AptarGroup Inc (ATR) Surpasses Analyst Earnings Projections in Q1 2024

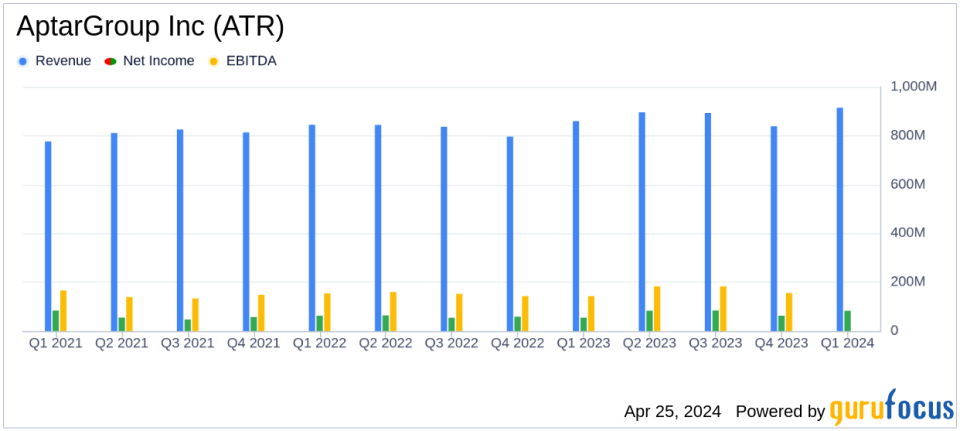

Reported Revenue: $915 million, up 6% year-over-year, surpassing estimates of $890.33 million.

Net Income: $83 million, a 52% increase from the previous year, significantly exceeding estimates of $76.34 million.

Earnings Per Share (EPS): Reported at $1.23, a 50% increase year-over-year, surpassing the estimate of $1.15.

Pharma Segment Growth: Reported sales growth of 14% and core sales growth of 13%, driven by strong demand for proprietary drug delivery systems.

Adjusted EBITDA: Increased by 16% to $179 million, reflecting improved operational performance and cost management.

Dividend and Share Repurchases: Announced a quarterly cash dividend of $0.41 per share and repurchased 86 thousand shares for approximately $12 million.

Future Outlook: Expects continued strong performance in the Pharma segment and improved demand for consumer dispensing technologies, with EPS guidance for Q2 2024 set at $1.30 to $1.38.

AptarGroup Inc (NYSE:ATR) released its 8-K filing on April 25, 2024, revealing a significant outperformance in its first-quarter earnings for 2024. The company reported a net income of $83 million and earnings per share (EPS) of $1.23, surpassing the analyst estimates of $76.34 million in net income and an EPS of $1.15. Sales also exceeded expectations, reaching $915 million against the forecasted $890.33 million.

Headquartered in Crystal Lake, Illinois, AptarGroup is a leading global supplier of dispensing systems such as aerosol valves, pumps, closures, and elastomer packaging components to the consumer goods and pharmaceutical markets. With a significant portion of its sales from Europe (50%) and the United States (33%), Aptar operates through three business segments: Pharma, Beauty, and Closures, with the Pharma segment contributing over two-thirds of group profits.

Quarterly Performance Highlights

The first quarter saw a 6% increase in reported sales and a 5% rise in core sales, excluding currency and acquisition effects. The Pharma segment was particularly strong, posting a 14% increase in reported sales and a 13% increase in core sales, driven by robust demand for proprietary drug delivery systems. The Beauty segment's sales remained flat, while the Closures segment reported a modest 2% growth in sales.

CEO Stephan B. Tanda highlighted the company's efficient cost management and operational leverage improvements, which contributed to the decrease in selling, general, and administrative (SG&A) expenses as a percentage of sales compared to the previous year.

Financial Statements Insight

The consolidated statements of income showed a marked improvement in operating income, which climbed to $112.083 million from $83.939 million in the prior year. This growth was supported by a lower tax rate due to a favorable mix of earnings and benefits from share-based compensation.

The balance sheet remains robust with total assets slightly decreased to $4.437 billion from $4.452 billion at the end of 2023. The company maintained a strong liquidity position with cash and equivalents of $199.834 million.

AptarGroup's commitment to shareholder returns continued, with the Board approving a quarterly cash dividend of $0.41 per share and the repurchase of 86 thousand shares for approximately $12 million during the quarter.

Outlook and Forward Guidance

Looking ahead, AptarGroup expects the positive trends to persist into the second quarter of 2024, with earnings per share projected to be between $1.30 and $1.38. The company anticipates ongoing strong performance in its Pharma segment and increasing demand for its consumer dispensing technologies.

The strategic focus for 2024 remains on accelerating growth and enhancing profitability, with ongoing initiatives to improve operational performance and manage costs effectively across all segments.

AptarGroup's robust first-quarter performance sets a positive tone for the year, reflecting its strong market position and effective execution of strategic initiatives. Investors and stakeholders can look forward to continued growth and operational enhancements that are likely to drive further value creation.

Explore the complete 8-K earnings release (here) from AptarGroup Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance