Arista's (ANET) Healthcare Network as a Service to Spur Growth

Arista Networks, Inc. ANET announced the development of Healthcare Network as a Service – an integrated solution to support various requirements of healthcare organizations and ensure a premium experience for end users. The service will offer a secure networking infrastructure to healthcare entities by delivering the requisite architecture and firewalls for high-quality patient care.

Healthcare is an essential service in modern society and demands 24x7 optimum operational efficiency. Health services frequently require improvised solutions, and even a small error can result in a major catastrophe.

The events in the last couple of years have shown us that digitalizing healthcare facilities is the need of the hour. Arista is focused on advancing digital health technologies and is committed to creating AI-ML powered digital ecosystem that will empower healthcare organizations to provide better patient experience.

Healthcare businesses must adhere to several legal and regulatory requisites to offer services. Organizations often face challenges related to hiring staff to manage complex network infrastructure. Arista’s CloudVision simplifies the process with workflow automation; it summarizes various operational tasks into a dashboard view and enriches service providers with essential insights based on real-time data analysis. This enables healthcare professionals to make better decisions and operate optimally. CloudVision’s compliance dashboard, combined with Arista DANZ Monitoring Fabric (DMF), allows healthcare organizations to meet legal and other compliance requirements.

Healthcare Network as a Service utilizes Arista Cognitive Unified Edge powered by machine learning capabilities to provide key insights related to Electronic Health Record (EHR) systems. The software also utilizes AI and conducts behavior analysis to enhance threat detection and track vital medical devices in the healthcare network. AI-driven Arista AVATM (Autonomous Virtual Assist) also ensures increased protection against ransomware and other insider threats.

The company continues benefiting from the expanding cloud networking market, driven by strong demand for scalable infrastructure. In addition to high capacity and easy availability, its cloud networking solutions promise predictable performance and programmability that enables integration with third-party applications for network management, automation and orchestration.

The company’s product portfolio facilitates the implementation of high-performance, highly scalable and appropriate solutions for every environment. Arista provides routing and switching platforms with industry-leading capacity, low latency, port density and power efficiency. The company also continues to innovate in areas such as deep packet buffers, embedded optics and reversible cooling.

Arista continues to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. It is well-poised for growth in data-driven cloud networking business with proactive platforms and predictive operations.

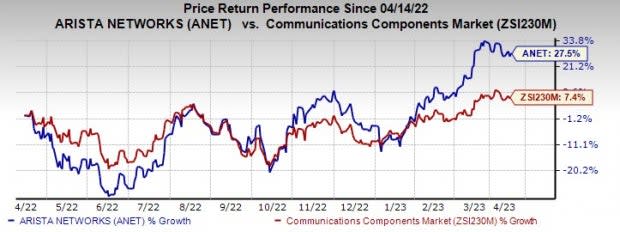

The stock has gained 27.5% in the past year compared with the industry’s rise of 7.4%.

Image Source: Zacks Investment Research

Arista currently sports a Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Juniper Networks, Inc. JNPR, carrying a Zacks Rank #2 (Buy), delivered an earnings surprise of 1.55%, on average, in the trailing four quarters. It is witnessing strong momentum across its core industry verticals and is confident of its long-term prospects. Investments in customer solutions and sales organizations have enabled the company to capitalize on the solid demand across end markets.

Juniper is a leading provider of networking solutions and communication devices. The company develops, designs and sells products that help build a network infrastructure for services and applications based on a single Internet protocol network worldwide. The company caters to the networking needs of enterprises, public sector organizations and service providers across the globe

Splunk Inc. SPLK, sporting a Zacks Rank #1, delivered an earnings surprise of 131.1%, on average, in the trailing four quarters. In the last reported quarter, it delivered an earnings surprise of 83.78%. Splunk provides software solutions that enable enterprises to gain real-time operational intelligence by harnessing the value of their data. The company's offerings enable users to investigate, monitor, analyze and act on machine data and big data, irrespective of format or source and help in operational decision-making.

Its software has a broad range of applications, including security analytics, business analytics and IT operations. Splunk benefits from healthy customer engagement, evident from the consistently high net retention and competitive win rates alongside solid momentum with large orders overall.

Workday Inc. WDAY, carrying a Zacks Rank #2, is a provider of enterprise-level software solutions for financial management and human resource domains. It delivered an earnings surprise of 7.67%, on average, in the trailing four quarters. Earnings estimates for WDAY for the current year is pegged at $4.99 per share.

Workday’s revenue growth continues to be driven by high demand for its HCM and financial management solutions. The company’s cloud-based business model and expanding product portfolio have been the primary growth drivers. Moreover, growing clout of Workday Prism Analytics and Adaptive Insights business planning cloud offerings holds promise. Based on its expanding product portfolio, we believe that Workday is well-positioned to gain from the strong growth prospect going forward.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Juniper Networks, Inc. (JNPR) : Free Stock Analysis Report

Splunk Inc. (SPLK) : Free Stock Analysis Report

Workday, Inc. (WDAY) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance