ArcelorMittal (MT) & Materialise Partner for Metal 3D Printing

ArcelorMittal S.A.’s MT unit ArcelorMittal Powders — dedicated to producing high-quality steel powders — entered into a memorandum of understanding with Materialise, a global leader in 3D printing software and services. This partnership aims to develop innovative solutions to optimize laser powder bed fusion (LPBF) equipment and metal 3D printing strategies. Through this collaboration, MT will utilize Materialise’s next-generation build processor for 3D printers.

The collaboration aligns with ArcelorMittal’s vision that success in additive manufacturing depends on the right combination of digital instructions and steel powders to achieve optimal quality and productivity. Whether developing applications with new alloys or validating recent designs for existing applications through steel additive manufacturing, Materialise provides a robust channel to integrate build instructions directly into the 3D printing process.

The partnership focuses on combining Materialise’s advanced build processor with ArcelorMittal Powders’ AdamIQ range of steel powders to enhance LPBF, the most widely-used technology for producing metal parts through additive manufacturing. Build processors connect 3D printers with data preparation software, streamlining the process from design to print. Materialise’s next-generation build processor supports larger build volumes and more complex geometries than traditional processors, allowing users to customize process parameters, streamline workflows and increase printing speed. When combined with AdamIQ steel powders, which are designed for additive manufacturing, these solutions improve setup and production speed, part quality, cost-efficiency, reproducibility and repeatability.

This partnership marks a significant step forward in realizing Materialise’s shared vision with ArcelorMittal. By enhancing processes and solutions, they aim to expand the applications and industries utilizing additive manufacturing. This collaboration brings them closer to a future where 3D printing achieves its full potential, enabling mass customization and large-scale production.

Materialise boasts over three decades of 3D printing experience and a proven track record in providing build processors. At the same time, ArcelorMittal Powders brings nearly 20 years of metallurgical expertise to offer steel solutions for additive manufacturing applications.

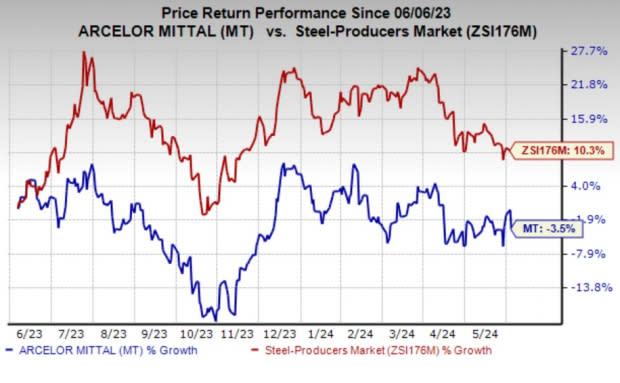

ArcelorMittal’s shares have dropped 3.5% in the past year compared with the industry’s 10.3% rise.

Image Source: Zacks Investment Research

In 2024, ArcelorMittal anticipates that low inventory levels, particularly in Europe, will result in a rebound in apparent demand with any actual demand increase. The company projects global steel consumption growth (excluding China) of 3-4%, with expected increases of 1.5-3.5% in the United States, 2-4% in Europe, 0.5-2.5% in Brazil and 6.5-8.5% in India.

Optimistic about medium to long-term steel demand prospects, ArcelorMittal is confident in its growth strategy and commitment to boosting shareholders’ returns. MT plans capital expenditures of $4.5-$5 billion for this year, with $1.4-$1.5 billion dedicated to strategic growth projects.

ArcelorMittal Price and Consensus

ArcelorMittal price-consensus-chart | ArcelorMittal Quote

Zacks Rank & Key Picks

ArcelorMittal currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Carpenter Technology Corporation CRS, sporting a Zacks Rank #1 (Strong Buy), and ATI Inc. ATI and Ecolab Inc. ECL, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

CRS’ earnings beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 15.1%. The company’s shares have soared 108.2% in the past year.

ATI’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, with the earnings surprise being 8.34%, on average. The stock has surged 52.4% in the past year.

The Zacks Consensus Estimate for Ecolab's current-year earnings is pegged at $6.59, indicating a year-over-year rise of 26.5%. The Zacks Consensus Estimate for ECL’s current-year earnings has moved up in the past 30 days. ECL beat the consensus estimate in each of the last four quarters, with the earnings surprise being 1.3%, on average. The stock has rallied nearly 36% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

ArcelorMittal (MT) : Free Stock Analysis Report

ATI Inc. (ATI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance