Alphabet (GOOGL) Q1 Earnings Beat, Revenues Increase Y/Y

Alphabet’s GOOGL first-quarter 2024 earnings of $1.89 per share beat the Zacks Consensus Estimate by 26.8%. The figure grew 61.5% year over year.

Revenues of $80.54 billion increased 15% year over year (16% at constant currency).

Net revenues, excluding total traffic acquisition costs (“TAC”) (the portion of revenues shared with Google’s partners, and the amount paid to distribution partners and others who direct traffic to Google’s website), were $67.6 billion, which surpassed the consensus mark of $66.04 billion. The figure rose 16.4% from the year-ago quarter.

TAC of $12.95 billion was up 10.5% year over year.

Top-line growth was driven by solid performances by Search and YouTube. The growing cloud and Other Bets segments were positives. Accelerating advertisement revenues created other tailwinds.

However, Alphabet continued to witness sluggishness in Google Network ads, which was concerning.

Nevertheless, the company’s growing investments in generative AI to boost its Search and cloud business are likely to yield massive returns in the days ahead. Growing momentum with Gemini was another positive.

Alphabet has gained 21.9% year to date, outperforming the Zacks Computer & Technology growth of 7.2%.

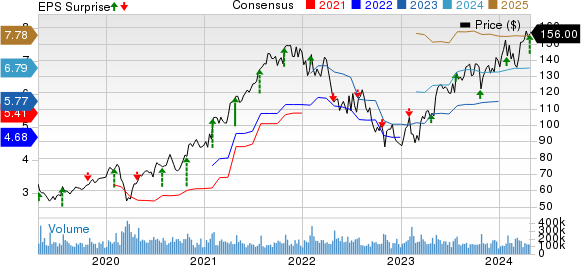

Alphabet Inc. Price, Consensus and EPS Surprise

Alphabet Inc. price-consensus-eps-surprise-chart | Alphabet Inc. Quote

Segments in Detail

Alphabet reports revenues under Google Services, Google Cloud and Other Bets.

Google Services:

Revenues from the Google Services business increased 13.6% year over year to $70.4 billion, accounting for 87.4% of the total revenues. The figure beat the Zacks Consensus Estimate of $69.04 billion.

Under this business, search revenues from Google-owned sites increased 14.4% year over year to $46.16 billion, surpassing the Zacks Consensus Estimate of $44.7 billion.

YouTube’s advertising revenues improved 20.9% year over year to $8.1 billion, while Network advertising revenues decreased 1.1% to $7.4 billion. While YouTube ad revenues beat the Zacks Consensus Estimate of $7.7 billion, Network ad revenues were below the consensus mark of $7.7 billion.

Total Google advertising revenues were up 13% year over year to $61.7 billion and accounted for 76.6% of the total revenues. The figure beat the consensus mark of $60.2 billion.

Google subscriptions, platforms and devices revenues, formerly known as Google Other revenues, were $8.74 billion in the fourth quarter, up 17.9% year over year. The figure missed the consensus mark of $8.9 billion.

Google Cloud:

Google Cloud revenues rose 28.4% year over year to $9.6 billion, accounting for 11.9% of the quarter’s total revenues. The reported metric surpassed the Zacks Consensus Estimate of $9.2 billion.

Other Bets:

Other Bets’ revenues were $495 million, up 71.9% year over year and accounted for 0.6% of the total first-quarter revenues. The figure beat the consensus mark of $384 million.

Regional Details

EMEA (30% of the total revenues): GOOGL generated $23.8 billion in revenues from the region, increasing 13% year over year.

APAC (16% of the total revenues): The region generated $13.3 billion in revenues, up 14% from the year-ago quarter.

Other Americas (6% of the total revenues): The region generated $4.7 billion in revenues, up 14% on a year-over-year basis.

United States (48% of the total revenues): Alphabet generated $38.7 billion in revenues from the region, which increased 18% from the prior-year quarter.

Operating Details

Costs and operating expenses were $55.1 billion, up 5.1% year over year. As a percentage of revenues, the figure contracted 660 basis points (bps) from the year-ago quarter.

The operating margin was 32%, which expanded 700 bps year over year. Segment-wise, Google Services’ operating margin of 35% expanded 450 bps from the prior-year quarter.

Google Cloud reported operating income of $900 million compared with $191 million in the year-ago quarter.

Other Bets reported a loss of $1.02 billion compared with a loss of $1.2 billion in the prior-year quarter.

Balance Sheet

As of Mar 31, 2024, cash, cash equivalents and marketable securities were $108.1 billion, down from $110.9 billion as of Dec 31, 2023.

Long-term debt was $13.23 billion at the end of the reported quarter compared with $13.25 billion at the end of the previous quarter.

Alphabet generated $28.8 billion of cash from operations in first-quarter 2024 compared with $19.92 billion in fourth-quarter 2023.

GOOGL spent $12.01 billion on capex, netting a free cash flow of $16.84 billion in the reported quarter.

Zacks Rank & Stocks to Consider

Currently, Alphabet has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Arista Networks ANET, Dell Technologies DELL and Badger Meter BMI, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Arista Networks have gained 4.2% in the year-to-date period. The long-term earnings growth rate for ANET is 17.48%.

Shares of Dell Technologies have gained 52.3% in the year-to-date period. The long-term earnings growth rate for DELL is projected at 12%.

Shares of Badger Meter have gained 17.5% in the year-to-date period. The long-term earnings growth rate for BMI is 15.57%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance