Asbury (ABG) Stock Falls 1% Since Q1 Earnings & Sales Miss

Shares of Asbury Automotive ABG have inched down 1% since the company reported first-quarter 2024 results. Adjusted earnings of $7.21 per share decreased 13.8% year over year and missed the Zacks Consensus Estimate of $7.78 on lower-than-expected gross profit from new vehicle, parts and service, and finance and insurance businesses. In the reported quarter, revenues amounted to $4.2 billion, which increased 17% year over year but missed the Zacks Consensus Estimate of $4.26 billion.

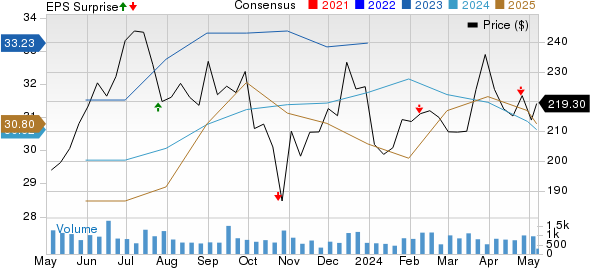

Asbury Automotive Group, Inc. Price, Consensus and EPS Surprise

Asbury Automotive Group, Inc. price-consensus-eps-surprise-chart | Asbury Automotive Group, Inc. Quote

Segment Details

In the quarter, new vehicle revenues rose 17% year over year to $2.06 billion, missing the Zacks Consensus Estimate of $2.16 billion. The underperformance could be attributed to lower-than-expected units sold, partly offset by higher average selling prices (ASPs). Retail units sold in the segment amounted to 40,677 (up 18% year over year), which missed the consensus mark of 42,824 units. New vehicles ASP was $50,747 (down 1% year over year), above the consensus mark of $50,116. Gross profit from the segment came in at $162.8 million, decreasing 9% from the prior-year quarter and missing the Zacks Consensus Estimate of $166 million.

Used-vehicle retail revenues rose 17% from the year-ago figure to $1.19 billion, which topped the Zacks Consensus Estimate of $1.14 billion on the back of higher-than-expected unit sales. Retail used vehicle units sold in the quarter totaled 39,489 (up 20% year over year) and topped the consensus mark of 38,988 units. Retail used vehicle ASP was $30,169 (down 3% year over year), missing the Zacks Consensus Estimate of $31,742. Gross profit from the segment came in at $65 million (down 8% year over year) and topped the Zacks Consensus Estimate of $63 million.

Revenues from used vehicle wholesale business surged 58% to $165.5 million and breezed past the consensus mark of $130 million. Gross profit from the unit rose 9% to $6.9 million and beat the consensus mark of $2.17 million.

Net revenues from the finance and insurance business amounted to $189.7 million, up 10% from the year-ago quarter. The metric missed the Zacks Consensus Estimate of $192 million. Gross profit was $181.1 million, which rose 14% year over year but marginally missed the Zacks Consensus Estimate of $182 million.

Revenues from the parts and service business rose 15% from the prior-year quarter to $590.4 million but lagged the Zacks Consensus Estimate of $633 million. Gross profit from this segment came in at $334 million, which rose 18% year over year. However, it missed the Zacks Consensus Estimate of $349 million.

Other Tidbits

Selling, general & administrative expenses as a percentage of gross profit rose to 62.5%, which marked an increase of 459 basis points year over year.

As of Mar 31, 2024, the company had cash and cash equivalents of $29 million, down from $45.7 million as of Dec 31, 2023. It had a long-term debt of $3.19 billion as of Mar 31, 2024, down from $3.2 billion as of Dec 31, 2023.

During the quarter under review, ABG repurchased 24,000 shares for $50 million. As of Mar 31, 2024, ABG had $153 million remaining under its share repurchase authorization.

Asbury currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

Group 1 Automotive GPI reported first-quarter 2024 adjusted earnings per share of $9.49, which missed the Zacks Consensus Estimate of $9.52 and declined 13.2% year over year. The automotive retailer registered net sales of $4.5 billion, beating the Zacks Consensus Estimate of $4.3 billion. Also, the top line rose from the year-ago quarter’s $4.13 billion. Group 1 had cash and cash equivalents of $41.9 million as of Mar 31, 2024, down from $57.2 million as of 2023-end. Total debt was $2.6 billion as of Mar 31, 2024, up from $2.1 million as of Dec 31, 2023.

Sonic Automotive SAH registered first-quarter 2024 adjusted earnings per share of $1.36, which topped the Zacks Consensus Estimate of $1.23 and rose 2.2% from the year-ago quarter figure. Total revenues amounted to $3.38 billion, marginally missing the Zacks Consensus Estimate of $3.39 billion and declining from the year-ago figure of $3.49 billion. As of Mar 31, SAH’s cash and cash equivalents amounted to $15.1 million. Long-term debt at the end of the quarter was $1.58 billion.

Lithia Motors LAD reported first-quarter 2024 adjusted earnings per share of $6.11, which declined from the prior-year quarter’s $8.44 and missed the Zacks Consensus Estimate of $7.85. Total revenues jumped 23% year over year to $8.56 billion. The top line outpaced the Zacks Consensus Estimate of $8.5 billion. Lithia had cash/cash equivalents/restricted cash of $404.6 million as of Mar 31, 2024, down from $941.1 million as of Dec 31, 2023. Long-term debt was $5.7 billion as of Mar 31, 2024, up from $5.5 billion as of Dec 31, 2023.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Group 1 Automotive, Inc. (GPI) : Free Stock Analysis Report

Sonic Automotive, Inc. (SAH) : Free Stock Analysis Report

Asbury Automotive Group, Inc. (ABG) : Free Stock Analysis Report

Lithia Motors, Inc. (LAD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance