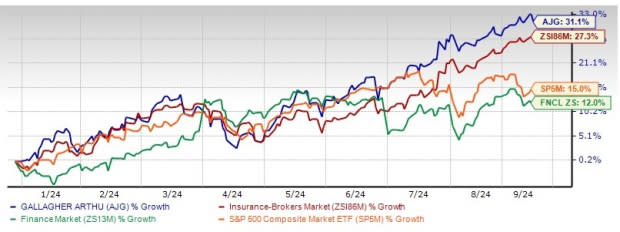

Arthur J. Gallagher Stock Rallies 31.1% YTD: More Room for Upside?

Shares of Arthur J. Gallagher AJG have rallied 31.1% year to date (YTD) compared with the industry’s growth of 27.3%. The Finance sector and the Zacks S&P 500 composite have returned 12% and 15%, respectively, in the same time frame. With a market capitalization of $64.55 billion, the average volume of shares traded in the last three months was 0.7 million.

AJG Outperforms Industry, Sector & S&P YTD

Image Source: Zacks Investment Research

The rally was driven by a strong performance of the Brokerage and Risk Management segments, strategic buyouts to capitalize on growing market opportunities and effective capital deployment.

AJG’s Growth Projection Encourages

The Zacks Consensus Estimate for Arthur J. Gallagher’s 2024 earnings per share indicates a year-over-year increase of 15.9%. The consensus estimate for revenues is pegged at $11.36 billion, implying a year-over-year improvement of 14.4%. The consensus estimate for 2025 earnings per share and revenues indicates an increase of 12% and 9.9%, respectively, from the corresponding 2024 estimates. Earnings have grown 20.7% in the past five years, better than the industry average of 13.2%.

Optimistic Analyst Sentiment on AJG

Six of the eight analysts covering the stock have raised estimates for 2024 and 2025 over the past 60 days. Thus, the Zacks Consensus Estimate for 2024 and 2025 moved 0.5% and 0.6% north in the last 60 days.

Impressive Earnings Surprise History of AJG

Arthur J. Gallagher’s bottom line outpaced estimates in each of the trailing four quarters, the average surprise being 1.93%.

Will AJG’s Rally Stay?

This Zacks Rank #2 (Buy) insurance broker closed at $294.65 on Wednesday, above its 50-day and 200-day simple moving average (SMA) of $281.41 and $252.66, respectively, signaling strong upward momentum. SMA is a widely used technical analysis tool to predict future price trends by analyzing historical price data.

Arthur J. Gallagher has geographically diversified operations with strong domestic as well as international presence. This ensures uninterrupted revenue generation. Its international operations contribute about one-third of revenues. Given the number and size of its non-U.S. acquisitions, AJG expects international contribution to total revenues to trend up.

AJG has an impressive organic growth track. A strong pipeline with about $550 million of revenues, associated with almost 60 term sheets, either agreed upon or being prepared, is well supported by AJG’s M&A capacity of $3.5 billion in 2024 and $4.5 billion in 2025 without using any equity.

Arthur J. Gallagher targets organic (particularly international) and inorganic growth and is thus tapping into growth opportunities across the globe. This, coupled with solid retention and improving renewal premium across all major geographies and most product lines, bodes well for growth. This insurance broker thus expects 2024 organic revenues and adjusted EBITDAC margins of the Risk Management and Brokerage segments to be better than the 2023 levels.

In the Brokerage segment, AJG expects organic growth to be 7-9% in 2024. In the Risk Management segment, the company expects organic growth to be 9% and margins around 20.5% in 2024.

AJG’s Wealth Distribution

AJG’s wealth distribution to shareholders in the form of dividend hikes and share repurchases is backed by its solid capital position. Its dividend has increased at a three-year CAGR of 7.7% and currently yields 0.8%. The board of directors also approved a $1.5 billion share buyback program.

Other Stocks to Consider

Some other top-ranked stocks from the insurance brokerage industry are Brown & Brown, Inc. BRO, Marsh & McLennan Companies, Inc. MMC and Ryan Specialty Holdings Inc. RYAN, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Brown & Brown has a solid track record of beating earnings estimates in each of the trailing four quarters, the average being 9.82 %. Year to date, shares of BRO have rallied 41.6%.

The Zacks Consensus Estimate for BRO’s 2024 and 2025 earnings implies year-over-year growth of 30.9% and 8.6%, respectively.

Marsh & McLennan has a solid track record of beating earnings estimates in each of the trailing four quarters, the average being 5.80%. Year to date, shares of MMC have jumped 20.9%.

The Zacks Consensus Estimate for MMC’s 2024 and 2025 earnings implies year-over-year growth of 9.3% and 7.9%, respectively.

The Zacks Consensus Estimate for Ryan Specialty’s 2024 and 2025 earnings implies year-over-year growth of 31.1% and 21.9%, respectively. Year to date, shares of RYAN have rallied 45.6%.

The Zacks Consensus Estimate for RYAN’s 2024 and 2025 earnings has moved 2.2% and 3.2% north, respectively, in the past 60 days, reflecting analysts’ optimism.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

Arthur J. Gallagher & Co. (AJG) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Ryan Specialty Holdings Inc. (RYAN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance