AMD Initiative to Address High-Growth Markets Aid Prospects

Advanced Micro Devices AMD shares have slumped 59.4% compared with the Zacks Electronics - Semiconductors industry’s and the Zacks Computer and Technology sector’s decline of 40.5% and 35.8%, respectively, in the year-to-date period.

Rising geo-political tensions between the United States and China, the global supply-chain challenges that adversely impacted the semiconductor industry, the ongoing Russia-Ukraine war, rising inflation and interest rate hike by the U.S. Federal Reserve. All of these reasons have created a volatile market situation which has created negative sentiments among investors specifically in cyclical sectors like tech.

Further impacting AMD’s share price negatively is the company’s recent third-quarter 2022 revenue forecast. It forecasted third-quarter 2022 revenues to be approximately $5.6 billion, an increase of 29% year over year, lower than the previously expected rise of roughly 55%.

AMD’s preliminary results reflect lower-than-expected client segment revenues resulting from reduced processor shipments due to weaker demand in the PC market and significant inventory correction actions across the PC supply chain.

AMD expects a non-GAAP gross margin of approximately 50%, down 400 basis points due to lowered client segment revenues.

The volatile macroeconomic situation has the broader tech sector in the doldrums as AMD’s peers in the sector NVIDIA NVDA and Intel INTC also bore the brunt of the situation.

NVDA and Intel shares have fallen 58.9% and 50%, respectively, in the year-to-date period compared with the Zacks Semiconductor – General industry’s decline of 50.1%.

However, the company is expecting a significant rise in its high-growth business segments like data center and gaming, in line with its previous guidance. AMD expects Data Center and gaming business to grow 45% and 14%, respectively, year over year. The company is also benefitting from its recent collaborations with organizations like The Energy Sciences Network in high-performance computing (HPC) and high-performance network business segment.

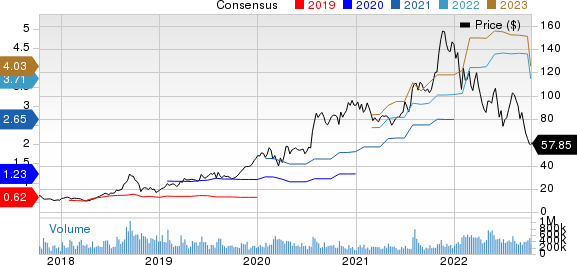

Advanced Micro Devices, Inc. Price and Consensus

Advanced Micro Devices, Inc. price-consensus-chart | Advanced Micro Devices, Inc. Quote

AMD Boosting Top Line by Addressing High-Growth Markets

AMD recently announced that it has collaborated with the Energy Sciences Network (ESnet) to launch ESnet6, the latest generation of the U.S. Department of Energy’s high-performance network.

This collaboration with ESnet is an extension of the partnership it built back in 2018. The recent expansion of agreement will help AMD fend off the stiff competition that the company faces from its peers NVIDIA and Intel in its various business segments.

NVIDIA is a dominant name in the data center, professional visualization and gaming markets, where its peers are close on its heels. NVDA has been benefiting from the rapid proliferation of AI. The company has been expanding its base in untapped markets like climate science, energy research, space exploration and digital biology.

Intel is still the leading name in the consumer PC market and is the major competitor of AMD in this segment. INTC is gradually reducing its dependence on the PC-centric business by transitioning to data-centric businesses such as AI and autonomous driving.

Nevertheless, AMD, which currently has Zacks Rank #3 (Hold), is expected to benefit from its plans to address new markets, accelerate data center growth and enter the AI and Augmented Reality spaces with its launch of various products by building strategic partnerships with companies like Dell Technologiesand OEM partners Hewlett Packard HPE, Acer and Lenovo. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AMD is also leading its peers in the HPC business segment as it enables customers across various fields like manufacturing, life sciences, financial services, climate research and more to utilize supercomputers for research purposes.

AMD partnered with Hewlett Packard and the U.S. Department of Energy’s Oak Ridge National Laboratory to build the world’s fastest and most energy-efficient supercomputer — Frontier.

It is also worth mentioning that AMD powers five of the top 10 most powerful and eight of the top 10 most energy-efficient supercomputers globally. CSC’s LUMI supercomputer powered by AMD EPYC and AMD Instinct MI200 systems is third on the Top500 list with 152 petaflops of performance and third on the Green500 list with 51.63 gigaflops/watt power efficiency, while the Adastra system at GENCI-CINES is 10th on the Top500 list and fourth on the Green500 list.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance