Amphenol's (APH) Q1 Earnings Beat Estimates, Revenues Up Y/Y

Amphenol’s APH first-quarter 2024 adjusted earnings of 80 cents per share beat the Zacks Consensus Estimate by 8.11%. The earnings figure increased 16% year over year.

Net sales increased 9.5% year over year to $3.26 billion and beat the consensus mark by 5.81%. Organically, net sales increased 6%.

The top line benefited from higher revenues across the commercial air, defense, automotive and IT datacom end-markets.

Quarterly Details

Harsh Environment Solutions’ (28.1% of net sales) sales came in at $916 million, up 7.2% from the year-ago quarter’s levels.

Communications Solutions’ (38.9% of net sales) sales were $1.27 billion, which increased 12.3% year over year.

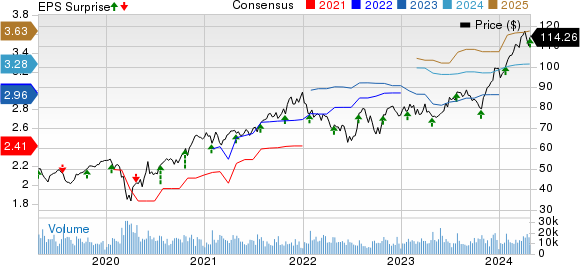

Amphenol Corporation Price, Consensus and EPS Surprise

Amphenol Corporation price-consensus-eps-surprise-chart | Amphenol Corporation Quote

Interconnect and Sensor Systems Solutions’ (33% of net sales) sales were $1.07 billion, up 8.2% year over year.

Gross margin, on a GAAP basis, expanded 170 basis points (bps) year over year to 33.4%.

Selling, general and administrative expenses, as a percentage of revenues, increased 80 bps on a year-over-year basis to 12.4%.

Adjusted operating margin expanded 110 bps on a year-over-year basis to 21%.

Balance Sheet

As of Mar 31, 2024, Amphenol had cash and cash equivalents worth $1.96 billion, up from $1.73 billion as of Dec 31, 2023.

Total debt was $4.31 billion as of Mar 31, 2024 compared with $4.29 billion as of Dec 31, 2023.

During the quarter, the company purchased 1.4 million shares for $154 million. It also paid dividends of $132 million.

Amphenol announced a new three-year share repurchase program worth $2 billion.

Guidance

Amphenol expects second-quarter 2024 earnings between 79 cents and 81 cents per share, indicating growth between 10% and 13% year over year. Revenues are anticipated between $3.24 billion and $3.30 billion.

The Zacks Consensus Estimate for second-quarter 2024 revenues is pegged at $3.24 billion, suggesting a 6.23% increase year over year. The consensus estimate for earnings is pegged at 79 cents per share, down by a penny over the past 30 days.

Zacks Rank & Other Stocks to Consider

Currently, Amphenol carries a Zacks Rank #2 (Buy).

Opera OPRA, Arista Networks ANET and Pinterest PINS are some better-ranked stocks that investors can consider in the broader sector, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Opera shares have gained 8.6% year to date. OPRA is set to report its first-quarter 2024 results on Apr 25.

Arista Networks shares have gained 8.6% year to date. ANET is set to report its first-quarter 2024 results on May 7.

Pinterest shares have declined 11.3% year to date. PINS is set to report its first-quarter 2024 results on Apr 30.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amphenol Corporation (APH) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Opera Limited Sponsored ADR (OPRA) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance