ARC Resources (TSE:ARX) Has Announced That It Will Be Increasing Its Dividend To CA$0.15

ARC Resources Ltd.'s (TSE:ARX) dividend will be increasing from last year's payment of the same period to CA$0.15 on 17th of April. This takes the annual payment to 4.0% of the current stock price, which unfortunately is below what the industry is paying.

See our latest analysis for ARC Resources

ARC Resources' Dividend Is Well Covered By Earnings

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. However, prior to this announcement, ARC Resources' dividend was comfortably covered by both cash flow and earnings. This means that most of what the business earns is being used to help it grow.

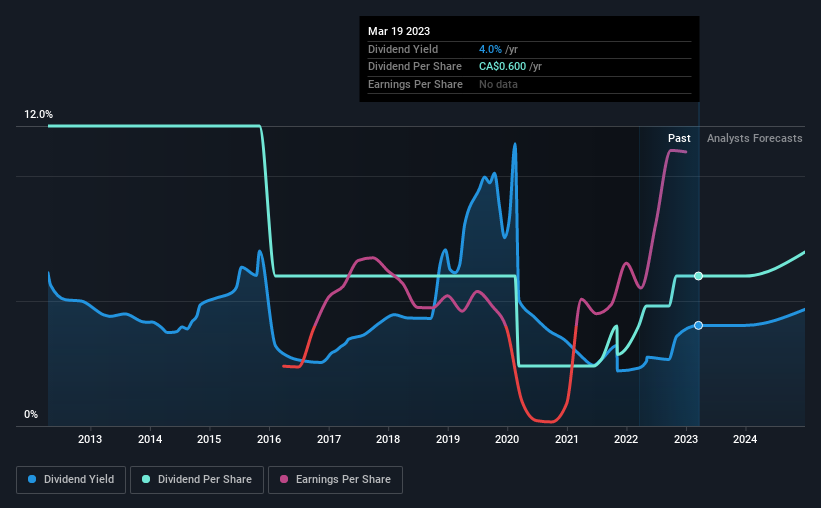

Looking forward, earnings per share is forecast to rise by 47.9% over the next year. If the dividend continues on this path, the payout ratio could be 8.4% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2013, the dividend has gone from CA$1.20 total annually to CA$0.60. Doing the maths, this is a decline of about 6.7% per year. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Dividend Looks Likely To Grow

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. ARC Resources has impressed us by growing EPS at 28% per year over the past five years. A low payout ratio gives the company a lot of flexibility, and growing earnings also make it very easy for it to grow the dividend.

ARC Resources Looks Like A Great Dividend Stock

Overall, a dividend increase is always good, and we think that ARC Resources is a strong income stock thanks to its track record and growing earnings. Earnings are easily covering distributions, and the company is generating plenty of cash. All of these factors considered, we think this has solid potential as a dividend stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come across 2 warning signs for ARC Resources you should be aware of, and 1 of them doesn't sit too well with us. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance