AppFolio And Two More US Growth Companies With High Insider Ownership

As the U.S. stock market navigates through a period of adjustments, with major indices like the S&P 500 and Nasdaq experiencing fluctuations from record highs, investors continue to seek stable investment opportunities. In this context, growth companies with high insider ownership can be particularly appealing, as significant insider stakes often signal confidence in the company's future prospects amidst market volatility.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

Duolingo (NasdaqGS:DUOL) | 15% | 48% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

Let's explore several standout options from the results in the screener.

AppFolio

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AppFolio, Inc. offers cloud-based business management solutions specifically tailored for the real estate sector in the United States, with a market capitalization of approximately $8.86 billion.

Operations: The company generates revenue primarily through its cloud-based business management software and Value+ platforms, totaling approximately $671.78 million.

Insider Ownership: 31.6%

AppFolio has shown a promising trajectory, transitioning to profitability this year with first-quarter sales jumping to US$187.43 million from US$136.1 million in the previous year, and net income reaching US$38.66 million after a loss of US$35.11 million. Despite high insider ownership, recent months have seen significant insider selling rather than buying, raising concerns about shareholder alignment. Nonetheless, AppFolio's earnings are expected to grow by 28.5% annually, outpacing the broader U.S market forecast of 14.7%.

Get an in-depth perspective on AppFolio's performance by reading our analyst estimates report here.

The valuation report we've compiled suggests that AppFolio's current price could be inflated.

Credit Acceptance

Simply Wall St Growth Rating: ★★★★★☆

Overview: Credit Acceptance Corporation operates in the United States, offering financing programs along with related products and services, with a market capitalization of approximately $6.23 billion.

Operations: The company generates revenue primarily through financing programs and related products and services, totaling $866.70 million.

Insider Ownership: 14.4%

Credit Acceptance, despite a high level of debt, is poised for robust growth with earnings projected to increase by 37.9% annually and revenue growth expected at 42.7% per year, both outpacing the U.S. market significantly. Recent adjustments in their credit facility terms and active share buybacks underline management's confidence in operational stability and shareholder value enhancement. However, a recent drop in quarterly net income highlights potential volatility in profitability amidst these expansions.

Amerant Bancorp

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Amerant Bancorp Inc., with a market capitalization of approximately $761.92 million, operates as the bank holding company for Amerant Bank, N.A., serving various customers and businesses.

Operations: The company generates its revenue primarily from banking activities, totaling approximately $315.85 million.

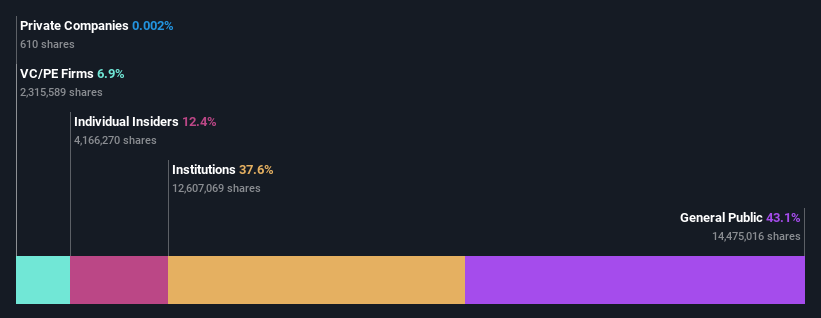

Insider Ownership: 12.4%

Amerant Bancorp Inc. is experiencing a notable decline in net interest income and net income as reported in its first quarter results, with earnings per share also decreasing from the previous year. Despite these challenges, the company maintains a dividend, recently affirming a $0.09 per-share payout. While insider transactions show more buying than selling over the past three months, Amerant's profit margins have diminished compared to last year, and its significant expected annual earnings growth outpaces broader market forecasts.

Make It Happen

Click here to access our complete index of 183 Fast Growing US Companies With High Insider Ownership.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGM:APPF NasdaqGS:CACC and NYSE:AMTB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance