Argentine Stocks Soar, Bonds Climb as Investors Cheer Milei Win

(Bloomberg) -- Argentina investors cheered libertarian economist Javier Milei’s bigger-than-expected win in Sunday’s presidential vote, encouraged by his pledges to usher in a radical remake of South America’s second-largest economy.

Most Read from Bloomberg

Sam Altman, OpenAI Board Open Talks to Negotiate His Possible Return

Binance Pleads Guilty, Loses CZ, Pays Fines to End Legal Woes

Higher Interest Rates Are Shattering Housing Dreams Around the World

‘Big Seven’ Rally in Focus as Nvidia Underwhelms: Markets Wrap

US-listed shares of Argentine companies skyrocketed Monday, with ADRs of oil company YPF SA posting the best session since they began trading in 1993, 40% higher. Banco Macro SA and Grupo Financiero Galicia SA ended the day up 20% and 17%, respectively. The Global X MSCI Argentina ETF jumped a record 12%. Local markets were closed Monday for a holiday.

“This is the opportunity for a new beginning,” said Jorge Piedrahita, founder of Gear Capital Management in New York.

Milei’s victory caps a bombastic campaign that promised radical fixes that appealed to Argentines tired of triple-digit inflation and repeated debt crisis, and hoping for a more vibrant economy. He pledged to slash public spending and shut down the central bank in a bid to tame inflation and shore up fiscal accounts, policies that may be a boon to bond investors who already expect another default is coming.

“Milei rightly emphasized that there’s no room for gradualism,” said Claudia Calich, the head of emerging-market debt at M&G Investments, who has a small overweight on Argentine bonds. “We need to change the course of the country very forcefully.”

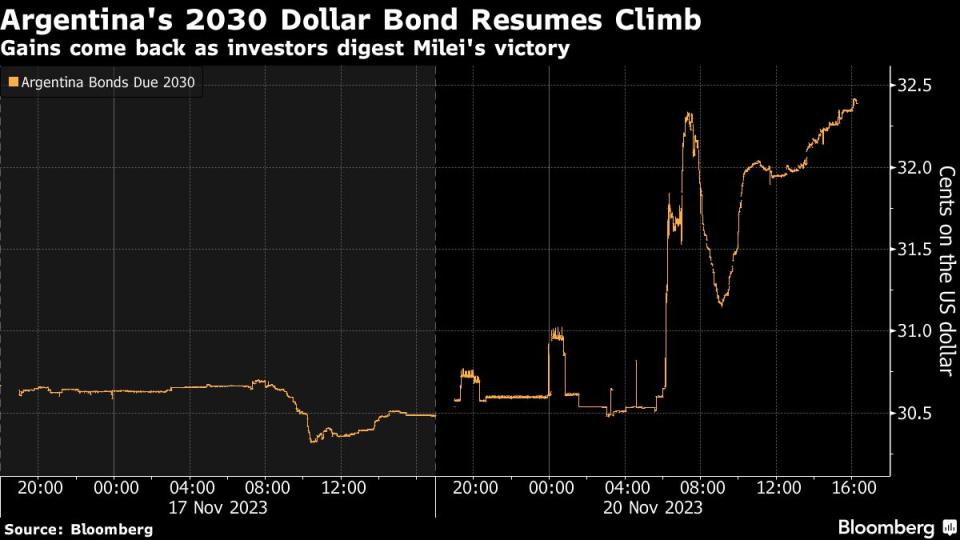

The country’s benchmark sovereign dollar bonds also climbed, with notes due 2030, 2041 and 2046 all rising at least 1.9 cents.

The peso is set to weaken in parallel markets used to skirt currency controls, reflecting Milei’s signature plan to replace it with the dollar. On Sunday, it fell to about 990 per dollar on local cryptocurrency exchanges, about 7% weaker than Friday’s price.

“The peso is likely to remain under significant pressure,” said Leandro Galli, an emerging-market debt portfolio manager at JPMorgan Asset Management. While efforts to shore up the budget will support bonds, upside is limited by concerns over the transition, governability and implementation risks, he said.

Read more: Milei’s Challenges Begin Ahead of Inauguration

In his victory speech Sunday night, Milei highlighted the critical condition of the economy.

“Today is the beginning of the end of Argentina’s decadence,” he said. “We’ll start doing things that history has shown work, and within 35 years, we’ll return to being a world power.”

During a second speech to supporters outside his campaign headquarters, Milei shouted his signature slogan: “Long live freedom, dammit!”

With 99% of votes counted, Milei won nearly 56% support, compared with 44% for Economy Minister Sergio Massa, who represented continuity with the existing Peronist government. Polls had showed Milei with just a slight edge in the run-up to the election, so there was a feeling among investors that the strong mandate might make it easier to push through his policies.

While Milei gained attention for quirks that were atypical for a potential head of state — his unusual hairdo, love of his cloned dogs and a penchant for campaigning with a chainsaw — he won fans among investors for his promise to usher in a business friendly era. But he has his work cut out for him. Economic growth is elusive, the peso has lost more than 90% of its value in four years, and around 40% of the population lives in poverty.

“It’s a vote in favor of reforms, but with tremendous execution risks,” said Patrick Esteruelas, the head of research at Emso Asset Management. “The upside will be capped by skepticism over whether he can politically survive an adjustment with limited support in Congress.”

Milei’s La Libertad Avanza party controls only a handful of seats in congress, and policies like dollarization would be an incredibly complex undertaking even with broad political support. Slashing government outlays will be a burden on Argentina’s poorest citizens.

What Bloomberg Economics Says

The lead-up to Milei’s Dec. 10 inauguration could be rocky. The outgoing administration can still tinker with the currency, reserve levels and public spending. Markets will pay close attention to his cabinet announcements. Asset-price moves — especially in the parallel exchange rate — could help shape the near-term inflation outlook.

— Adriana Dupita, Brazil and Argentina economist

— Click here to read the full report.

Still, some investors think Milei is the best shot at salvaging the economy after years of market pain. The nation’s overseas bonds handed investors losses of more than 40% since they were restructured in 2020, among the worst showings in emerging markets.

“The question is more about Milei’s ability to get things done,” said Diego Ferro, founder of M2M Capital in New York. “And that is where I think there’s still a big question mark. But the near-term prognosis should be higher bond prices.”

--With assistance from Srinivasan Sivabalan, Vinícius Andrade, Philip Sanders and Sydney Maki.

(Updates assets’ moves in second and sixth paragraphs.)

Most Read from Bloomberg Businessweek

More Americans on Ozempic Means Smaller Plates at Thanksgiving

Guatemalan Town Invests Remittance Dollars to Deter Migration

The Share of Americans Who Are Mortgage-Free Is at an All-Time High

At REI, a Progressive Company Warns That Unionization Is Bad for Vibes

©2023 Bloomberg L.P.

Yahoo Finance

Yahoo Finance