Amazon Brings Music Service to Brazil, Boosts Global Presence

Amazon.com Inc. AMZN is going great guns with global expansion of media services. Recently, the company announced that it has launched the Amazon Music service in Brazil.

This streaming service gives customers an access to more than 50 million songs on the Amazon Music app for iOS and Android, and on Mac, PC, and the Fire TV Stick.

These songs include releases from top Brazilian and International artists, namely Pabllo Vittar, Post Malone, Ivete Sangalo, Billie Eilish, Gustavo Mioto and many more. In addition, the service offers a variety of localized programming created by Amazon Music experts.

The new subscribers will get a 90-day free trial that will be available on all widely used platforms. Notably, the service will be later charged BRL$16.90 a month or BRL$169.00 per year for an individual.

The news comes on the heels of the company’s launch of Prime in Brazil, through which subscribers in the country has full access to video and music content on the Prime Video app.

Notably, the latest move will help the e-commerce giant to capitalize on LATAM’s video and streaming market.

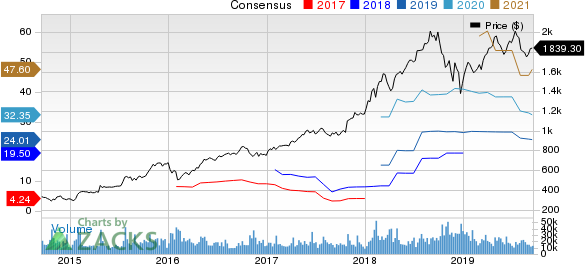

Amazon.com, Inc. Price and Consensus

Amazon.com, Inc. price-consensus-chart | Amazon.com, Inc. Quote

Growth in Music Streaming Market

Amazon is making all efforts to lead the music streaming space, which is expected to generate $11.1 billion revenues in 2019, per a Statista report.

The figure is expected to rise to $13.1 billion at a CAGR of 4.1% between 2019 and 2023. Further, user penetration is 14.7% for 2019 and the figure is likely to increase to 16.1% in 2023.

According to Absolute Market Insights report, the demand for music streaming services is expected to see a CAGR of 17.9% globally by 2027.

This growing presence will help Amazon expand its share in the music streaming space. Per a Digital TV Research report, Amazon’s video streaming subscribers are likely to hit 3.7 million in 2019 and 9.5 million by 2024.

Global Expansion Continues

Apparently, Amazon has been putting in diligent efforts to search for new markets for services like Music and Prime.

The rate at which the company is penetrating into new markets makes us optimistic. It has already expanded the Amazon Music service to more than 40 countries, thereby further cementing the company’s presence in the music streaming market.

Its further penetration into Brazil will help the company increase the Music Unlimited user base. Consequently, its recurring revenue base will improve.

Markedly, the latest move will not only help Amazon to expand media services in Brazil, but also enable the company to get a greater access to user data that it can utilize to provide more customer-oriented services. This will bode well for the company’s top line over the long haul.

Zacks Rank & Stocks to Consider

Currently, Amazon has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader technology sector include Alphabet Inc. GOOGL, Itron, Inc. ITRI and MACOM Technology Solutions Holdings, Inc. MTSI, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for Alphabet, Itron and MACOM Technology is currently projected at 17.5%, 25% and 15%, respectively.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.6% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

MACOM Technology Solutions Holdings, Inc. (MTSI) : Free Stock Analysis Report

Itron, Inc. (ITRI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance