Announcing: Largo Resources (TSE:LGO) Stock Increased An Energizing 122% In The Last Three Years

While Largo Resources Ltd. (TSE:LGO) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 29% in the last quarter. In contrast, the return over three years has been impressive. Indeed, the share price is up a very strong 122% in that time. After a run like that some may not be surprised to see prices moderate. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

View our latest analysis for Largo Resources

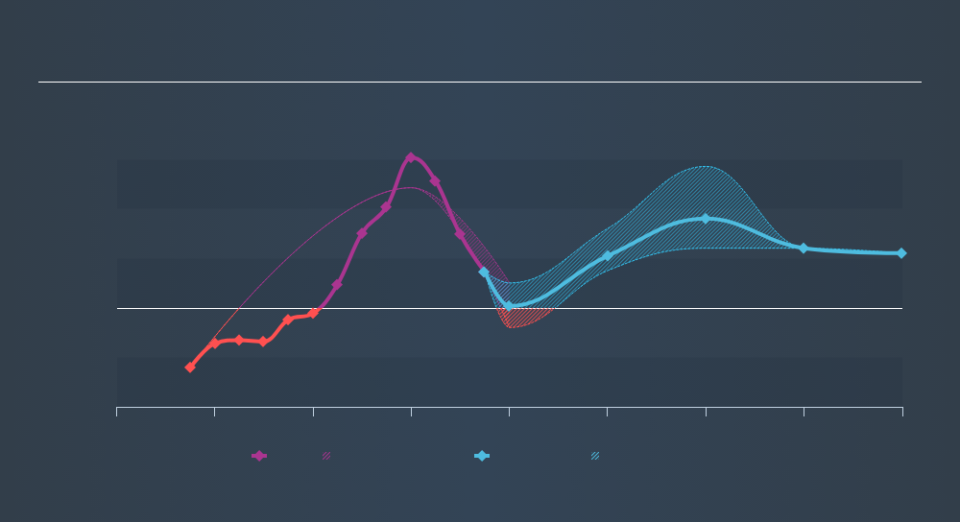

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During three years of share price growth, Largo Resources moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Largo Resources has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Largo Resources stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market gained around 11% in the last year, Largo Resources shareholders lost 73%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 12% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Before spending more time on Largo Resources it might be wise to click here to see if insiders have been buying or selling shares.

We will like Largo Resources better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance