Amgen's (AMGN) Uplizna Meets Study Goal for Rare Disease

Amgen AMGN announced positive results from the phase III MITIGATE study, which evaluated its rare disease drug Uplizna (inebilizumab) for treating Immunoglobulin G4-related disease (IgG4-RD), a rare inflammatory condition.

The MITIGATE study achieved its primary endpoint — patients treated with Uplizna over a 52-week period showed a statistically significant 87% reduction in the risk of IgG4-RD flare when compared with a placebo. The study also achieved key secondary endpoints, which include annualized flare rate and flare-free, treatment-free complete remission.

Management intends to present the detailed results from the MITIGATE study at a future medical meeting.

We remind investors that Uplizna is currently approved by the FDA to treat adults with neuromyelitis optica spectrum disorder (NMOSD), a rare autoimmune disease. The drug is also approved for similar indications in Europe and Canada.

Based on the primary analysis results of the MITIGATE study, Amgen plans to seek label expansion for Uplizna in IgG4-RD indication. Management intends to submit similar regulatory filings in other key markets after the FDA submission.

Per Amgen, the MITIGATE study is a ‘landmark study’ that shows the clinical benefit of a drug for a rare disease like IgG4-RD. There are no marketed drugs to treat this rare indication.

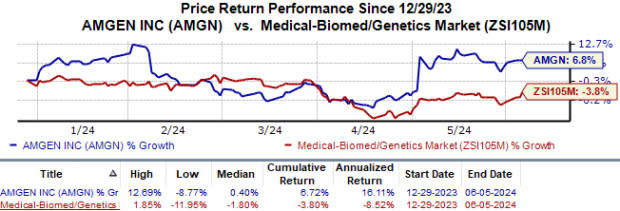

Year to date, Amgen’s shares have risen 6.7% against the industry’s 3.8% fall.

Image Source: Zacks Investment Research

A progressive disease, IgG4-RD, generally affects multiple organs of the body and can cause irreversible organ damage with or without the presence of symptoms. Per management, the incidence of the disease is estimated at one to five in 100,000, although the number of patients is difficult to determine due to limited epidemiology data.

Uplizna is a part of Amgen’s rare disease franchise, which was added to the company’s portfolio last year in October following the acquisition of Horizon Therapeutics for nearly $28 billion. The deal also added other rare disease drugs like Tepezza and Krystexxa to the company’s portfolio of marketed drugs.

Apart from IgG4-RD, Amgen is also evaluating Uplizna in a late-stage study for myasthenia gravis.

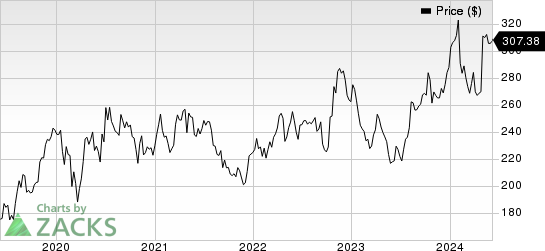

Amgen Inc. Price

Amgen Inc. price | Amgen Inc. Quote

Zacks Rank & Key Picks

Amgen currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include Arcutis Biotherapeutics ARQT, Marinus Pharmaceuticals MRNS and Heron Therapeutics HRTX, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Arcutis Biotherapeutics’ 2024 loss per share have narrowed from $2.49 to $1.60. During the same period, the loss estimates per share for 2025 have improved from $1.77 to $1.14. Year to date, shares of Arcutis have surged 146.8%.

Earnings of Arcutis Biotherapeutics beat estimates in three of the last four quarters while missing the mark on one occasion. Arcutis delivered a four-quarter average earnings surprise of 14.93%.

In the past 60 days, estimates for Marinus Pharmaceuticals’ 2024 loss per share have improved from $2.43 to $1.87. During the same period, loss estimates for 2025 have narrowed from $1.97 to 90 cents.

Earnings of Marinus Pharmaceuticals beat estimates in two of the last four quarters and met the mark on one occasion while missing the mark on another. Marinus registered a four-quarter average earnings surprise of 3.27%.

In the past 60 days, estimates for Heron Therapeutics’ 2024 loss per share have improved from 22 cents to 10 cents. During the same period, estimates for 2025 have improved from a loss of 9 cents to earnings of 1 cent. Year to date, HRTX’s shares have appreciated 124.7%.

Earnings of Heron Therapeutics beat estimates in three of the last four quarters while missing the mark on one occasion. HRTX delivered a four-quarter average earnings surprise of 30.33%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amgen Inc. (AMGN) : Free Stock Analysis Report

Heron Therapeutics, Inc. (HRTX) : Free Stock Analysis Report

Marinus Pharmaceuticals, Inc. (MRNS) : Free Stock Analysis Report

Arcutis Biotherapeutics, Inc. (ARQT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance