AQR Hails Comeback of Convertible Arbitrage in Era of High Rates

(Bloomberg) -- AQR Capital Management says the resurgence of a niche strategy riding debt that can convert into equity has room to run, as a trade that was famously routed during the financial crisis enjoys a big comeback.

Most Read from Bloomberg

What to Know About the Deadly Flesh-Eating Bacteria Spreading in Japan

‘I Live in Hell’: Anti-Growth Fervor Grips US South After Pandemic Boom

Stocks Rise as Bullish Nvidia Call Boosts AI Trade: Markets Wrap

Citi Pitches Money-Moving ‘Crown Jewel’ as Central to Revamp

Flesh-Eating Bacteria That Can Kill in Two Days Spreads in Japan

The $109 billion quant firm co-founded by Cliff Asness reckons the latest revival of convertible arbitrage, which seeks to capitalize on price discrepancies between convertible bonds and their underlying stock, will gather pace amid a wave of new issuance in the higher-for-longer interest rate regime. The trade has overtaken merger arbitrage as the largest strategy exposure in the $1.9 billion AQR Diversified Arbitrage Fund.

Convertible bonds start their life as low-interest notes but can turn into equities if share prices go high enough, and a typical arbitrage approach would take a long position in the debt and a short position on the stock. If the equity price falls then investors profit from the short, but if it rises past a certain level they can convert the bond when it matures.

Hedge funds have been adding cash to the strategy in recent months as companies increasingly turn to the hybrid instruments, which typically cost borrowers less than conventional debt. This broadening base of issuers, a looming wall of maturities and a slew of corporate events are all presenting new ways to profit from the trade, according to Greenwich, Connecticut-based AQR.

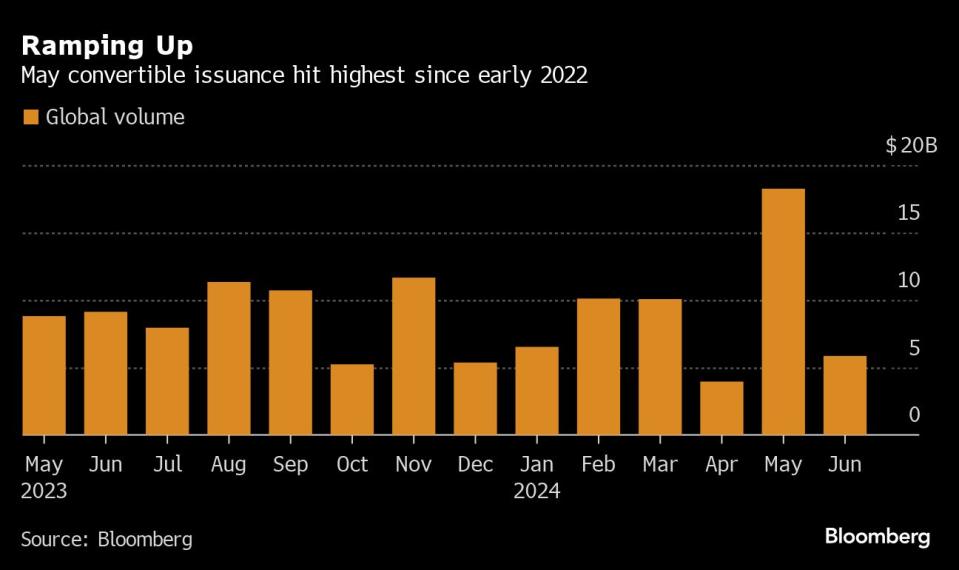

“It’s really the expansion of the opportunity set that gives us the reason to keep adding exposure,” said Josh Lavan, managing director of convertible bond strategies for AQR Arbitrage. “We saw almost $20 billion convertible bond issuance in May alone and June has gone off to a great start.”

In addition to new borrowers arriving, a stack of convertibles issued at rock-bottom yields during the pandemic are also about to expire. That often means companies buying back their existing debt at a premium to the market price, or offering holders favorable terms in a new issue.

A glut of sales can also weaken prices, creating attractive entry points for arbitrageurs. US convertible bonds with a face value of about $115 billion, or about 43% of the outstanding total, are set to mature between now and 2026, according to data compiled by Bloomberg.

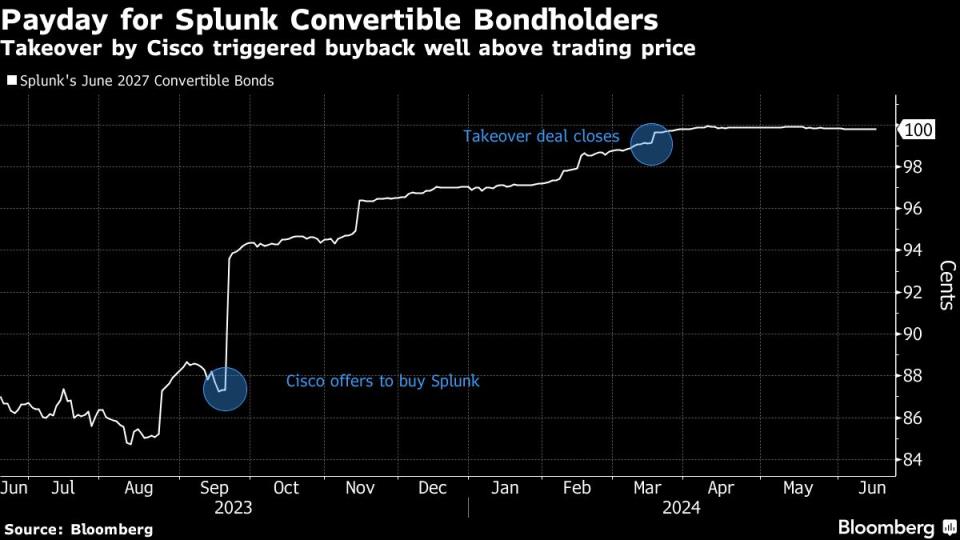

Corporate events like takeovers and bankruptcies provide additional opportunities. Cisco Systems Inc.’s deal to buy software company Splunk Inc. for $28 billion, announced last year, triggered a so-called takeover protection embedded in Splunk’s convertible bonds. That allowed holders to tender their notes back to the company at par.

The September takeover proposal immediately boosted the price of the convertible bonds expiring 2027 from the mid-80-cent range to the mid-90 cents, and the debt continued to climb as the deal approached its March closing.

Meanwhile, the market is seeing more issuers enter the space that also have tradable conventional debt, thereby increasing the capital structure arbitrage possibilities, Lavan said.

“Your option is not just buying a billion dollars of converts and only shorting equity,” Lavan said. “You could have a really diversified set of sub-strategies. That’s the biggest reason why you’ve seen hedge funds growing in the space.”

The boom is the latest revival for convertible arbitrage, and is a far cry from the depths of the financial crisis when the strategy imploded in the wake of the Lehman Brothers collapse. In a paper published by the CFA Institute shortly after, associates at AQR said the trade handed investors losses of 34% in 2008 as financing was withdrawn from the market, leaving arbitrageurs effectively stranded.

Convertible arbitrage long positions accounted for around 45% of the AQR Diversified Arbitrage Fund’s net assets in the first quarter, compared to about one third in June last year. The fund has returned 0.5% in 2024, and 4.1% in the past year, according to data compiled by Bloomberg.

Overall, Nasdaq eVestment data show convertible arbitrage strategies attracted inflows of more than $700 million this year through April, when event-driven funds saw more than $8 billion exit. The Bloomberg Convertible Bond Arbitrage Index was up 5.33% in that time, while the Merger Arbitrage Index was down 0.12%.

Most Read from Bloomberg Businessweek

Google DeepMind Shifts From Research Lab to AI Product Factory

Coke—and Dozens of Others—Pledged to Quit Russia. They’re Still There

Trump’s Planned Tariffs Would Tax US Households, Economists Warn

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance