Amicus (FOLD) Q1 Earnings Top, Sales Lag, '24 Outlook Updated

Amicus Therapeutics FOLD reported first-quarter 2024 adjusted loss of 2 cents per share, narrower than the Zacks Consensus Estimate of a loss of 6 cents. The company had incurred a loss of 6 cents per share in the year-ago quarter.

The year-over-year improvement can be attributed to higher revenues from Galafold (migalastat) sales and incremental revenues from the sale of the newly approved combo drug, Pombiliti + Opfolda.

Revenues in the reported quarter totaled $110.4 million, up 28% year over year on a reported and constant-currency (cc) basis. However, the figure missed the Zacks Consensus Estimate of $112 million. The top line comprised sales of Galafold, which is approved for Fabry disease and Pombiliti + Opfolda.

The FDA approved Pombiliti + Opfolda, a two-component therapy for treating late-onset Pompe disease in September 2023.

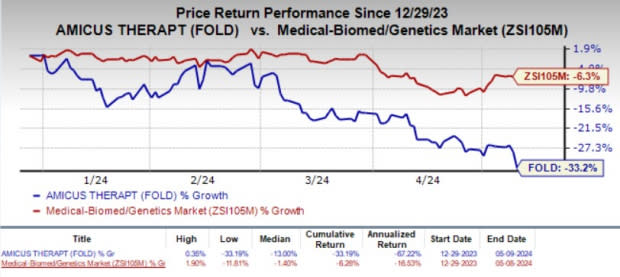

Shares of Amicus lost 6.5% on Mar 9, following the first-quarter earnings release. Year to date, shares of FOLD have plunged 33.2% compared with the industry’s 6.3% decline.

Image Source: Zacks Investment Research

Quarter in Detail

In the first quarter, Galafold net product sales were $99.4 million, up 16% year over year at cc, driven by new patient starts and sustained patient compliance and adherence rates of more than 90%. The drug’s sales marginally beat the Zacks Consensus Estimate of $99.1 million but missed our model estimate of $100.8 million.

Net product sales of Pombiliti + Opfolda were $11 million, reflecting sequential growth of 30%. The figure missed the Zacks Consensus Estimate of $12.5 million but surpassed our model estimate of $10 million. Per Amicus, as of the end of April, more than 155 patients are on treatment with this combo drug or scheduled to be treated.

The commercial launch of the drug is currently underway in various markets, including Europe and the U.K.

Total adjusted operating expenses of $85.6 million increased 6% from the year-ago quarter’s figure, primarily due to a rise in commercialization expenses to support the launch of Pombiliti + Opfolda.

As of Mar 31, 2024, Amicus had cash, cash equivalents and marketable securities worth $239.6 million compared with $286.2 million as of Dec 31, 2023.

Updated 2024 Guidance

Amicus updated its previously provided guidance for the full year. The company expects total revenues to grow in the range of 25-30% in 2024.

The company now anticipates its total Galafold revenues to grow in the range of 13-17% compared with the previous guidance of 11-16%.

This guidance reflects continued patient demand from both switch and treatment-naïve patients, expansion into other geographies, label extensions, continued diagnosis of new Fabry patients and commercial execution across all major markets, including the EU, Japan, the United States and U.K.

For 2024, the company expects total Pombiliti + Opfolda revenues in the range of $62-$67 million.

Amicus’ shares were down, probably because investors were not too impressed with the sales outlook.

The company projects total adjusted operating expenses in the band of $345-$365 million.

The company expects to achieve its first full year of non-GAAP profitability in 2024. Its profits are anticipated to grow in the remainder of the year.

Amicus Therapeutics, Inc. Price and EPS Surprise

Amicus Therapeutics, Inc. price-eps-surprise | Amicus Therapeutics, Inc. Quote

Zacks Rank & Stocks to Consider

Amicus currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the drug/biotech industry are Ligand Pharmaceuticals LGND, ANI Pharmaceuticals ANIP and Annovis Bio ANVS, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for Ligand’s 2024 earnings per share has remained constant at $4.56. During the same time frame, the estimate for Ligand’s 2025 earnings per share has remained constant at $5.27. Year to date, shares of LGND have gained 19.2%.

Ligand beat estimates in each of the trailing four quarters, delivering an average surprise of 56.02%.

In the past 30 days, estimates for ANI Pharmaceuticals’ 2024 earnings per share have risen from $4.43 to $4.44. Meanwhile, during the same period, the estimate for ANI Pharmaceuticals’ 2025 earnings per share has remained constant at $5.04. Year to date, shares of ANIP have climbed 19.4%.

ANI Pharmaceuticals beat estimates in each of the last four quarters, delivering an average surprise of 109.06%.

In the past 30 days, the Zacks Consensus Estimate for Annovis’ 2024 loss per share has narrowed from $3.35 to $2.93. During the same period, the estimate for Annovis’ 2025 loss per share has widened from $2.82 to $2.83. Year to date, shares of ANVS have plunged 67.1%.

ANVS beat estimates in two of the trailing four quarters and missed the mark on the other two occasions, delivering an average negative surprise of 15.70%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Amicus Therapeutics, Inc. (FOLD) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance