Amidst increasing losses, Investors bid up Vivos Therapeutics (NASDAQ:VVOS) 19% this past week

This week we saw the Vivos Therapeutics, Inc. (NASDAQ:VVOS) share price climb by 19%. But that's small comfort given the dismal price performance over the last year. Like an arid lake in a warming world, shareholder value has evaporated, with the share price down 65% in that time. So the bounce should be viewed in that context. Of course, it could be that the fall was overdone.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Vivos Therapeutics

Given that Vivos Therapeutics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Vivos Therapeutics grew its revenue by 23% over the last year. We think that is pretty nice growth. Unfortunately it seems investors wanted more, because the share price is down 65% in that time. It is of course possible that the business will still deliver strong growth, it will just take longer than expected to do it. To our minds it isn't enough to just look at revenue, anyway. Always consider when profits will flow.

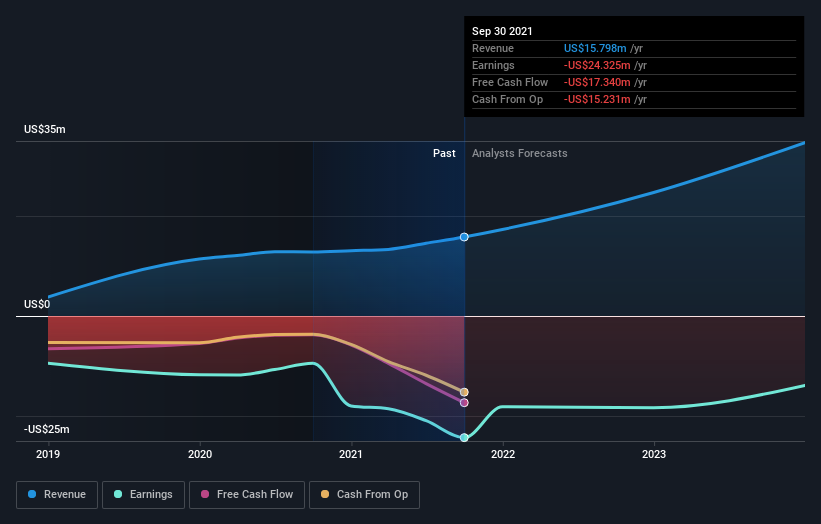

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Vivos Therapeutics stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Given that the market gained 22% in the last year, Vivos Therapeutics shareholders might be miffed that they lost 65%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 44%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It's always interesting to track share price performance over the longer term. But to understand Vivos Therapeutics better, we need to consider many other factors. For example, we've discovered 4 warning signs for Vivos Therapeutics (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

Of course Vivos Therapeutics may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance