Apparel, Accessories and Luxury Goods Stocks Q1 Teardown: Ralph Lauren (NYSE:RL) Vs The Rest

As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at apparel, accessories and luxury goods stocks, starting with Ralph Lauren (NYSE:RL).

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 17 apparel, accessories and luxury goods stocks we track reported a mixed Q1; on average, revenues were in line with analyst consensus estimates. while next quarter's revenue guidance was 2.2% below consensus. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and while some of the apparel, accessories and luxury goods stocks have fared somewhat better than others, they collectively declined, with share prices falling 1.5% on average since the previous earnings results.

Ralph Lauren (NYSE:RL)

Originally founded as a necktie company, Ralph Lauren (NYSE:RL) is an iconic American fashion brand known for its classic and sophisticated style.

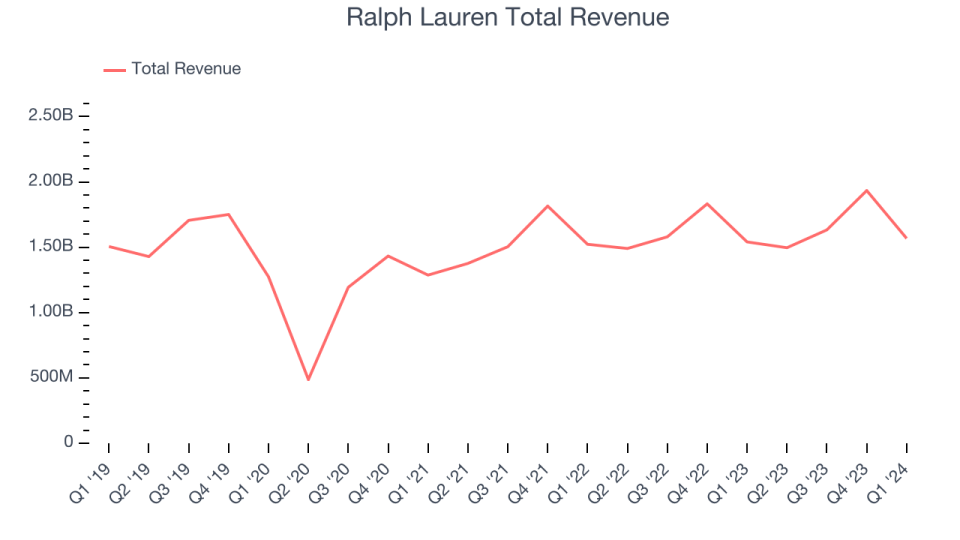

Ralph Lauren reported revenues of $1.57 billion, up 1.8% year on year, in line with analysts' expectations. It was a mixed quarter for the company: Ralph Lauren narrowly topped analysts' constant currency revenue and EPS expectations. On the other hand, its operating margin and full-year revenue guidance fell short of estimates.

"Our teams delivered continued progress on our strategic and financial commitments in year two of our Next Great Chapter: Accelerate plan," said Patrice Louvet, President and Chief Executive Officer.

The stock is up 2.8% since the results and currently trades at $168.73.

Read our full report on Ralph Lauren here, it's free.

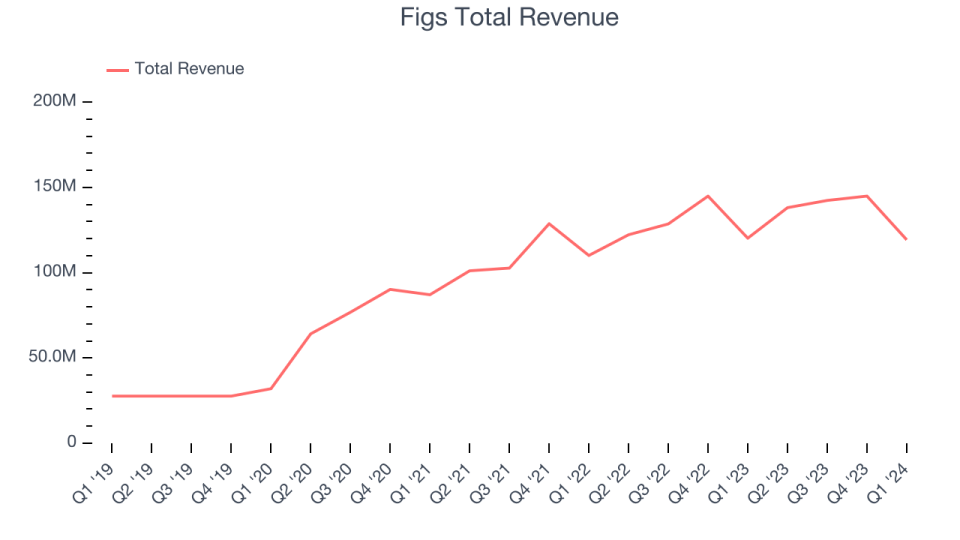

Best Q1: Figs (NYSE:FIGS)

Rising to fame via TikTok and founded in 2013 by Heather Hasson and Trina Spear, Figs (NYSE:FIGS) is a healthcare apparel company known for its stylish approach to medical attire and uniforms.

Figs reported revenues of $119.3 million, down 0.8% year on year, outperforming analysts' expectations by 1.6%. It was an very strong quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is down 2.7% since the results and currently trades at $5.48.

Is now the time to buy Figs? Access our full analysis of the earnings results here, it's free.

ThredUp (NASDAQ:TDUP)

Founded to revolutionize thrifting, ThredUp (NASDAQ:TDUP) is a leading online fashion resale marketplace that offers a wide selection of gently-used clothing and accessories.

ThredUp reported revenues of $79.59 million, up 4.8% year on year, falling short of analysts' expectations by 0.9%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

ThredUp had the weakest full-year guidance update in the group. The stock is down 12.3% since the results and currently trades at $1.64.

Read our full analysis of ThredUp's results here.

Kontoor Brands (NYSE:KTB)

Founded in 2019 after separating from VF Corporation, Kontoor Brands (NYSE:KTB) is a clothing company known for its high-quality denim products.

Kontoor Brands reported revenues of $631.2 million, down 5.4% year on year, surpassing analysts' expectations by 3.8%. It was a strong quarter for the company, with an impressive beat of analysts' earnings and constant currency revenue estimates.

The stock is up 4.4% since the results and currently trades at $64.83.

Read our full, actionable report on Kontoor Brands here, it's free.

Columbia Sportswear (NASDAQ:COLM)

Originally founded as a hat store in 1938, Columbia Sportswear (NASDAQ:COLM) is a manufacturer of outerwear, sportswear, and footwear designed for outdoor enthusiasts.

Columbia Sportswear reported revenues of $770 million, down 6.2% year on year, surpassing analysts' expectations by 3.6%. It was a solid quarter for the company, with an impressive beat of analysts' constant currency revenue and earnings estimates.

The stock is down 0.7% since the results and currently trades at $78.46.

Read our full, actionable report on Columbia Sportswear here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance