Apparel, Accessories and Luxury Goods Stocks Q1 In Review: Oxford Industries (NYSE:OXM) Vs Peers

As the Q1 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers in the apparel, accessories and luxury goods industry, including Oxford Industries (NYSE:OXM) and its peers.

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 17 apparel, accessories and luxury goods stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 0.5%. while next quarter's revenue guidance was 2.2% below consensus. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and apparel, accessories and luxury goods stocks have held roughly steady amidst all this, with share prices up 2.6% on average since the previous earnings results.

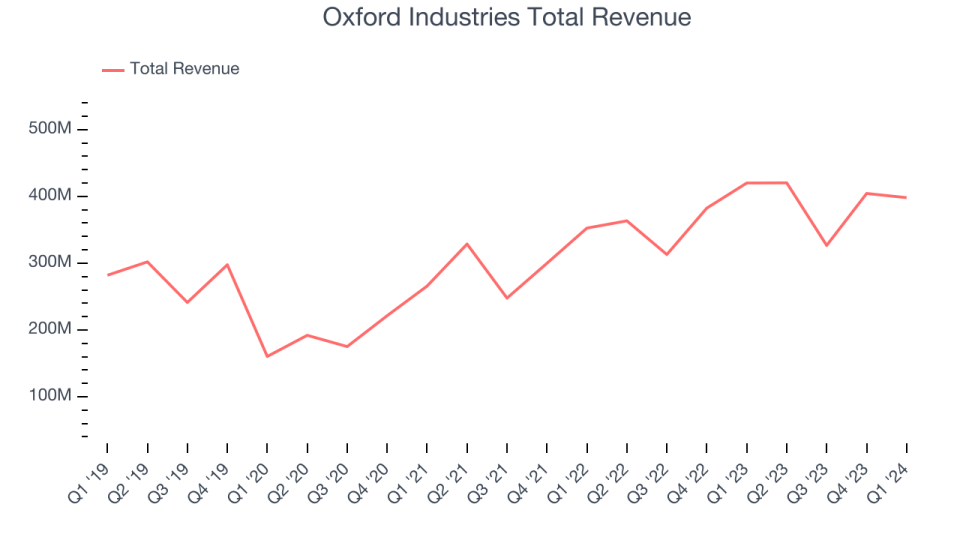

Oxford Industries (NYSE:OXM)

The parent company of Tommy Bahama, Oxford Industries (NYSE:OXM) is a lifestyle fashion conglomerate with brands that embody outdoor happiness.

Oxford Industries reported revenues of $398.2 million, down 5.2% year on year, falling short of analysts' expectations by 1.6%. It was a weak quarter for the company, with underwhelming earnings guidance for the full year and a miss of analysts' operating margin estimates.

Tom Chubb, Chairman and CEO, commented, “Our strong brands and excellent team focused on executing our strategy allowed us to deliver sales and adjusted EPS within our guidance ranges for the first quarter despite continued macroeconomic headwinds and lower levels of consumer sentiment.

The stock is down 0.7% since the results and currently trades at $100.32.

Read our full report on Oxford Industries here, it's free.

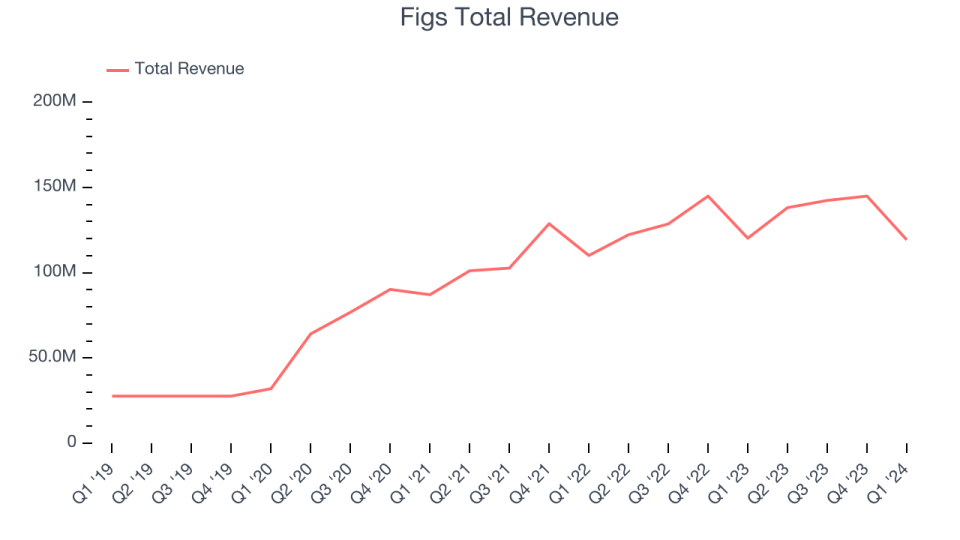

Best Q1: Figs (NYSE:FIGS)

Rising to fame via TikTok and founded in 2013 by Heather Hasson and Trina Spear, Figs (NYSE:FIGS) is a healthcare apparel company known for its stylish approach to medical attire and uniforms.

Figs reported revenues of $119.3 million, down 0.8% year on year, outperforming analysts' expectations by 1.6%. It was a very strong quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is down 20.2% since the results and currently trades at $4.49.

Is now the time to buy Figs? Access our full analysis of the earnings results here, it's free.

ThredUp (NASDAQ:TDUP)

Founded to revolutionize thrifting, ThredUp (NASDAQ:TDUP) is a leading online fashion resale marketplace that offers a wide selection of gently-used clothing and accessories.

ThredUp reported revenues of $79.59 million, up 4.8% year on year, falling short of analysts' expectations by 0.9%. It was a weak quarter for the company, with a miss of analysts' operating margin and earnings estimates.

ThredUp pulled off the fastest revenue growth but had the weakest full-year guidance update in the group. The stock is down 11.8% since the results and currently trades at $1.65.

Read our full analysis of ThredUp's results here.

Guess (NYSE:GES)

Flexing the iconic upside-down triangle logo with a question mark, Guess (NYSE:GES) is a global fashion brand known for its trendy clothing, accessories, and denim wear.

Guess reported revenues of $591.9 million, up 3.9% year on year, surpassing analysts' expectations by 3%. It was a mixed quarter for the company, with a miss of analysts' operating margin estimates.

The stock is down 12.4% since the results and currently trades at $20.48.

Read our full, actionable report on Guess here, it's free.

Movado (NYSE:MOV)

With its watches displayed in 20 museums around the world, Movado (NYSE:MOV) is a watchmaking company with a portfolio of watch brands and accessories.

Movado reported revenues of $136.7 million, down 5.7% year on year, falling short of analysts' expectations by 5.9%. It was an ok quarter for the company, with optimistic earnings guidance for the full year but a miss of analysts' operating margin estimates.

Movado had the weakest performance against analyst estimates among its peers. The stock is down 5.9% since the results and currently trades at $25.14.

Read our full, actionable report on Movado here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance