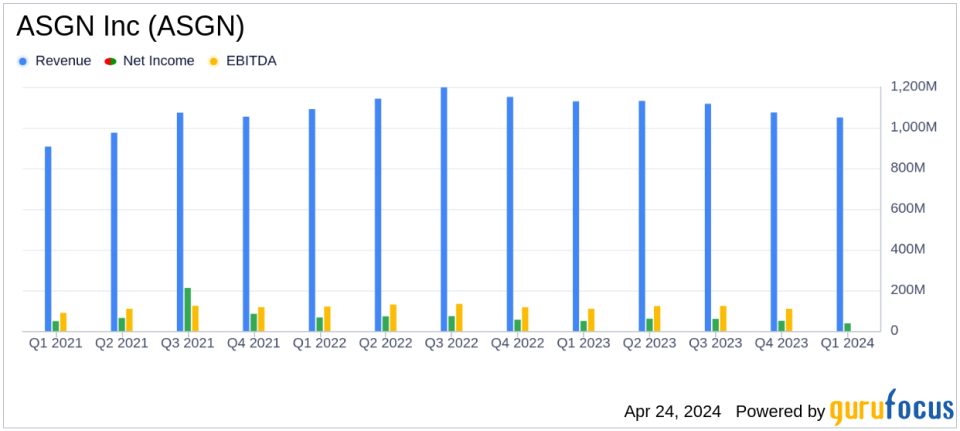

Revenue: $1.05 billion, down 7.1% year-over-year, slightly above estimates of $1.043 billion.

Net Income: $38.1 million, fell short of estimates of $54.35 million.

Earnings Per Share (EPS): $0.81, below estimates of $1.11.

Free Cash Flow: $62.5 million, demonstrating strong cash generation capabilities.

Gross Margin: Decreased to 28.2% from 28.9% year-over-year, reflecting a higher mix of lower-margin government segment revenues.

Stock Repurchase: Repurchased approximately 0.8 million shares for $79.7 million; approved a new $750 million stock repurchase program.

IT Consulting Revenues: Comprised 56.7% of total revenues, up from 50.4% the previous year, indicating a shift towards higher-value services.

On April 24, 2024, ASGN Inc (NYSE:ASGN), a prominent provider of IT services and solutions, disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The company reported revenues of $1.05 billion and a net income of $38.1 million, which aligns closely with analyst expectations of $1.043 billion in revenue and $54.35 million in net income. The earnings per share (EPS) stood at $0.81, closely aligning with the estimated $1.11, considering adjusted figures and non-GAAP metrics.

ASGN operates through two segments: the Commercial Segment and the Federal Government Segment. The former, which is the primary revenue generator, offers consulting, creative digital marketing, and permanent placement services, while the latter provides mission-critical solutions to various government agencies.

Financial Performance Insights

The companys revenue of $1.05 billion represents a slight decline of 7.1% from the previous year, primarily due to a 12.1% decrease in the Commercial Segment, which faced softness in more cyclical parts of the business. However, the Federal Government Segment saw a 7.0% increase, underscoring a diversified and resilient revenue base.

ASGN's gross margin for Q1 2024 was reported at 28.2%, a decrease from 28.9% in the same period last year, influenced by a higher mix of revenues from the Federal Government Segment, which typically yields lower margins. Adjusted EBITDA was $108.3 million or 10.3% of revenues, reflecting a robust operational performance near the upper end of the company's guidance.

Strategic Developments and Capital Allocation

Among significant strategic moves, ASGN refinanced its term loan B, reducing the interest rate, and repurchased approximately 0.8 million shares for $79.7 million. Notably, the Board of Directors approved a new $750 million stock repurchase program, marking the largest in the company's history, signaling confidence in its financial health and future prospects.

CEO Ted Hanson commented on the quarters performance, emphasizing the growth in IT consulting revenues, which now represent a larger portion of the consolidated revenues. Hanson highlighted the strategic positioning of ASGN to navigate macroeconomic challenges and seize growth opportunities as IT spending accelerates.

Looking Ahead: Q2 2024 Projections

For the second quarter of 2024, ASGN projects revenues between $1.034.5 million and $1.054.5 million, with net income expected to range from $44.7 million to $48.3 million. The EPS is forecasted to be between $0.97 and $1.04. These estimates reflect the company's ongoing operational adjustments and market conditions without factoring in potential acquisition-related expenses.

ASGNs consistent alignment with earnings projections and strategic initiatives to enhance shareholder value, despite revenue fluctuations, positions it as a resilient player in the IT services sector. Investors and stakeholders might find ASGN's commitment to financial stability and growth prospects a compelling reason for continued engagement and investment.

Explore the complete 8-K earnings release (here) from ASGN Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance