American Eagle (NYSE:AEO) Reports Sales Below Analyst Estimates In Q1 Earnings, Stock Drops

Young adult apparel retailer American Eagle Outfitters (NYSE:AEO) missed analysts' expectations in Q1 CY2024, with revenue up 5.8% year on year to $1.14 billion. It made a GAAP profit of $0.34 per share, improving from its profit of $0.09 per share in the same quarter last year.

Is now the time to buy American Eagle? Find out in our full research report.

American Eagle (AEO) Q1 CY2024 Highlights:

Revenue: $1.14 billion vs analyst estimates of $1.15 billion (small miss)

Gross Margin (GAAP): 40.6%, up from 38.2% in the same quarter last year

Locations: 1,173 at quarter end, in line with the same quarter last year

Market Capitalization: $4.70 billion

“Our strong first quarter results underscore the power of our iconic brand portfolio and demonstrate great progress on our Powering Profitable Growth strategy. We achieved record revenue, amplifying American Eagle’s and Aerie’s leading market positions and opportunity in casual apparel. We continued to offer exciting merchandise collections and customer activations, providing compelling in-store and digital shopping experiences. This, combined with actions to optimize our operations and drive efficiencies across the organization, contributed to meaningful profit expansion, which was ahead of expectations,” commented Jay Schottenstein, AEO’s Executive Chairman of the Board and Chief Executive Officer.

With a heavy focus on denim, American Eagle Outfitters (NYSE:AEO) is a specialty retailer offering an assortment of apparel and accessories to young adults.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

American Eagle is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it's growing off a smaller base than its larger counterparts.

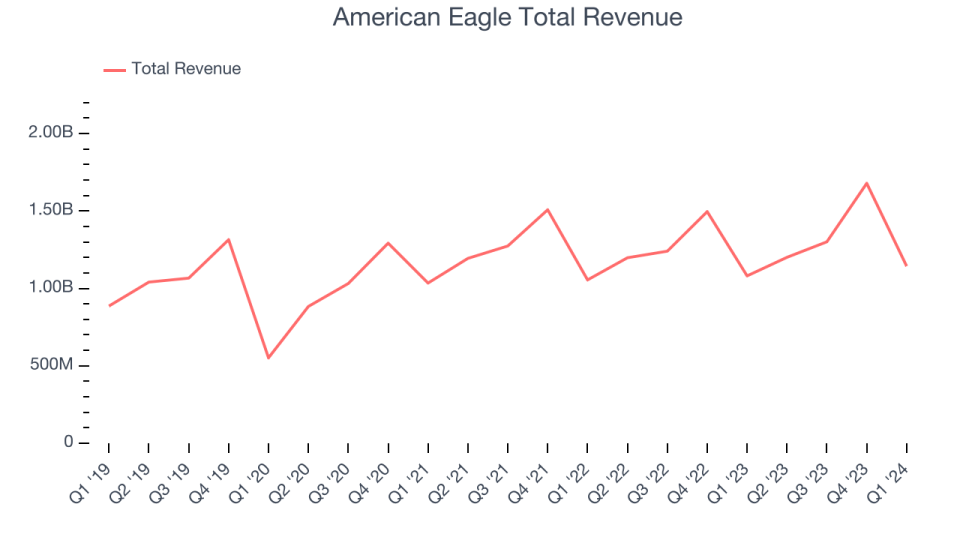

As you can see below, the company's annualized revenue growth rate of 5.4% over the last five years was weak , but to its credit, it opened new stores and expanded its reach.

This quarter, American Eagle's revenue grew 5.8% year on year to $1.14 billion, missing Wall Street's expectations. Looking ahead, Wall Street expects sales to grow 2.7% over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Same-Store Sales

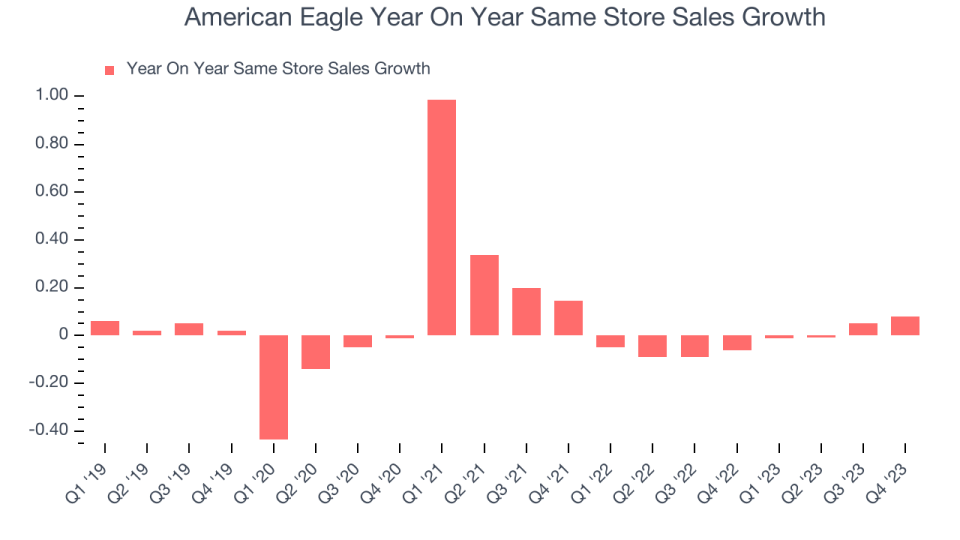

Same-store sales growth is a key performance indicator used to measure organic growth and demand for retailers.

American Eagle's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 1.8% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

Key Takeaways from American Eagle's Q1 Results

We enjoyed seeing American Eagle exceed analysts' gross margin and EPS expectations this quarter. On the other hand, its revenue and quarterly operating income guidance unfortunately missed Wall Street's estimates. Overall, we think this was a strong quarter that should satisfy shareholders but investors were likely expecting more with competitor Abercrombie & Fitch (NYSE:ANF) posting a blowout quarter earlier today. The stock is down 6.4% after reporting and currently trades at $22.50 per share.

So should you invest in American Eagle right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance