Analysts Just Shipped A Notable Upgrade To Their Stelco Holdings Inc. (TSE:STLC) Estimates

Shareholders in Stelco Holdings Inc. (TSE:STLC) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with analysts modelling a real improvement in business performance.

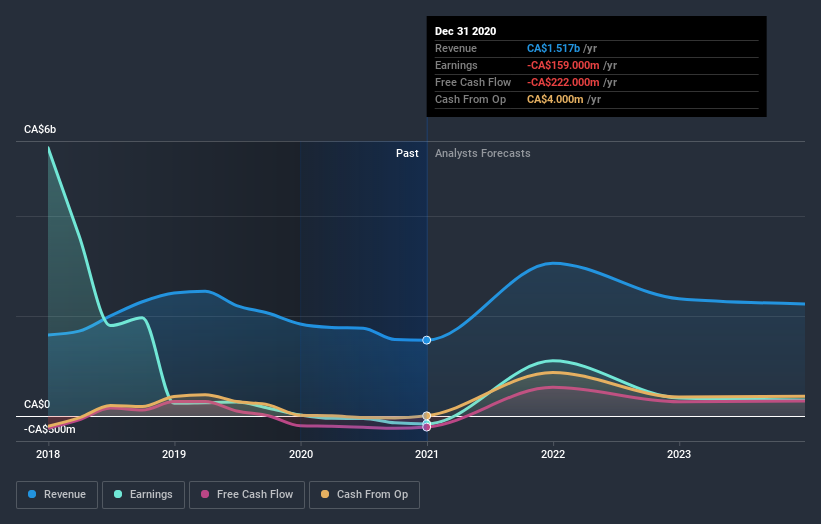

Following the upgrade, the latest consensus from Stelco Holdings' seven analysts is for revenues of CA$3.1b in 2021, which would reflect a substantial 102% improvement in sales compared to the last 12 months. The losses are expected to disappear over the next year or so, with forecasts for a profit of CA$12.43 per share this year. Before this latest update, the analysts had been forecasting revenues of CA$2.8b and earnings per share (EPS) of CA$5.41 in 2021. So we can see there's been a pretty clear increase in analyst sentiment in recent times, with both revenues and earnings per share receiving a decent lift in the latest estimates.

See our latest analysis for Stelco Holdings

With these upgrades, we're not surprised to see that the analysts have lifted their price target 11% to CA$34.14 per share. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values Stelco Holdings at CA$38.00 per share, while the most bearish prices it at CA$26.00. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

Of course, another way to look at these forecasts is to place them into context against the industry itself. The analysts are definitely expecting Stelco Holdings' growth to accelerate, with the forecast 102% annualised growth to the end of 2021 ranking favourably alongside historical growth of 5.6% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 6.8% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Stelco Holdings to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. With a serious upgrade to expectations and a rising price target, it might be time to take another look at Stelco Holdings.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Stelco Holdings analysts - going out to 2023, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance