Andreas Halvorsen's Strategic Acquisition in Longboard Pharmaceuticals

Overview of the Recent Transaction

On July 3, 2024, Viking Global Investors, under the leadership of Andreas Halvorsen (Trades, Portfolio), executed a significant transaction by acquiring 1,752,656 shares of Longboard Pharmaceuticals Inc (NASDAQ:LBPH). This move not only increased the firm's holdings in the company by 771,328 shares but also adjusted its portfolio impact to 0.09%. The shares were purchased at a price of $31.91, reflecting a strategic addition to Vikings diverse investment portfolio.

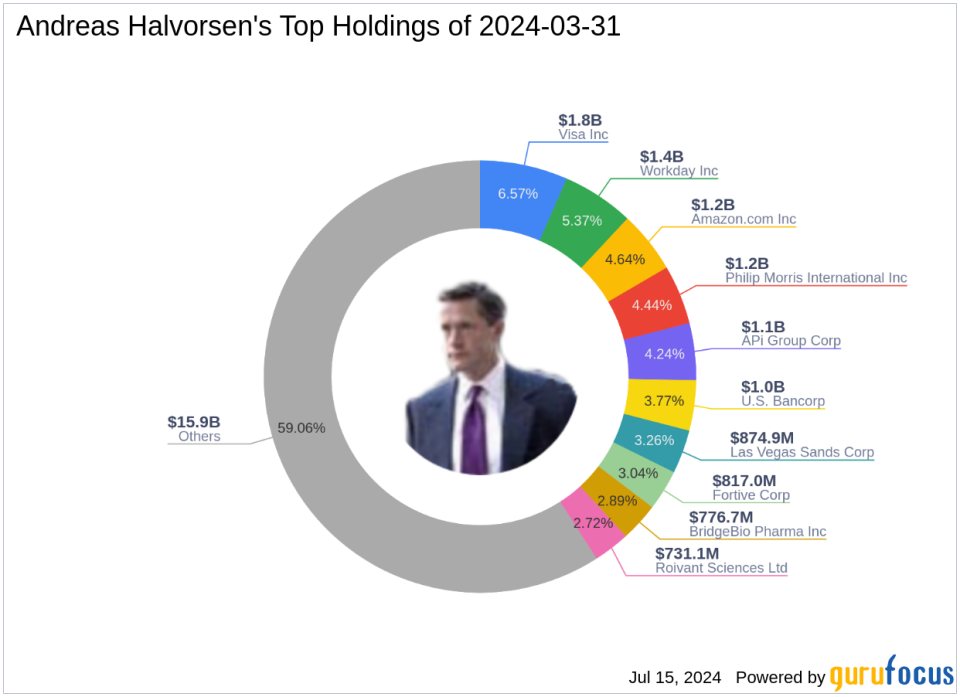

Profile of Andreas Halvorsen (Trades, Portfolio) and Viking Global Investors

Andreas Halvorsen (Trades, Portfolio), a notable figure in the investment world, founded Viking Global Investors LP in 1999. The firm, now managed by CIO Ning Jin, is renowned for its research-intensive and long-term focused investment approach, primarily in public and private equity across various sectors. Vikings strategy emphasizes fundamental analysis, decentralized investment research, and centralized risk management. With top holdings in major companies like Amazon.com Inc and Visa Inc, Viking manages a substantial equity portfolio valued at $26.86 billion, with a strong inclination towards the healthcare and technology sectors.

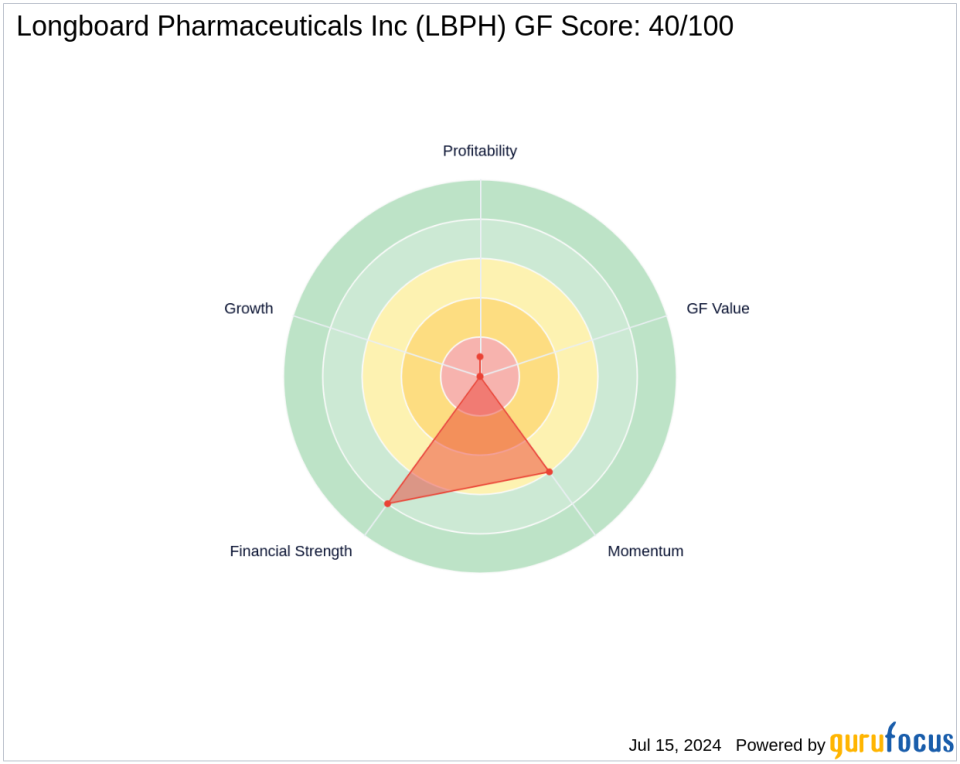

Introduction to Longboard Pharmaceuticals Inc

Longboard Pharmaceuticals Inc, a clinical-stage biopharmaceutical company, is at the forefront of developing transformative medicines for neurological diseases. Since its IPO on March 12, 2021, Longboard has been dedicated to advancing a portfolio of product candidates targeting specific G protein-coupled receptors (GPCRs), with a notable focus on LP352, a potential treatment for seizures associated with various encephalopathies.

Financial Analysis of the Trade

The recent acquisition by Viking Global Investors has not only increased its total shares in Longboard Pharmaceuticals to 1,752,656 but also enhanced its position in the firms portfolio to 5.20%. This strategic move is indicative of Vikings confidence in Longboards market potential and its alignment with Vikings investment philosophy.

Market Performance and Sector Context

Currently, Longboard Pharmaceuticals boasts a market capitalization of $1.5 billion, with a recent stock price surge to $38.65, marking a 21.12% gain since the transaction. Despite its impressive year-to-date performance increase of 53.98%, Longboard operates in the competitive biotechnology industry, where it continues to innovate in the neurological sector.

Future Outlook and Implications

This acquisition could signal a positive outlook for Longboard Pharmaceuticals, potentially bolstering its market position and enhancing its developmental projects. For Viking Global Investors, this investment aligns with its strategy of investing in companies with robust management teams and significant growth potential within their respective industries.

Conclusion

The recent acquisition by Andreas Halvorsen (Trades, Portfolio)s Viking Global Investors in Longboard Pharmaceuticals underscores a strategic investment move, reflecting confidence in the companys future and alignment with Vikings long-term investment philosophy. This transaction not only diversifies Vikings portfolio but also positions it to capitalize on potential growth in the biotechnology sector, particularly in the development of treatments for neurological diseases.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance