Analysts Just Made A Major Revision To Their Columbia Property Trust, Inc. (NYSE:CXP) Revenue Forecasts

The analysts covering Columbia Property Trust, Inc. (NYSE:CXP) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

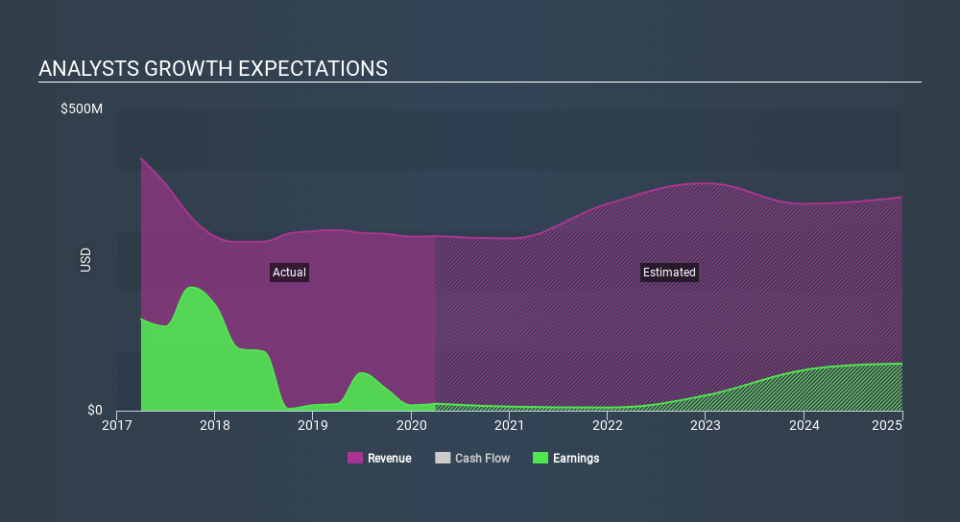

Following this downgrade, Columbia Property Trust's four analysts are forecasting 2020 revenues to be US$286m, approximately in line with the last 12 months. Prior to the latest estimates, the analysts were forecasting revenues of US$325m in 2020. The consensus view seems to have become more pessimistic on Columbia Property Trust, noting the measurable cut to revenue estimates in this update.

View our latest analysis for Columbia Property Trust

We'd point out that there was no major changes to their price target of US$20.50, suggesting the latest estimates were not enough to shift their view on the value of the business. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Columbia Property Trust at US$26.00 per share, while the most bearish prices it at US$16.00. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would also point out that the forecast 1.4% revenue decline is better than the historical trend, which saw revenues shrink -18% annually over the past five years

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for this year. They're also anticipating slower revenue growth than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Columbia Property Trust after today.

Hungry for more information? We have estimates for Columbia Property Trust from its four analysts out until 2024, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance