Announcing: VOXX International (NASDAQ:VOXX) Stock Soared An Exciting 398% In The Last Five Years

It hasn't been the best quarter for VOXX International Corporation (NASDAQ:VOXX) shareholders, since the share price has fallen 23% in that time. But that doesn't change the fact that the returns over the last half decade have been spectacular. To be precise, the stock price is 398% higher than it was five years ago, a wonderful performance by any measure. So we don't think the recent decline in the share price means its story is a sad one. Of course what matters most is whether the business can improve itself sustainably, thus justifying a higher price.

View our latest analysis for VOXX International

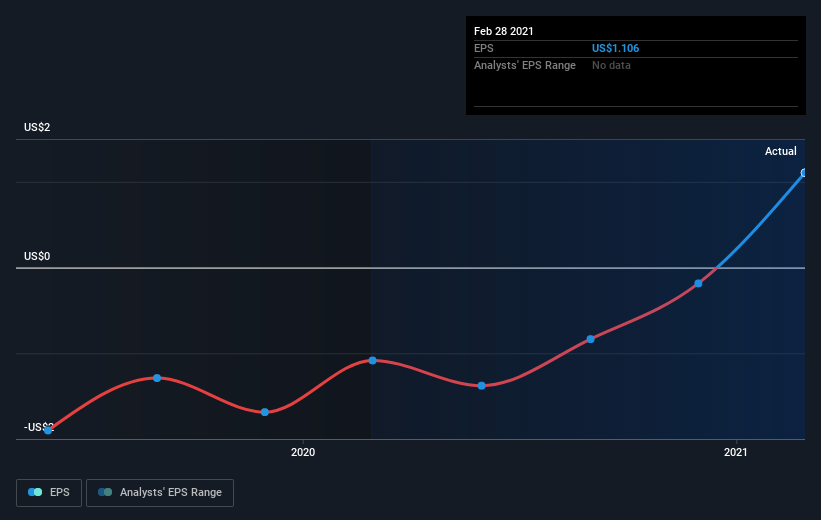

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, VOXX International became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. Indeed, the VOXX International share price has gained 182% in three years. In the same period, EPS is up 240% per year. This EPS growth is higher than the 41% average annual increase in the share price over the same three years. Therefore, it seems the market has moderated its expectations for growth, somewhat.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into VOXX International's key metrics by checking this interactive graph of VOXX International's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that VOXX International shareholders have received a total shareholder return of 190% over the last year. That gain is better than the annual TSR over five years, which is 38%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for VOXX International that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance