Altria (MO) Navigates Hurdles on Pricing, Smoke-Free Strength

Altria Group, Inc. MO has effectively leveraged its pricing power and strategic pivot toward smoke-free products to navigate market uncertainties. These upsides have been helping this tobacco giant stay firm despite facing declining cigarette volumes.

Harnessing Pricing Power

Altria's robust pricing strategy has been essential in maintaining stability amid industry challenges. While elevated prices may potentially discourage cigarette consumption, it is seen that smokers tend to absorb price increases owing to the addictive quality of cigarettes.

In the first quarter of 2024, higher pricing offered aided revenues across the Smokeable Products and Oral Tobacco categories, which were otherwise hurt by lower volumes. Higher pricing offered respite to the adjusted operating companies income (OCI) in both segments. The continuation of such trends is likely to remain an upside for Altria.

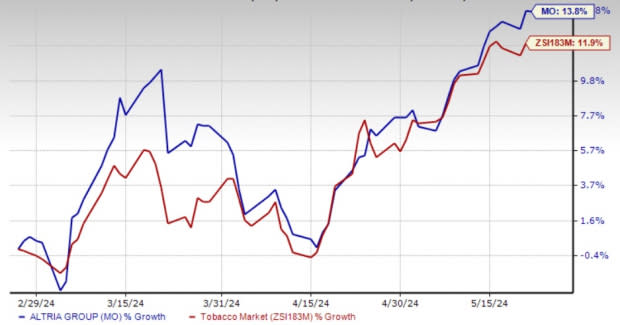

Image Source: Zacks Investment Research

Embracing Smoke-Free Alternatives

Adapting to changing market trends, Altria has expanded its portfolio to include oral tobacco, e-vapor and heated tobacco products. Through its subsidiary Helix Innovations, Altria fully owns on!, a popular tobacco-derived nicotine (TDN) pouch product. on! is a significant addition to Altria's smoke-free lineup, especially as oral TDN products gain traction in the United States, where they are marketed as low-risk alternatives.

The significant strategic agreement between Altria and JT Group (announced in October 2022), which comprises a joint venture for the commercialization of heated tobacco stick products in the United States, also deserves attention. Net revenues in the Oral Tobacco Products segment saw a 3.7% increase to $651 million in the first quarter of 2024, driven by enhanced pricing strategies and a reduction in promotional investments. During the quarter, reported shipment volumes of on! jumped 32%.

Within the smoke-free category, Altria is exploring ways to best compete in the significant e-vapor category — being extremely successful in shifting smokers away from cigarettes. The acquisition of NJOY Holdings (June 2023) is noteworthy in this respect. During the first quarter of 2024, Altria expanded the distribution of NJOY to more than 80,000 stores, with plans to reach nearly 100,000 stores by the end of the year.

Navigating Core Challenges

The overall cigarette industry has been bearing the brunt of the inflationary environment, which has affected Adult Tobacco Consumers’ (“ATC”) spending patterns. Altria has been witnessing a decline in its Smokeable Product segment revenues for the past few quarters now, which has been hurting the company’s overall top line.

In the Smokeable Products segment, net revenues decreased 3.6% year over year to $4,906 million in the first quarter, mainly due to reduced shipment volume and increased promotional investments, partly compensated by greater pricing. Domestic cigarette shipment volumes tumbled 10%, mainly due to the industry’s decline rate and retail share losses. The industry’s decline was a result of macroeconomic pressure on ATC disposable income and increases in illegitimate e-vapor products.

Wrapping Up

As Altria navigates a dynamic external landscape, the company continues to monitor economic factors such as inflation, ATC purchasing behaviors, the adoption of smoke-free products, enforcement against illegal e-vapor products and regulatory developments. Nevertheless, Altria's strategic strengths are expected to help mitigate these obstacles and support its continued success.

For 2024, the company envisions the adjusted EPS in the range of $5.05-$5.17. The guidance indicates growth of 2-4.5% from the $4.95 recorded in 2023. Management expects the bottom-line growth to be skewed toward the second half of 2024 due to the timing of the NJOY acquisition in 2023 and additional shipping days in 2024.

Shares of this Zacks Rank #3 (Hold) company have rallied 13.8% in the past three months compared with the industry’s growth of 11.9%.

Promising Staple Picks

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently sports a Zacks Rank #1 (Strong Buy). VITL has a trailing four-quarter average earnings surprise of 102.1%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 22.5% and 59.3%, respectively, from the year-ago reported numbers.

Utz Brands Inc. UTZ manufactures a diverse portfolio of salty snacks and currently carries a Zacks Rank #2 (Buy). UTZ has a trailing four-quarter earnings surprise of 2% on average.

The Zacks Consensus Estimate for Utz Brands’ current financial-year earnings suggests growth of 24.6% from the year-ago reported numbers.

McCormick & Company, Inc. MKC is a leading manufacturer, marketer and distributor of spices, seasonings, specialty foods and flavors. It currently carries a Zacks Rank of 2.

The Zacks Consensus Estimate for McCormick & Company’s current fiscal-year sales and earnings indicates advancements of 0.3% and 5.6%, respectively, from the year-ago reported figures. MKC has a trailing four-quarter earnings surprise of 5.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Altria Group, Inc. (MO) : Free Stock Analysis Report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance