AMC Entertainment (AMC) Up 86% in Three Months: Time to Buy?

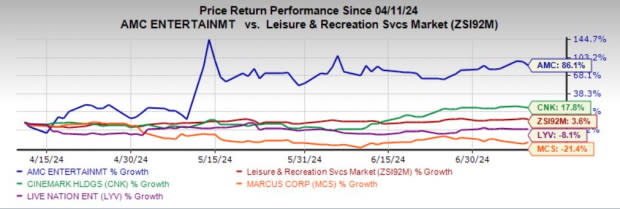

Shares of AMC Entertainment Holdings, Inc. AMC have rallied 86.1% in the past three months compared with the Zacks Leisure and Recreation Services industry’s 3.6% rise. The company’s share price performance outshined other industry players, including Cinemark Holdings, Inc. CNK, The Marcus Corporation MCS and Live Nation Entertainment, Inc. LYV.

AMC is benefiting from increased attendance from moviegoers, the availability of diverse film options and movie-themed merchandise offerings. Also, strong consumer spending on premium large-screen formats and innovative food and beverage options have bolstered its performance.

Image Source: Zacks Investment Research

Record Attendance in June and July

Despite the industry box office being hindered by production delays due to Hollywood strikes, AMC demonstrated remarkable resilience and outperformed expectations.

During the Jun 13-16, 2024 period, AMC reported the highest attendance and admissions revenues across its U.S. and international locations. Over the weekend, more than one million patrons visited AMC locations in the United States, making it the highest-performing Friday, Saturday and Sunday in terms of attendance and admissions revenues for AMC in 2024. Total attendance at AMC Theatres in the nation reached approximately 3.8 million from Thursday to Sunday. The robust attendance at AMC Theatres, both domestically and internationally, is attributed to the strong box-office performance of films, including Inside Out 2 and Bad Boys: Ride Or Die.

The momentum continued in July, as the company reported more than 4 million domestic moviegoer footfall in its theaters in the United States during the extended Jul 4 holiday weekend. From Jul 3 to Jul 7, AMC reported 4.2 million guests across its U.S. locations and strong attendance internationally.

The surge in attendance was fueled by a diverse lineup of films, including family, horror, action and Western genres. The company reported strong box office performance from the release of Despicable Me 4. To commemorate the movie, AMC unveiled a new line of movie-themed merchandise featuring a collectible popcorn bucket and plush toys. The merchandise line received solid customer feedback, thereby making it its highest-grossing merchandise program of the year and second-highest in the company’s history.

Will the Growth Sustain?

AMC's focus on enhancing the guest experience and operational efficiency has been pivotal in its success. The company continues to innovate and diversify its offerings. The company’s retail popcorn initiative expanded to 6,500 points of distribution, including major retailers like Walmart, Amazon, Publix, and Kroger.

The emphasis on food and beverage sales, bolstered by new menu offerings bode well. This and the legislative change allowing alcohol sales in New York theaters are likely to diversify and strengthen revenue streams.

AMC is also exploring new revenue areas, such as concert films and special events. The company has partnered with major musical artists to bring exclusive concert films and listening events to its theaters. Collaborations with artists like Taylor Swift, Beyoncé and Billie Eilish have opened new opportunities for growth. The initiatives, along with the launch of AMC Theaters Distribution, underscore the company’s commitment to innovative programming and revenue diversification, reinforcing a competitive edge.

Looking ahead, AMC is optimistic about the future of the movie theater industry. The company’s extensive review of upcoming movie releases for 2024, 2025, and 2026 indicates promising times ahead. The forthcoming movie slate, including Deadpool and Wolverine and Joker: Folie a Deux, promises a strong box office recovery.

Risk Factors and Mitigation

While the outlook for AMC is positive, it's essential to acknowledge potential risks. Although the company expects a more robust box office performance in the upcoming periods, the successful release and reception of films remain vital. Any further delays or underperformance of the anticipated movies can lead to a potential negative impact on AMC's financial performance.

The company has undertaken steps to rationalize its theater portfolio, closing underperforming locations and opening new ones. Despite the efforts, the company continues to face operational challenges. During the first quarter 2024, the company reported a 2.2% decline in total revenues from the previous year’s levels, thanks to persistent struggles in maintaining consistent growth.

The broader economic environment adds another layer of risk. Consumer behavior and spending patterns can be unpredictable, especially in uncertain economic times. While AMC has been witnessing increased per-patron spending on food and beverages lately, challenges related to trend sustainment persist in a potentially volatile economy.

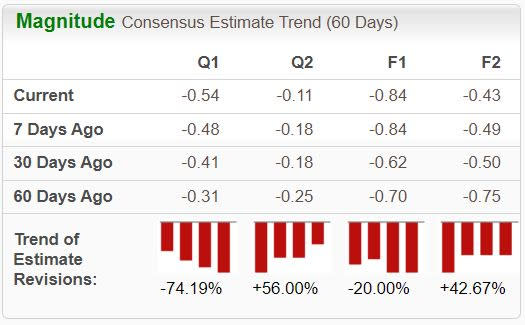

AMC’s loss estimates for 2024 have widened from 70 cents per share to 84 cents in the past 60 days. For 2025, estimates have narrowed from a loss of 75 cents to 43 cents.

Image Source: Zacks Investment Research

Valuation

The company is currently trading at a forward 12-month price-to-sales ratio of 0.32X, well below the industry average of 1.45X, reflecting an attractive investment opportunity.

Image Source: Zacks Investment Research

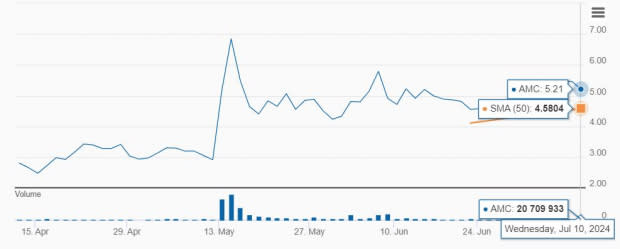

Technical indicators are supportive of AMC's performance. The stock is currently trading above its 50-day moving average, indicating strength in upward momentum and price stability.

Image Source: Zacks Investment Research

Conclusion

AMC Entertainment exhibits strength buoyed by strong attendance figures, strategic initiatives, and a promising movie lineup. While the company’s stock performance and supportive technical indicators signal potential growth, heavy reliance on an unpredictable slate of future movie releases paves a path for uncertainty in future stock performance. Also, the company’s ability to navigate the operational challenges, capitalize on revenue diversification streams and deliver on upcoming movie releases remains vital.

Given the current market dynamics, a retain recommendation is warranted for AMC. Investors are advised to monitor future developments, including box office performance and strategic advancements, before considering investment or divestment in the stock.

AMC currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marcus Corporation (The) (MCS) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

Cinemark Holdings Inc (CNK) : Free Stock Analysis Report

AMC Entertainment Holdings, Inc. (AMC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance