American Software And Two More Top Dividend Stocks To Consider

As the S&P 500 and Nasdaq Composite recently hit record highs, reflecting a robust appetite for risk among investors, the market's performance sets an intriguing backdrop for considering dividend stocks. In such an optimistic climate, identifying stocks that offer not only growth potential but also the stability and consistent returns of dividends can be particularly compelling.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.16% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.04% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.88% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.83% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.72% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 4.92% | ★★★★★★ |

Ennis (NYSE:EBF) | 4.82% | ★★★★★★ |

Carter's (NYSE:CRI) | 4.73% | ★★★★★☆ |

Marine Products (NYSE:MPX) | 5.42% | ★★★★★☆ |

CVB Financial (NasdaqGS:CVBF) | 4.69% | ★★★★★☆ |

Click here to see the full list of 204 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

American Software

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: American Software, Inc. is a company that develops, markets, and supports various business application software products both in the United States and internationally, with a market capitalization of approximately $349.48 million.

Operations: American Software, Inc. generates revenue primarily from its Supply Chain Management (including ERP) segment, which amounts to $101.80 million.

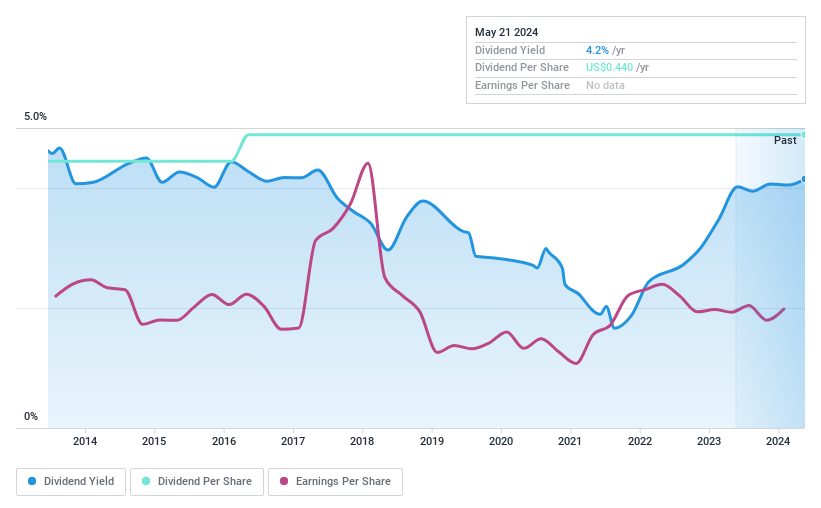

Dividend Yield: 4.2%

American Software has seen a decade of stable, albeit modest, dividend growth with a current yield of 4.15%, slightly below the top US dividend payers. Despite trading below fair value estimates and consistent dividends over ten years, its dividend sustainability is questionable; coverage by earnings is lacking with a high payout ratio of 138.6%. Moreover, earnings are projected to decline annually by 16.4% over the next three years, further straining its dividend viability amidst recent share buybacks and corporate reclassification plans aimed at long-term structural changes.

Cal-Maine Foods

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cal-Maine Foods, Inc., a company engaged in the production, grading, packaging, marketing, and distribution of shell eggs, has a market capitalization of approximately $2.99 billion.

Operations: Cal-Maine Foods, Inc. generates its revenue primarily from the production and sale of shell eggs, totaling approximately $2.37 billion.

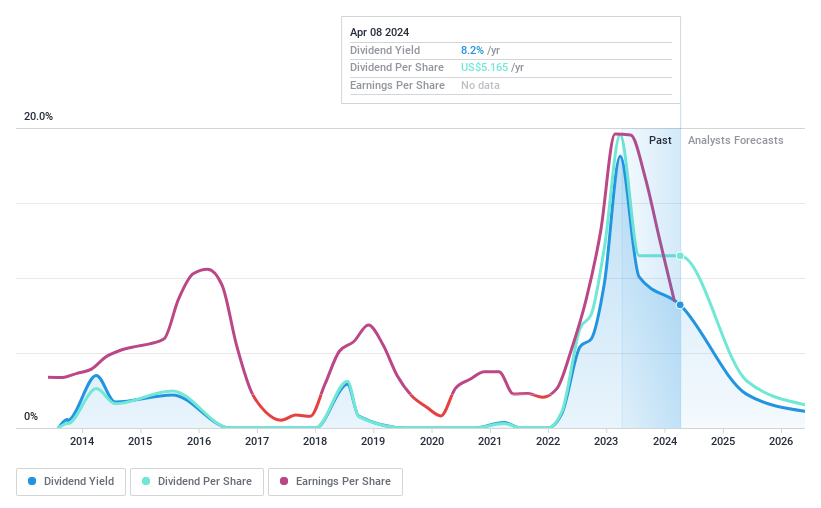

Dividend Yield: 8.5%

Cal-Maine Foods, with a dividend yield of 8.46%, ranks in the top quartile of US dividend payers. The company's dividends, pegged at one-third of quarterly net income, saw a recent payout of US$1.00 per share despite a significant year-over-year drop in Q3 earnings from US$323.22 million to US$146.71 million and sales falling to US$703.08 million from US$997.49 million previously. While its Price-To-Earnings ratio stands attractively at 10.9x, dividends are not fully covered by cash flows, reflecting potential sustainability issues amid volatile payouts over the last decade and expected earnings decline by 48.8% annually over the next three years.

Navigate through the intricacies of Cal-Maine Foods with our comprehensive dividend report here.

Our valuation report unveils the possibility Cal-Maine Foods' shares may be trading at a premium.

Flushing Financial

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Flushing Financial Corporation, functioning as the bank holding company for Flushing Bank, offers banking products and services mainly to consumers, businesses, and governmental units with a market capitalization of approximately $388.07 million.

Operations: Flushing Financial Corporation generates its revenue primarily through its Community Bank segment, which posted earnings of $191.50 million.

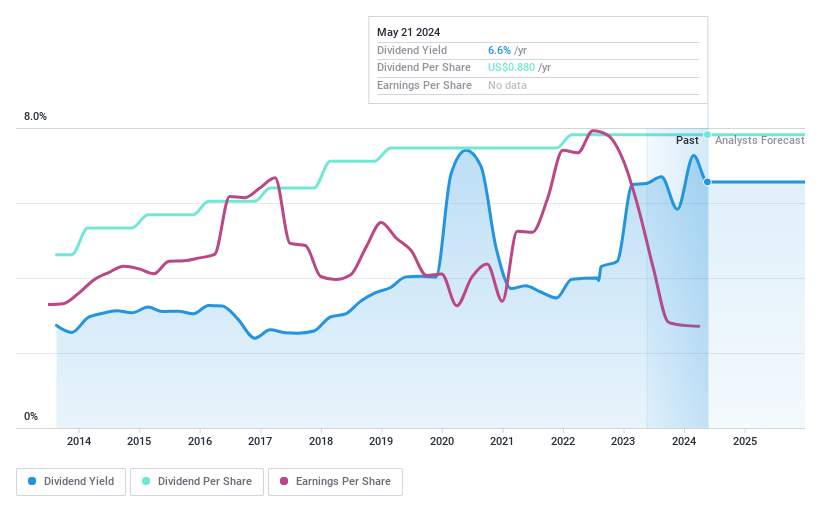

Dividend Yield: 6.6%

Flushing Financial Corporation has maintained a steady dividend over the past decade, recently declaring a quarterly payment of US$0.22 per share. Despite this consistency, the company's net profit margin has declined from 27.3% to 14.8% year-over-year, and its high payout ratio of 92.6% raises concerns about the sustainability of future dividends as they are not well covered by earnings. Additionally, significant insider selling in the past three months might signal caution, although its Price-To-Earnings ratio at 13.8x is below the US market average.

Turning Ideas Into Actions

Click here to access our complete index of 204 Top Dividend Stocks.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:AMSW.A NasdaqGS:CALM and NasdaqGS:FFIC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance