Apple Warns of Sluggish Holiday Quarter After China Slowdown

(Bloomberg) -- Apple Inc., already facing a slowdown in China, warned that revenue in the holiday quarter will be about the same as last year, signaling that investors won’t see the growth rebound they were banking on.

Most Read from Bloomberg

Rockstar Plans to Announce Much Anticipated ‘Grand Theft Auto VI’

US 30-Year Mortgage Rate Tumbles by Most in More Than a Year

VIX Notches Its Longest Slide Since October 2015: Markets Wrap

Virginia Democrats Fend Off Republican Sweep in Win for Abortion Rights

Though iPhone revenue is expected to increase in the December quarter, overall sales will be similar to the year-earlier period, Chief Financial Officer Luca Maestri said on a conference call Thursday following Apple’s quarterly report. The tepid outlook sent shares down as much as 2.4% Friday, before paring some losses.

Wall Street had projected revenue growth of about 5% in the quarter, which is invariably Apple’s biggest sales period of the year. Revenue from the iPad and the company’s wearables category, which includes its smartwatch line, will drop significantly during the quarter, Apple said. The Mac, on the other hand, will see an acceleration.

The company has been trying to pull out of its longest sales slowdown in decades. It just reported its fourth straight revenue decline, matching a streak it suffered in 2001, as the company struggles with a sluggish computer market and shaky demand in China.

Revenue fell to $89.5 billion in the fiscal fourth quarter, which ended Sept. 30. That compared with an average Wall Street estimate of $89.4 billion. Apple didn’t provide formal guidance for the current quarter, sticking with a policy it adopted during the pandemic.

Read More: Apple’s Disappointing Outlook Spotlights Growing China Woes

The results suggest that Apple is facing a deceleration in China. The government there has imposed bans on US technology in some workplaces, and a new phone from Huawei Technologies Co. is providing fresh competition. Revenue from that region amounted to $15.1 billion last quarter, down slightly from a year earlier and well short of the $17 billion that some analysts had predicted. Cook said the decline was due to a drop in Mac and iPad sales, as well as currency fluctuations.

Apple shares dropped 1.1% to $175.57 at 9:47 a.m. in New York on Friday. They were up 37% this year at Thursday’s close.

The company updated the iPhone, its flagship product, during the fourth quarter. The period included a little over a week of sales data following the device’s launch on Sept. 22. The Cupertino, California-based company also released new watch models — the Series 9 and Ultra 2 — and updated its AirPods Pro to add a USB-C port.

Even with the challenges, the iPhone performed slightly better than projected. It generated $43.8 billion in sales, compared with an average estimate of $43.7 billion. And, despite the concerns, the device reached a quarterly revenue record in mainland China, Chief Executive Officer Tim Cook said during the conference call with analysts. Earnings came in at $1.46 a share last quarter, topping the $1.39 forecast.

Cook also said the company was investing “quite a bit” in generative artificial intelligence. Bloomberg News recently reported that Apple is planning to inject the technology into several new apps and services next year. “You will see product advancements over time,” Cook said, “where those technologies are at the heart of them.”

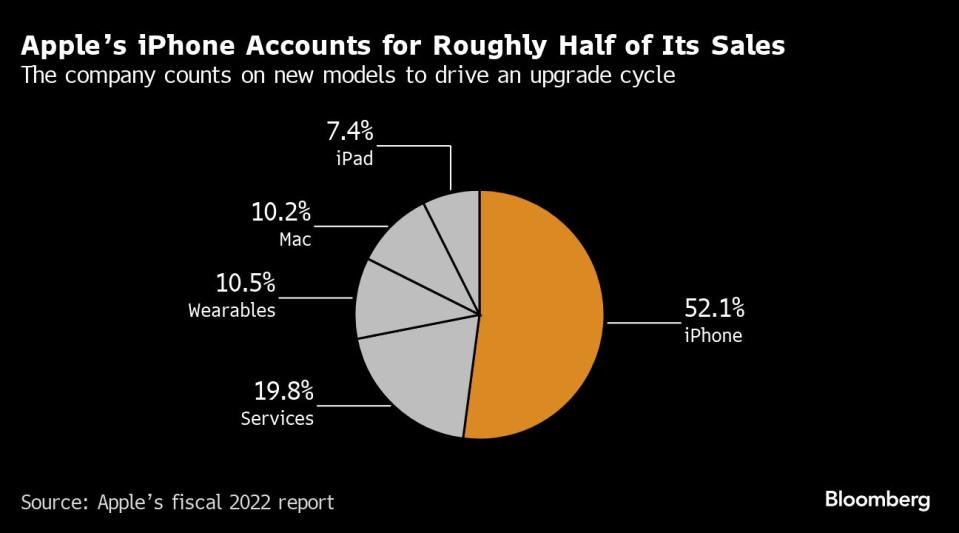

The iPhone accounts for roughly half of Apple’s sales, so the launch of a new model is closely watched by investors. With the iPhone 15, the company redesigned the high-end versions — giving them titanium cases — and added features such as a more powerful zoom camera lens. The hope was to entice smartphone shoppers who had been holding onto their old models for longer these days.

Apple had a favorable year-over-year comparison this cycle because 2022’s iPhone 14 Pro models faced supply constraints due to shutdowns at Apple’s manufacturing partners in China. The iPhone 15 Pro had no such limitations.

Thursday’s report follows an upbeat view from Qualcomm Inc., the leading maker of smartphone chips. On Wednesday, it forecast stronger sales for the current quarter than analysts expected, kicking off a rally for its stock.

What Bloomberg Intelligence Says:

“The sales miss in China is discouraging and could have been caused by soft consumer spending.”

— Anurag Rana, BI technology industry analyst

Click here to read his research.

In one potentially ominous sign, Qualcomm said that its smartphone chip business saw a 35% increase from Chinese manufacturers of Android phones, suggesting that customers in the region are opting for non-iPhones in larger numbers.

The area is Apple’s largest international market, accounting for about a fifth of sales. Still, Cook said he believes Apple actually gained smartphone market share in China during the quarter.

The company said that the iPhone set revenue records in several developed and emerging markets, including India.

The personal computer market also is poised for a resurgence, but Apple didn’t debut any new models during the quarter. Though it unveiled new MacBook Pros, iMacs and M3 processors earlier this week, sales of those machines won’t show up in Apple results until the quarter ending in December.

Apple brought in $7.61 billion from the Mac during the fourth quarter, missing forecasts of $8.76 billion. The company did release some new computers earlier this year, including a 15-inch MacBook Air and faster desktops. Apple blamed the steep decline on manufacturing challenges for the Mac last year. The company lost sales during the June quarter a year ago, only to regain them from pent-up demand in the September period. That set up a poor comparison for this year.

Read More: Apple Unveils New Laptops, iMac and Trio of More Powerful Chips

Revenue for the September quarter might have been stronger if the company had released new iPads during the period, which it sometimes does, or made more significant changes to its accessories. The latest Apple Watches and AirPods only represent modest tweaks from their predecessors.

The Wearables, Home and Accessories segment, which includes the watch, AirPods, Apple TV set-top box and Beats headphones, brought revenue of $9.32 billion. That fell short of the $9.41 billion estimate.

The services segment generated $22.3 billion in sales, beating Wall Street targets of $21.4 billion. That’s an all-time record for the category. The company is looking to make that business even more lucrative: It raised the prices for Apple TV+, Arcade and News+ last month, though that change was too recent to affect these results.

The iPad brought in revenue of $6.44 billion. Though that was a 10% decline from last year, it was better than the $6.12 billion projection. Apple hasn’t introduced a new iPad this calendar year, the first time that’s happened since the product first debuted in 2010. It did, however, release a cheaper Apple Pencil stylus for its tablets this week.

(Updates with shares in second and seventh paragraphs)

Most Read from Bloomberg Businessweek

In Uruguay, a Tax Haven With Lots of Beaches and Little Crime

Top-Ranked MBA Programs Struggle to Reverse Declining Applications

©2023 Bloomberg L.P.

Yahoo Finance

Yahoo Finance