Some Ardagh Group (NYSE:ARD) Shareholders Are Down 37%

This month, we saw the Ardagh Group S.A. (NYSE:ARD) up an impressive 39%. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 37% in the last three years, significantly under-performing the market.

See our latest analysis for Ardagh Group

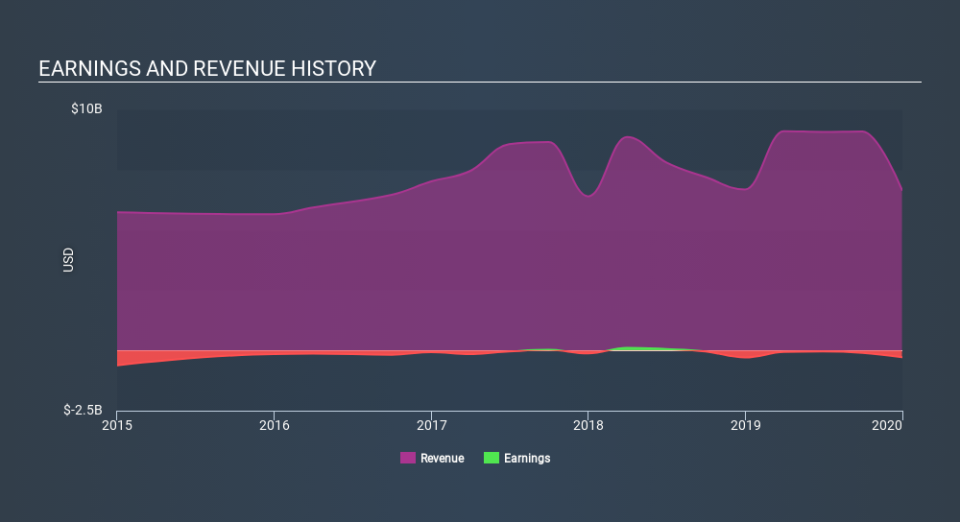

Ardagh Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Ardagh Group saw its revenue grow by 2.3% per year, compound. That's not a very high growth rate considering it doesn't make profits. The stock dropped 14% during that time. Shareholders will probably be hoping growth picks up soon. But the real upside for shareholders will be if the company can start generating profits.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Ardagh Group's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Ardagh Group's TSR for the last 3 years was -31%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While it's never nice to take a loss, Ardagh Group shareholders can take comfort that , including dividends, their trailing twelve month loss of 1.2% wasn't as bad as the market loss of around -3.3%. Furthermore, the stock lost shareholders 11% per year over three years, so the one-year return was better in a relative sense. It is of course not much comfort to know that the losses have slowed. Shareholders will be hoping for a proper turnaround, no doubt. It's always interesting to track share price performance over the longer term. But to understand Ardagh Group better, we need to consider many other factors. Take risks, for example - Ardagh Group has 2 warning signs we think you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance