Arthur J. Gallagher & Co. Reports First Quarter 2024 Earnings, Surpasses Analyst Expectations

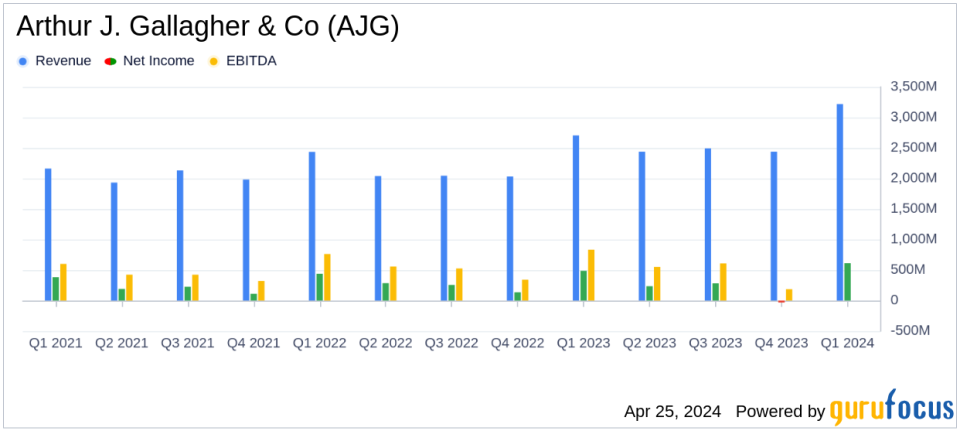

Total Revenue: $3,218.1 million for Q1 2024, up from $2,672.9 million in Q1 2023, exceeding estimates of $3,181.21 million.

Net Income: Reported at $612.7 million in Q1 2024 compared to $486.6 million in Q1 2023, surpassing the estimated $740.89 million.

Earnings Per Share (EPS): Reported EPS of $2.74, up from $2.24 year-over-year, below the estimate of $3.41.

Adjusted Earnings Per Share (EPS): Adjusted EPS reached $3.49, up from $3.02 in the previous year, exceeding the estimated $3.41.

Brokerage Segment Revenue: Increased to $2,864.9 million in Q1 2024 from $2,375.2 million in Q1 2023.

Risk Management Segment Revenue: Grew to $352.8 million in Q1 2024 from $297.6 million in Q1 2023.

Acquisition Activity: Closed 12 acquisitions in Q1 2024 with estimated annualized revenues of $69.2 million.

On April 25, 2024, Arthur J. Gallagher & Co. (NYSE:AJG) released its financial results for the first quarter of 2024, showcasing a robust performance that exceeded analyst expectations. The detailed financial outcomes were disclosed in their latest 8-K filing. AJG, a global leader in insurance brokerage, risk management, and consulting services, reported a total revenue of $3,218.1 million for the quarter, a significant increase from $2,672.9 million in the same quarter the previous year. This performance surpasses the estimated revenue of $3,181.21 million projected by analysts.

Company Overview

Headquartered in Rolling Meadows, Illinois, Arthur J. Gallagher & Co. operates primarily through its brokerage segment, which is the main revenue generator, earning commissions by negotiating and placing insurance for clients. The company has a significant presence in the United States and extends its services globally across regions including Australia, Bermuda, Canada, the Caribbean, New Zealand, and the United Kingdom.

Financial Highlights and Adjustments

The adjusted net earnings for the quarter stood at $774.6 million, compared to $654.4 million in Q1 2023, reflecting a 26% growth. This figure also outstrips the analysts' net income estimate of $740.89 million. Earnings per share (EPS) on an adjusted basis were $3.49, which is higher than the anticipated $3.41. These adjustments were primarily due to acquisition integration costs, workforce and lease terminations, and other related adjustments.

Strategic Achievements and Market Position

J. Patrick Gallagher, Jr., Chairman and CEO, highlighted the company's substantial growth in core brokerage and risk management segments, with a 20% revenue increase and a 9.4% organic revenue growth. The firm's strategic acquisitions continue to bolster its market position, with 12 acquisitions in the first quarter, slightly up from 10 in the same period last year.

Detailed Financial Analysis

The brokerage segment, after adjustments for various non-GAAP items, reported revenues of $2,838.4 million, up from $2,380.2 million in Q1 2023. The risk management segment also showed strong performance with adjusted revenues of $353.0 million, compared to $296.4 million in the prior year's first quarter.

Operational efficiency is evident in the adjusted compensation and operating expense ratios, which have improved year-over-year. The company also reported a solid balance sheet with substantial liquidity to support ongoing operations and strategic initiatives.

Looking Forward

Arthur J. Gallagher & Co. remains optimistic about the remainder of 2024, driven by strong market fundamentals, disciplined cost management, and strategic growth initiatives. The company's leadership is confident in their ability to attract new clients and retain existing ones, leveraging their industry-leading expertise and global reach.

For more detailed information on Arthur J. Gallagher & Co.'s financial performance and strategic outlook, stakeholders are encouraged to review the full earnings release and supplementary materials available on the company's investor relations website.

Contact for further information: Ray Iardella, Vice President - Investor Relations, at 630-285-3661 or via email at ray_iardella@ajg.com.

Explore the complete 8-K earnings release (here) from Arthur J. Gallagher & Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance