Aramco’s $12 Billion Sale Said to Draw Strong Foreign Demand

(Bloomberg) -- Foreign investors have flocked to Saudi Aramco’s $12 billion share sale, people familiar with the matter said, marking a turnaround from the oil giant’s 2019 listing that ended up as a largely local affair.

Most Read from Bloomberg

Billionaire-Friendly Modi Humbled by Indians Who Make $4 a Day

A Struggling Business Park Deals a Blow to Singapore's Regional Hub Ambitions

‘Everything Is Not Going to Be OK’ in Private Equity, Apollo’s Co-President Says

The deal attracted significant interest from foreign investors, according to the people, who declined be identified as the information is private. It wasn’t immediately clear exactly how much demand came from overseas, but those investors put in enough bids to more than fully cover the offering, the people said.

Apart from Western institutions, demand for the offer was also strong among Asian investors, one of the people said, signaling the kingdom’s growing ties with larger Asian economies like China and India. Locally, too, there’s been strong interest.

The demand indicates that, for some investors, the world’s largest oil company has become a more attractive stock to hold despite rising concerns about climate change and the energy transition. Aramco’s huge dividend, coupled with a massive investment plan in renewable power, petrochemicals, gas and the opportunity to buy the stock at a discount, have drawn in investors.

Institutional investors can submit orders until Thursday for the deal, which was covered in just a few hours after it opened on Sunday. The extent of foreign participation will be closely watched — Saudi Aramco’s top executives held a series of events in the UK and the US this week to drum up demand.

One of those roadshows was held at London’s Hilton Park Lane Hotel on Tuesday. Aramco Chief Executive Officer Amin Nasser addressed a gathering of about 100 people, including senior bankers from HSBC Holdings Plc, Citigroup Inc. and Moelis & Co. who were in attendance.

An international investor present at the event, who declined to be identified, said their firm was considering an allocation and cited the oil giant’s dividend yield as one of the reasons.

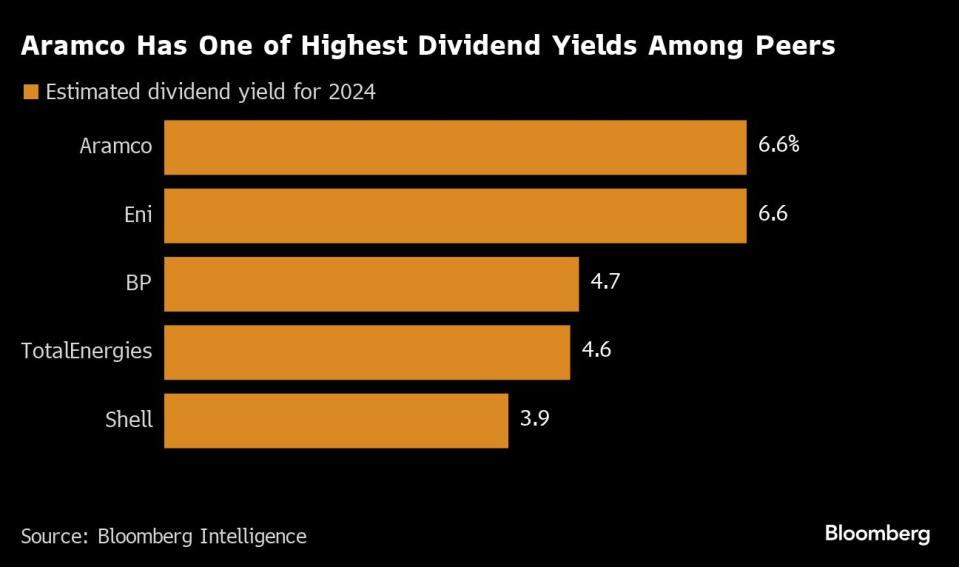

Aramco’s dividend is one of the world’s biggest. Investors willing to look past a steep valuation and the lack of buybacks would cash in on a $124 billion annual payout that Bloomberg Intelligence estimates will give the company a dividend yield of 6.6%.

During Aramco’s listing, overseas investors had largely balked at valuation expectations and left the government reliant on local buyers. The kingdom planned a series of international events for that $29.4 billion deal, including one in London, which it scrapped.

The company also decided not to market the sale in the US, Canada or Japan, and instead held a roadshow in front of a home audience. The IPO eventually drew orders worth $106 billion, and about 23% of shares were allocated to foreign buyers.

The Saudi government owns about 82% of Aramco, while the Public Investment Fund holds a further 16% stake. The kingdom will continue to be the main shareholder after the offering, which adds to Riyadh’s efforts to raise cash and fill a budget deficit.

(updates with context in 4th paragraph)

Most Read from Bloomberg Businessweek

Sam Altman Was Bending the World to His Will Long Before OpenAI

David Sacks Tried the 2024 Alternatives. Now He’s All-In on Trump

Startup Brings New Hope to the Pursuit of Reviving Frozen Bodies

The Budget Geeks Who Helped Solve an American Economic Puzzle

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance