Antero Resources Corp (AR) Posts First Quarter 2024 Earnings: A Focus on Efficiency and Liquidity

Net daily natural gas equivalent production: Averaged 3.4 Bcfe/d in Q1 2024, including 202 MBbl/d of liquids.

Average realized natural gas price: $2.35 per Mcf, an $0.11 premium to the First-of-Month NYMEX Henry Hub price.

C3+ NGL realized price guidance for 2024: Increased to a range of $0.00 to $1.00 per barrel premium to Mont Belvieu.

Free Cash Flow: Reported at $11 million in Q1 2024.

All-in cash expense: Reduced to $2.44 per Mcfe, a 1% decrease year-over-year.

Capital expenditures: Drilling and completion capital expenditures were $187 million in Q1 2024.

Production guidance for 2024: Increased to 3.35 to 3.4 Bcfe/d, reflecting higher liquids volumes and capital efficiency gains.

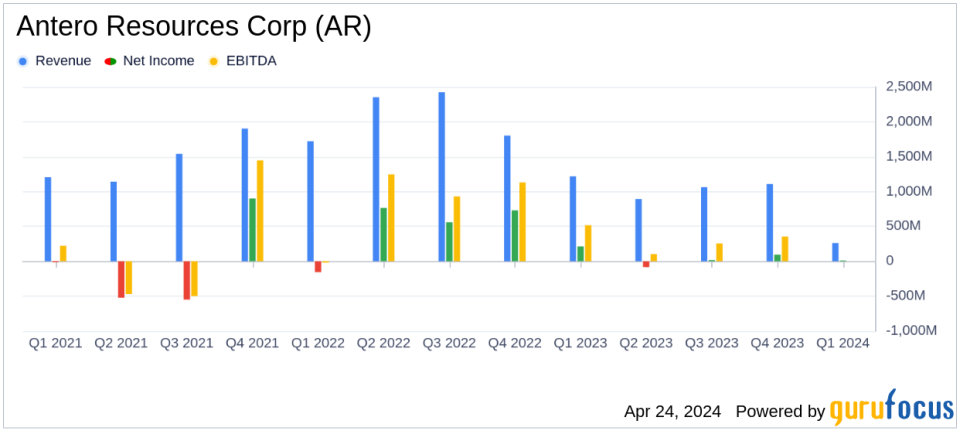

On April 24, 2024, Antero Resources Corp (NYSE:AR), a prominent player in the natural gas and liquids sector, disclosed its financial and operational results for the first quarter of 2024 through its 8-K filing. The Denver-based company, known for its extensive activities in the exploration and production of natural gas and natural gas liquids primarily in the U.S. and Canada, reported several operational achievements and a strategic focus that led to record-setting performance metrics in the quarter.

Operational Highlights and Financial Performance

Antero Resources achieved significant operational efficiencies, highlighted by record completion stages and pumping hours, which have been pivotal in driving production volumes and reducing costs. The company reported a net daily natural gas equivalent production of 3.4 Bcfe/d, with liquids making up 202 MBbl/d. This production is supported by a strategic shift in NGL marketing, focusing on international benchmarks which have led to a 14% increase in C3+ NGL prices from the previous quarter.

The financial outcomes for Q1 2024 were notably influenced by these operational efficiencies and the strategic marketing of liquids. Despite a challenging pricing environment with the NYMEX Henry Hub price averaging at $2.24 per Mcf, Antero's average realized natural gas price stood at $2.35 per Mcf, a premium over the NYMEX rate. This premium is a direct result of the company's unhedged production profile and robust firm transportation position, which ensures delivery of 100% of its natural gas out of basin.

Financial Strategy and Market Adaptation

Antero's financial strategy in the first quarter was marked by a significant reduction in maintenance capital expenditures and a focus on liquid development, culminating in a positive Free Cash Flow of $11 million. This is an impressive turnaround considering the unhedged position against a backdrop of low natural gas prices. The company's ability to adapt to market conditions and strategically manage its portfolio of assets and operations has been crucial in maintaining financial stability and liquidity.

Moreover, Antero has updated its full-year 2024 guidance, reflecting increased optimism with a production guidance uplift to 3.35 to 3.4 Bcfe/d and a decrease in cash production expense guidance to $2.40 to $2.50 per Mcfe. These adjustments underscore the company's efficient operational capabilities and responsive market strategies.

Challenges and Industry Outlook

While Antero Resources has navigated the first quarter with notable successes, the industry continues to face challenges from fluctuating commodity prices and regulatory pressures. However, the company's focus on capital efficiency and operational excellence positions it well to manage these challenges effectively. The anticipated balance in the natural gas market, driven by reduced U.S. supply and increased demand from LNG exports and power sectors, is expected to provide a favorable environment for Antero moving forward into 2025.

Commitment to Sustainability and Community Engagement

Antero Resources is not just focusing on financial and operational metrics but is also deeply engaged in sustainability and community initiatives. The expansion of its Project Canary certification and partnerships for cleaner energy solutions in Ghana highlight the company's commitment to environmental stewardship and social responsibility. These efforts are aligned with its goal to achieve Net Zero Scope 1 & 2 GHG emissions by 2025, demonstrating a holistic approach to value creation that encompasses financial performance, environmental sustainability, and community impact.

In conclusion, Antero Resources Corp's first quarter of 2024 illustrates a resilient and strategically poised company leveraging operational efficiencies and market adaptations to navigate a complex industry landscape. With a clear focus on sustainability and community engagement, Antero is setting standards in the natural gas sector that could potentially translate to sustained long-term growth and shareholder value.

Explore the complete 8-K earnings release (here) from Antero Resources Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance