Artisan Partners (APAM) Reports 2.9% Decline in April AUM

Artisan Partners Asset Management Inc. APAM reported preliminary assets under management (AUM) of $155.7 billion as of Apr 30, 2024. This indicates a 2.9% decline from the prior quarter’s AUM of $160.4 billion.

Of this, Artisan Funds and Artisan Global Funds accounted for $75.5 billion (48.4%) of the total AUM, while separate accounts and other AUMtotaled $80.2 billion (51.5%). As of Mar 31, 2024, Artisan Funds and Artisan Global Funds comprised 46% of the total AUM, whereas separate accounts and other AUM consisted of 54% of the total AUM.

Markedly, Artisan Partners’ total AUM has been witnessing improvement over the years. The metric saw a five-year (2018-2023) compound annual growth rate (CAGR) of 9.3%. The improving trend continued in first-quarter 2024 as well. The company’s efforts to improve and add investment strategies have supported its AUM growth.

A diversified AUM base across equity and fixed-income classes is another positive. Going forward, an improvement in global equity and debt markets with the stabilization in the economy will likely support AUM, thus aiding top-line growth.

Artisan Partners witnessed a CAGR of 3.3% in net revenues over the last five years (ended 2023) with some volatility. The increasing trend continued in first-quarter 2024 and was mainly driven by a solid AUM balance. The company’s diverse product offerings and investment strategies continue to attract investors and are expected to support revenue growth in the upcoming period.

Focusing on long-term growth, it continues to invest in new teams, and technological and operational capabilities. In 2022, it expanded its available investment strategies with the launch of Value Income, Artisan Emerging Markets Local Opportunities, Artisan Global Unconstrained and Artisan Emerging Markets Debt Opportunities Strategies.

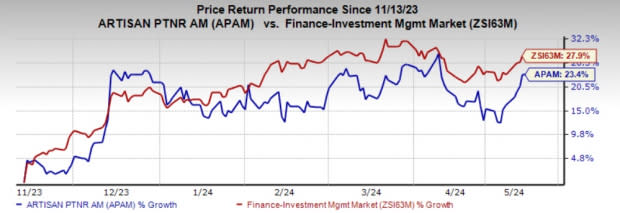

Over the past six months, APAM shares have risen 23.4% compared with 27.9% growth of the industry.

Image Source: Zacks Investment Research

Currently, APAM carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Competitive Landscape

Victory Capital Holdings, Inc. VCTR reported an AUM of $163.6 billion for April 2024. This reflected a 4% decline from $170.3 billion as of Mar 31, 2024.

By asset class, VCTR’s U.S. Mid Cap Equity AUM declined 5.8% from the March level to $31.02. The U.S. Small Cap Equity AUM of $15.18 billion decreased 6.8%. The Global/Non-U.S. Equity AUM declined 2.2% to $17.8 billion. The U.S. Large Cap Equity AUM dipped 5.5% to $13.13 billion.

Franklin Resources, Inc. BEN reported its preliminary AUM of $1.60 trillion as of Apr 30, 2024. This reflected a decrease of 2.5% from the prior month.

For the quarter ended Apr 30, 2024, BEN’s AUM declined on negative markets and long-term net outflows, including $5.9 billion related to the $25-billion AUM received from the Great-West Lifeco acquisition.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Franklin Resources, Inc. (BEN) : Free Stock Analysis Report

Artisan Partners Asset Management Inc. (APAM) : Free Stock Analysis Report

Victory Capital Holdings, Inc. (VCTR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance