Apellis (APLS) Q1 Earnings Miss, Empaveli & Syfovre Fuel Growth

Apellis Pharmaceuticals, Inc. APLS reported first-quarter 2023 loss of $1.56 per share, which was wider than the Zacks Consensus Estimate of a loss of $1.42. The figure was also wider than our model estimates of a loss of $1.40 per share. The company reported a loss of $1.42 per share in the year-ago quarter.

Total revenues amounted to $44.8 million, which surpassed the Zacks Consensus Estimate of $26 million. The figure was also higher than our model estimates of $26.3 million. In the year-ago quarter, the company reported revenues of $14 million.

APLS’ shares were up almost 8% on Thursday, after trading hours, following the earnings results. The stock has risen 63.2% so far this year against the industry’s 6.2% decline.

Image Source: Zacks Investment Research

Quarter in Detail

Revenues in the reported quarter included product sales of the marketed drugs — Empaveli (pegcetacoplan) and Syfovre (pegcetacoplan injection) — and licensing and other revenues.

Empaveli recorded sales of $20.4 million in the reported quarter, up 69% from that reported in the year-ago quarter. Syfovre recorded its first sales of $18.4 million in the quarter.

In February this year, the FDA approved Syfovre for treating geographic atrophy secondary to age-related macular degeneration. The commercial launch of the drug began in March 2023. A marketing authorization application seeking approval of pegcetacoplan for geographic atrophy is currently under review by the European Medicines Agency. A decision regarding the same is expected in early 2024.

Licensing and other revenues came in at 6 million, up 266% from the year-ago quarter’s figure.

Research and development expenses increased 21% to $110 million from the prior-year quarter’s level. This was due to an increase in personnel costs and additional expenses for pre-clinical studies.

General and administrative expenses totaled $102.1 million, up 99% from $51.2 million in the comparable quarter of 2022. This was driven by higher employee-related costs and an increase in professional and consulting fees.

As of Mar 31, 2023, Apellis had cash, cash equivalents and marketable securities worth $765 million compared with $551.8 million as of Dec 31, 2022.

Pipeline Updates

Last month, the company discontinued a phase II MERIDIA study of systemic pegcetacoplan for amyotrophic lateral sclerosis. The decision was based on an unblinded review of the available data by an independent data monitoring committee,which did not support the continuation of the treatment. The top-line data for the same are expected in the second quarter of 2023, which will help in deciding the next steps of the program.

In March, the FDA notified Apellis that it would miss the PDUFA target action date of Mar 15, 2023, for the Empaveli Injector supplemental new drug application (sNDA) application. APLS is awaiting further timing information. Empaveli injector is an on-body drug delivery system capable of self-administering pegcetacoplan through subcutaneous infusion.

In February, the FDA approved the sNDA, seeking approval of Empaveli for treatment-naive PNH patients. The approval was based on results from the phase III PRINCE and the 48-week phase III PEGASUS studies.

The phase III VALIANT study of systemic pegcetacoplan for Immune complex membranoproliferative glomerulonephritis and C3 glomerulopathy is currently enrolling patients. Data from the study is anticipated in 2024.

Apellis’ partner, Sobi, is currently enrolling patients in its phase II study evaluating the efficacy and safety of systemic pegcetacoplan in patients with hematopoietic stem cell transplantation-associated thrombotic microangiopathy. Data from this study is expected in 2024. Sobi is also currently enrolling patients for its phase III CASCADE study of systemic pegcetacoplan for cold agglutinin disease.

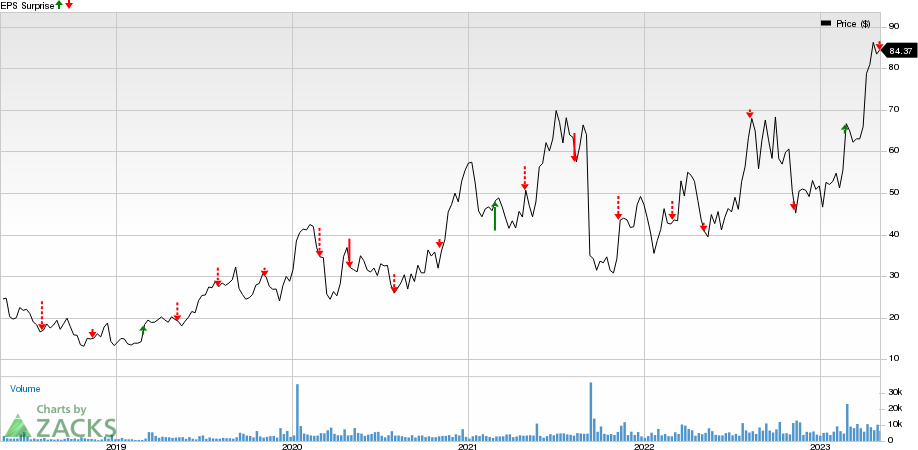

Apellis Pharmaceuticals, Inc. Price and EPS Surprise

Apellis Pharmaceuticals, Inc. price-eps-surprise | Apellis Pharmaceuticals, Inc. Quote

Zacks Rank and Stocks to Consider

Apellis currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same sector are Ocuphire Pharma OCUP, Allogene Therapeutics ALLO and Arcus Biosciences RCUS. While Ocuphire Pharma sports a Zacks Rank #1 (Strong Buy), Allogene Therapeutics and Arcus Biosciences, both carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Loss per share estimates for Ocuphire Pharma have narrowed from 29 cents to 24 cents for 2023 and from 86 cents to 81 cents for 2024, in the past 60 days. The company’s shares have surged 66% in the year-to-date period. Ocuphire’s earnings beat estimates in three of the last four quarters and missed the mark in one, the average surprise being 23.85%.

Loss per share estimates for Allogene have narrowed from $2.56 to $2.44 for 2023, in the past 60 days. Shares of ALLO have gained 2.5% in the year-to-date period. Allogene’s earnings beat estimates in each of the last four quarters, the average surprise being 8.33%.

Loss per share estimates for Arcus Biosciences have narrowed from $4.52 to $4.42 for 2023 and from $3.51 to $3.33 for 2024, in the past 60 days. Shares of RCUS have plunged 5.7% in the year-to-date period. Arcus Biosciences’ earnings outpaced estimates in two of the last four quarters, met the mark in one and missed in another, the average negative surprise being 48.83%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apellis Pharmaceuticals, Inc. (APLS) : Free Stock Analysis Report

Arcus Biosciences, Inc. (RCUS) : Free Stock Analysis Report

Allogene Therapeutics, Inc. (ALLO) : Free Stock Analysis Report

Ocuphire Pharma, Inc. (OCUP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance