Artesian Resources Corp (ARTNA) Surpasses Analyst Revenue Forecasts with Strong Q1 2024 Performance

Net Income: $4.4M, up 19.1% year-over-year, surpassing the previous year's $3.7M.

Earnings Per Share (EPS): Increased to $0.43, up 10.3% from $0.39 in the same quarter last year, exceeding estimates of $0.42.

Revenue: Reached $24.5M, up 9.1% year-over-year, slightly surpassing estimates of $24.0M.

Water Sales Revenue: Grew by 10.0% to $1.8M, driven by a 7.5% temporary rate increase and higher water consumption.

Operating Expenses: Increased by 5.6% to $0.8M, primarily due to higher costs in water treatment and distribution.

Capital Expenditures: $8.9M invested in the first quarter for water and wastewater infrastructure projects, including new treatment facilities and equipment.

Interest Charges: Decreased by $0.3M due to lower borrowing levels, contributing to improved financial performance.

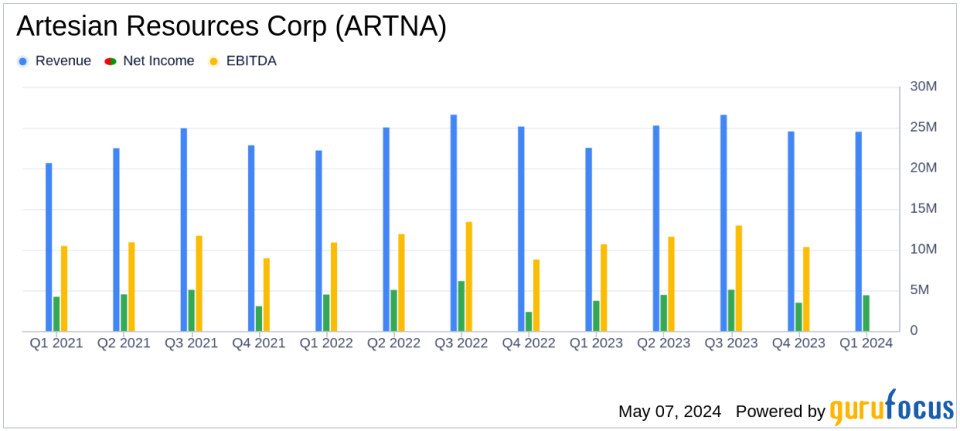

On May 6, 2024, Artesian Resources Corp (NASDAQ:ARTNA), a prominent provider of water and wastewater services on the Delmarva Peninsula, disclosed its financial results for the first quarter of 2024 through its 8-K filing. The company reported a net income of $4.4 million, marking a 19.1% increase from the previous year, and a diluted net income per share of $0.43, up 10.3% year-over-year. These figures notably exceeded the estimated earnings per share of $0.42.

Revenue for the quarter reached $24.5 million, surpassing the analyst's expectation of $24 million and reflecting a 9.1% increase from the same period last year. This growth was primarily driven by a 10.0% increase in water sales revenue, attributed to a temporary 7.5% rate increase and higher overall water consumption. Additionally, other utility operating revenue saw a 7.0% rise, mainly due to an increase in wastewater revenue associated with a growing customer base.

Operational and Financial Highlights

Operating expenses, excluding depreciation and income taxes, climbed by 5.6% to $0.8 million, mainly due to higher costs in water treatment and distribution operations, alongside increases in payroll and administrative expenses. Despite these rising costs, the company effectively managed its financials, with depreciation and amortization expenses growing by 7.5% due to ongoing investments in utility infrastructure.

Capital expenditures for the quarter were significant, totaling $8.9 million, focused on enhancing water and wastewater infrastructure. Notable projects included the installation of PFAS treatment equipment and the commencement of the Sussex Regional Recharge Facilitys wastewater treatment plant, which aims to provide environmentally sound wastewater solutions in Sussex County.

Strategic Developments and Future Outlook

Artesian Resources has continued to invest in strategic projects that support sustainable growth and operational efficiency. The construction of the Sussex Regional Recharge Facility is a pivotal development, enhancing the company's capacity to manage wastewater treatment effectively and support regional growth.

President of Artesian Water Company, Nicki Taylor, expressed satisfaction with the temporary rate adjustments, which have helped mitigate the increased operational costs, ensuring continued high-quality service to customers. The company's proactive management and strategic investments underscore its commitment to maintaining reliable and efficient utility services across its operational areas.

As Artesian Resources moves forward, its focus remains on reinforcing infrastructure resilience and expanding its customer base, thereby ensuring sustained growth and stability in its financial performance.

For detailed information, please contact Nicki Taylor, Investor Relations, at (302) 453-6900 or via email at ntaylor@artesianwater.com.

Artesian Resources Corp operates as a holding company with a focus on water distribution and wastewater services. Its regulated utility segment includes subsidiaries providing water and wastewater services in Delaware, Maryland, and Pennsylvania. The company also engages in non-utility businesses, offering service line protection plans, engineering services, and contract operations for water and wastewater systems. The regulated utility segment constitutes the largest portion of the company's operations, subject to regulations by Delaware, Maryland, and Pennsylvania.

Explore the complete 8-K earnings release (here) from Artesian Resources Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance