Annovis (ANVS) Up as Its Lead Candidate Meets Goals in PD Study

Annovis Bio ANVS announced that it has met the primary and secondary endpoints in the late-stage study evaluating two dosage strengths (10mg and 20mg) of its lead product candidate, buntanetap, for treating Parkinson’s disease (PD). Per the company, treatment with the candidate demonstrated a safe and effective improvement in motor and non-motor activities and improved cognitive functions in patients with early PD.

Annovis’ shares surged 76.1% on Jul 2 following the encouraging news. Buntanetap, an orally available small molecule, has a unique mechanism of action that allows the candidate to reverse neurodegeneration by inhibiting the formation of multiple neurotoxic proteins, including amyloid beta, tau, alpha-synuclein and TDP43.

Please note that the phase III study was completed in December 2023, with an original plan for data announcement in the first quarter of 2024. Due to a delay in the process of organizing and cleaning data, Annovis announced the unblinding of the phase III PD study data in May 2024 followed by the top-line efficacy and safety data in the latest press release.

It was observed that patients who were diagnosed with PD for less than three years showed minimal or no deficits in MDS-UPDRS Part II, the primary endpoint of the phase III study, complicating the assessment of treatment effectiveness. However, in those patients who were diagnosed for more than three years, 20mg of buntanetap significantly improved MDS-UPDRS Part II, Part III, Part II+III and Total scores compared with placebo and baseline.

Furthermore, patients with postural instability and gait difficulty (PIGD) treated with buntanetap showed significant improvements in MDS-UPDRS Part II, Part III, Part II-III and Total scores. Since PIGD progresses faster than in other PD patients, these patients responded better to buntanetap and showed greater improvements compared with other PD patients.

Additionally, in the phase III PD study, the placebo group experienced cognitive deterioration, while both treatment groups (10mg and 20mg of buntanetap) maintained baseline cognitive levels, demonstrating a statistically significant effect in halting cognitive decline. Among patients with mild dementia, cognitive deterioration occurred more rapidly in the placebo group compared with the 10mg buntanetap group, as measured by the exploratory endpoint of MMSE 20-26. On the other hand, treatment with 20mg buntanetap significantly improved cognition compared with placebo.

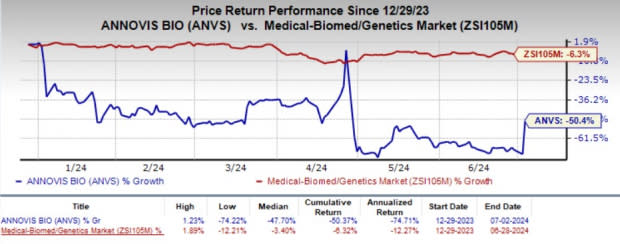

Year to date, shares of ANVS have plunged 50.4% compared with the industry’s 6.3% decline.

Image Source: Zacks Investment Research

In the same press release, Annovis clarified that although MDS-UPDRS Part II+III was initially chosen as the primary endpoint of the phase III PD study, MDS-UPDRS Part II alone was later deemed more appropriate for reflecting clinically relevant changes, based on FDA feedback. Therefore, the company adjusted its primary endpoint to MDS-UPDRS Part II with MDS-UPDRS Part III as a key secondary endpoint.

Per Annovis, the encouraging data readout from the late-stage PD study supports advancing buntanetap into a longer-period study to verify symptomatic improvements and explore its potential disease-modifying properties.

We remind the investors that the company is also evaluating buntanetap for the treatment of Alzheimer’s disease (AD). In the first half of 2024, Annovis reported positive results from a phase II/III study of the candidate for the treatment of patients with AD.

Annovis expects to discuss the AD data with the FDA soon and initiate an 18-month pivotal phase III study to confirm and expand these findings, focusing on biomarker-positive early AD patients. The company aims to complete the necessary pivotal studies for buntanetap by the end of 2026 and consequently file two new drug applications with the FDA for the AD and PD indications.

Apart from AD and PD, Annovis is also simultaneously evaluating the candidate for the treatment of other neurological indications in separate early-stage studies. The company’s pipeline also comprises two other investigational candidates, which are currently in early to mid-stage development for several other neurodegenerative diseases.

Zacks Rank and Other Stocks to Consider

Annovis currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the drug/biotech industryworth mentioning are ALX Oncology Holdings ALXO, Aligos Therapeutics, Inc. ALGS and Compugen CGEN, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology’s 2024 loss per share has remained constant at $2.89. During the same period, the consensus estimate for 2025 loss per share has remained constant at $2.73. Year to date, shares of ALXO have plunged 61.6%.

ALX Oncology beat estimates in two of the trailing four quarters and missed twice, delivering an average negative surprise of 8.83%.

In the past 30 days, the Zacks Consensus Estimate for Aligos Therapeutics’ 2024 loss per share has remained constant at 73 cents. During the same period, the consensus estimate for 2025 loss per share has remained constant at 71 cents. Year to date, ALGS shares have declined 39.8%.

ALGS’ earnings beat estimates in three of the trailing four quarters and missed the same on the remaining occasion, the average surprise being 7.83%.

In the past 30 days, the Zacks Consensus Estimate for Compugen’s 2024 earnings per share has remained constant at 5 cents. The consensus estimate for 2025 loss per share is currently pegged at 11 cents. Year to date, shares of CGEN have lost 14.6%.

CGEN’s earnings beat estimates in three of the trailing four quarters and missed once, delivering an average surprise of 5.79%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Compugen Ltd. (CGEN) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

Aligos Therapeutics, Inc. (ALGS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance