American Express Can Sustain Its Rally

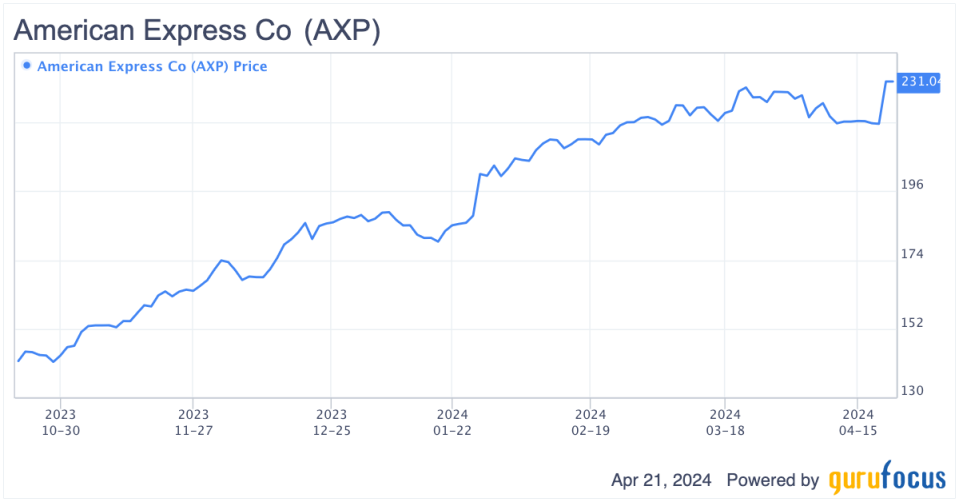

Shares of American Express Co. (NYSE:AXP) have moved sharply higher. Over the past six months, the stock has delivered a total return of roughly 55%. Comparably, the S&P 500 has delivered a total return of around 17% over the same period.

The rally has been driven by strong performance of the company's underlying business and significant multiple expansion.

Despite the recent rally and a strong business with a wide moat around it, American Express shares trade at a valuation discount to the broader market and peers. Moreover, the company is also trading at a reasonable valuation relative to its own historical norms. For these reasons, I believe the stock can continue to rally from here.

AXP Data by GuruFocus

High-quality business with a wide moat

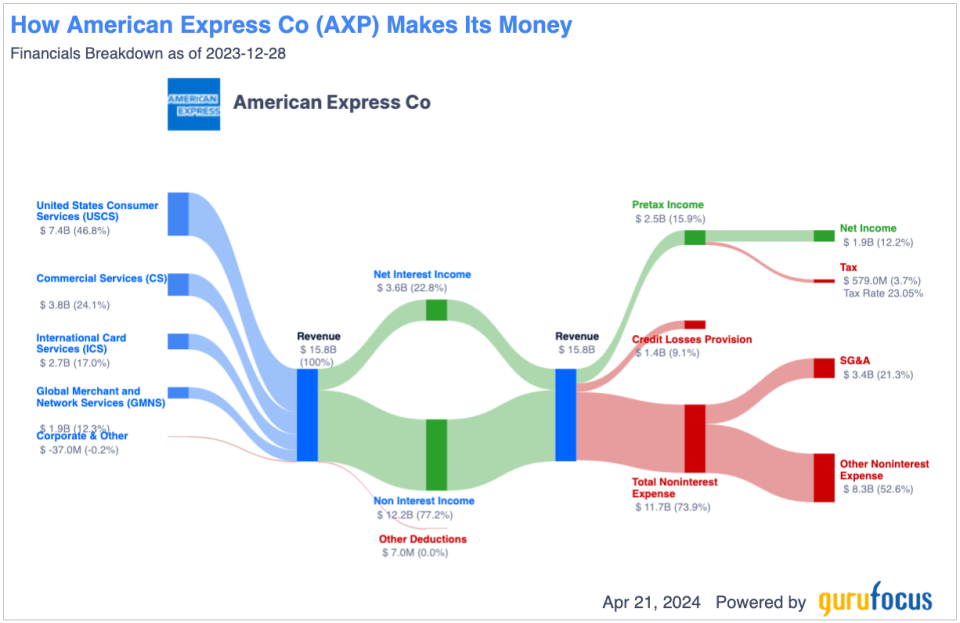

American Express is a globally integrated payments company with a history dating back to 1850. It operates a bank holding company, which issues cards and extends credit, as well as a payments network business. On the payment network side of the business, the company faces relatively little competition. It competes primarily with Visa (NYSE:V) and Mastercard (NYSE:MA), but these companies tend not to compete aggressively on price as lower merchant fees do not typically result in increased traffic to a card network. In addition to facing limited competition, the credit card network business also benefits from very high barriers to entry given the network effects required in order to achieve the scale needed to compete in the industry.

It differs from Visa and Mastercard in that is also a bank holding company, which issues cards and extends credit to customers. On this side of the business, American Express faces competition from banks such as JPMorgan Chase (NYSE:JPM), Citigroup (NYSE:C), Capital One (NYSE:COF), Bank of America (NYSE:BAC) and many others. While competition is more intense on this side of the business, the company has been able to succeed due to its focus on the high spending and strong credit rating part. The focus on the high spending part of the credit card issuance market has generally given American Express increased pricing power with merchants relative to Visa and Mastercard, as merchants are generally interested in having American Express cardholders as customers given their high level of spending compared to other card issuers. While the high-end credit card market has gotten more competitive in recent years, American Express has continued to grow and generate strong financial results.

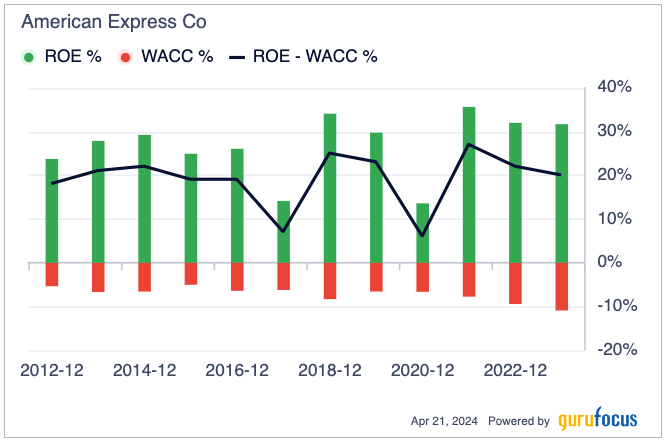

The strength of American Express' business can be seen in looking at its relatively high profit margin and high return on equity compared to its cost of capital.

Strong first-quarter earnings and outlook

On April 19, American Express reported first-quarter results that surpassed consensus estimates. The company reported total revenue net of interest expense of $15.80 billion, which represents an 11% increase compared to the same period a year ago. Diluted earnings came in at $3.33 per share, a 39% increase from the same period a year ago.

In addition to reporting strong results, American Express reaffirmed its 2024 guidance, calling for revenue growth of 9% to 11% and earnings per share of $12.65 to $13.15. Currently, consensus estimates call for the company to report earnings of $12.89 for the year, which is roughly in line with the midpoint estimate.

American Express shares moved sharply higher following the release and are now trading very close to the all-time high reached earlier this year.

Valuation is reasonable

Currently, American Express trades at nearly 18 times consensus 2024 earnings. Comparably, the S&P 500 trades at a multiple of around 20 times consensus. Thus, on a relative basis, the stock is trading at a modest discount to the broader market. In addition, the stock is trading at a discount to Visa and Mastercard, which trade at 27 times and 32 times forward earnings.

Historically, Visa and Mastercard have traded at a valuation premium relative to American Express due to better growth prospects. However, that is not currently the case as American Express has near-term growth prospects that are fairly similar to both companies. Currently, consensus estimates call for American Express to grow earnings per share by 15% in 2024 and 2025 and by 14% in 2026. Visa is expected to grow earnings by 13%, 12.50% and 14% over the same period, while Mastercard is expected to experience slightly higher annual earnings growth rates. For this reason, on a relative basis, I believe American Express' current valuation is reasonable relative to peers.

American Express also trades relatively close to its own historical norms. Moreover, the company has been an active repurchaser of its own shares, repurchasing 5.30 million shares at an average price of $213.59 during the first quarter of 2024. This suggests that management views the stock as reasonably valued at current levels.

Risks to consider

Perhaps the biggest risk to the bull case is potential regulatory reform, which might limit how much card network operations can charge. One key piece of legislation which investors should keep an eye on is the Credit Card Competition Act. This proposed legislation would require banks to give merchants a choice of two different payment networks to process transactions on. This legislation has the potential to negatively impact American Express as its fees tend to be higher than the fees charged by Visa and Mastercard. However, given the opposition from banks and credit card companies, I believe it will be difficult for this act to pass. Moreover, Congress is currently focused on other priorities, such as boarder security and funding for our allies abroad entangled in geopolitical conflicts.

Another risk to consider is the potential for an economic slowdown. American Express is a highly cyclical business as its revenue growth tends to be driven by increasing consumer spending. An economic slowdown would result in less spending by card holders and potential for higher delinquency rates. That said, given recent economic data, a significant economic slowdown in the near term seems to be unlikely and thus the current economic climate remains supportive.

Conclusion

American Express shares have delivered very strong performance over the past six months on the back of strong performance of the underlying business and multiple expansion. The company benefits from a high-quality business with a strong competitive moat around it.

Despite the recent rally, American Express shares remain reasonably valued and trade at a discount to the broader market and credit card network peers. While regulatory reform remains a threat, the passage of key legislation appears unlikely in the near term given competing priorities in Washington and strong opposition from credit card companies and banks.

For these reasons, I believe shares of American Express can continue moving higher from current levels.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance