Apple is China's top mobile brand (AAPL)

BI Intelligence

This story was delivered to BI Intelligence Apps and Platforms Briefing subscribers hours before appearing on Business Insider. To be the first to know, please click here.

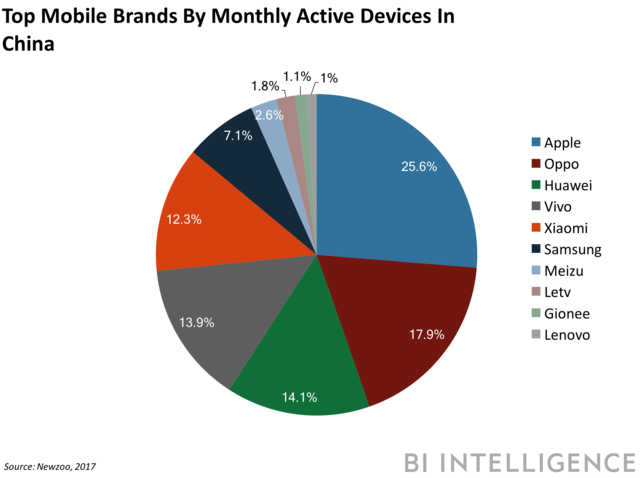

While iOS may not be the leading OS in China, Apple is China’s leading device manufacturer and accounts for the largest share of monthly active devices in the region, according to Newzoo.

Android accounts for 74% of active devices in the Chinese smartphone market, leaving the iOS ecosystem with just a 26% share. Yet, Apple iPhones and iPads represent 25.6% of monthly active mobile devices in China, well above that of its closest rivals OPPO, Huawei, Vivo, and Xiaomi at 17.9%, 14.1%, 13.9%, and 12.3%, respectively (see chart, below).

The prominence of Apple iPhones and iPads in China highlights the fragmentation among the Android ecosystem.

The fragmentation of the device and software ecosystem in China could play to Apple’s advantage. China is an important growth market for Apple, but one that Apple has been struggling to capitalize on over the past few years; although China accounts for the most active iPhones in use globally, it’s only Apple’s third-largest market in terms of revenue. Here’s how Apple could grow that revenue in China in 2018:

Leverage the reach of the iOS App Store to win over developers. Apple’s App Store is China’s leading mobile app store by downloads, recording more than 500 million app downloads in March 2017. That’s more than twice the amount of downloads its closest rival Tencent recorded in the same period, according to China Internet Watch. If the App Store has more reach than competing app stores in China, that could compel more developers to create more content for iOS and help grow overall revenue.

Increase its share of active devices by driving switchers from Chinese manufacturers and prompting upgrades from preexisting iOS users in China. The release of the iPhone X has driven faster switching rates from competing vendors like Huawei and OPPO, according to Morgan Stanley. Apple’s newest flagship has also spurred upgrades; about half of China’s iPhone X buyers upgraded from the iPhone 7 or 7 Plus, which are only a year old.

In addition to spurring iPhone ownership and iOS development in China, Apple’s also focused on staying within China’s regulatory constraints. Apple’s made a number of compromises to accommodate China’s strict regulatory body.

Last month, Apple removed its “tipping tax” in China, which applied Apple’s standard 30% revenue cut for in-app purchases to voluntary tipping from users, just two months after it introduced the controversial App Store policy. And a few months ago, Apple announced the removal of several virtual private network (VPN) services from its App Store in China, after the Chinese government had been pressuring the firm to ban all VPNs — which allow users to bypass China’s heavily regulated internet — that aren’t approved by state regulators. Continued cooperation with the Chinese government could help Apple win over additional consumers and developers in China.

To receive stories like this one directly to your inbox every morning, sign up for the Apps and Platforms Briefing newsletter. Click here to learn more about how you can gain risk-free access today.

See Also:

Yahoo Finance

Yahoo Finance