Here's Why You Should Buy Bonanza Creek Stock Right Now

On May 12, Bonanza CreekEnergy, Inc. BCEI was raised to a Zacks Rank #1 (Strong Buy).

Why the Upgrade?

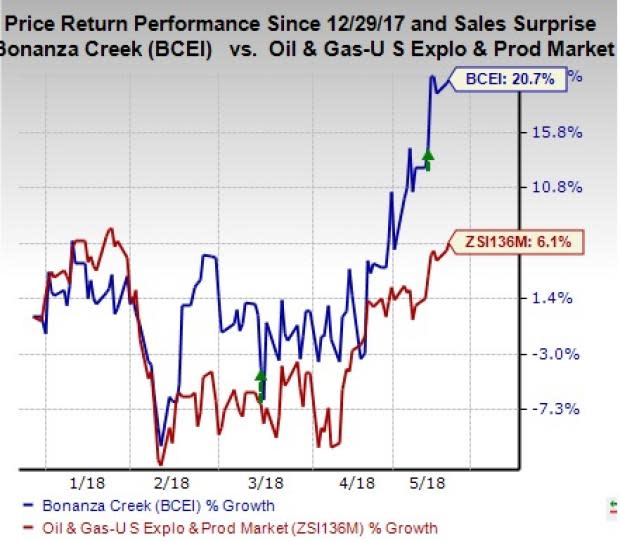

The share price of Bonanza Creek has jumped 20.7% year to date, outperforming the industry’s 6.1% gain.

The Zacks Consensus Estimate for 2018 earnings per share has been revised upward from $3.24 to $3.71 over the last 60 days. We expect the company to record sales growth of 39.5% and 48.8% in 2018 and 2019, respectively.

Bonanza Creek has a strong earnings surprise history. The company surpassed the Zacks Consensus Estimate for earnings in each of the last four quarters, the average positive surprise being 215.4%.

In first-quarter 2018, the company posted adjusted earnings per share of $1.07, surpassing the Zacks Consensus Estimate of 71 cents and the year-ago adjusted profit of 2 cents. The company’s top line of $64.2 million beat the Zacks Consensus Estimate of $59 million and rose from the year-ago $52.6 million. Oil equivalent production was higher than the company’s expectations on increased well completion activities. This drove the strong first-quarter results.

Moreover, the business scenario is pretty profitable for upstream activities. The West Texas Intermediate crude has crossed the $70-a-barrel psychological mark after President Trump’s announcement that the United States will pull out of the Iran nuclear deal. Since nearly 60% of the company’s production comprises oil, the favorable crude pricing environment is highly favorable for Bonanza Creek.

Other Stocks to Consider

Other prospective players in the energy space are BP plc BP, WildHorse Resource Development Corporation WRD and W&T Offshore, Inc. WTI. BP and WildHorse sport a Zacks Rank #1, while W&T Offshore carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BP managed to beat the Zacks Consensus Estimate in three of the last four quarters.

WildHorse is expected to see year-over-year earnings growth of 288.4% in 2018.

W&T Offshore, Inc. (WTI) will likely witness earnings growth of 7.1% in 2018.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP) : Free Stock Analysis Report

W&T Offshore, Inc. (WTI) : Free Stock Analysis Report

Bonanza Creek Energy, Inc. (BCEI) : Free Stock Analysis Report

Wildhorse Resource Development Corporation (WRD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance