Alnylam Pharmaceuticals And Two More Value Stocks On US Exchange Estimated To Be Trading Below Intrinsic Value

As the S&P 500 and Nasdaq Composite continue to reach record highs, fueled by strong tech performances and rate cut anticipations, investors are keenly watching the market for opportunities. In this environment, identifying stocks that appear undervalued relative to their intrinsic value could be particularly compelling.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

Name | Current Price | Fair Value (Est) | Discount (Est) |

Hanover Bancorp (NasdaqGS:HNVR) | $16.18 | $31.97 | 49.4% |

Lazard (NYSE:LAZ) | $39.91 | $78.79 | 49.3% |

Victory Capital Holdings (NasdaqGS:VCTR) | $47.30 | $92.71 | 49% |

Array Technologies (NasdaqGM:ARRY) | $9.44 | $18.59 | 49.2% |

Daqo New Energy (NYSE:DQ) | $15.48 | $30.43 | 49.1% |

AppLovin (NasdaqGS:APP) | $84.71 | $165.42 | 48.8% |

Hexcel (NYSE:HXL) | $64.11 | $127.33 | 49.7% |

APi Group (NYSE:APG) | $36.48 | $71.48 | 49% |

Hecla Mining (NYSE:HL) | $5.27 | $10.53 | 49.9% |

Zillow Group (NasdaqGS:ZG) | $46.35 | $92.65 | 50% |

Underneath we present a selection of stocks filtered out by our screen.

Alnylam Pharmaceuticals

Overview: Alnylam Pharmaceuticals, Inc. is a biopharmaceutical company engaged in discovering, developing, and commercializing novel therapeutics based on ribonucleic acid interference, with a market capitalization of approximately $32.27 billion.

Operations: The company generates its revenue primarily from the discovery, development, and commercialization of RNAi therapeutics, totaling approximately $2.00 billion.

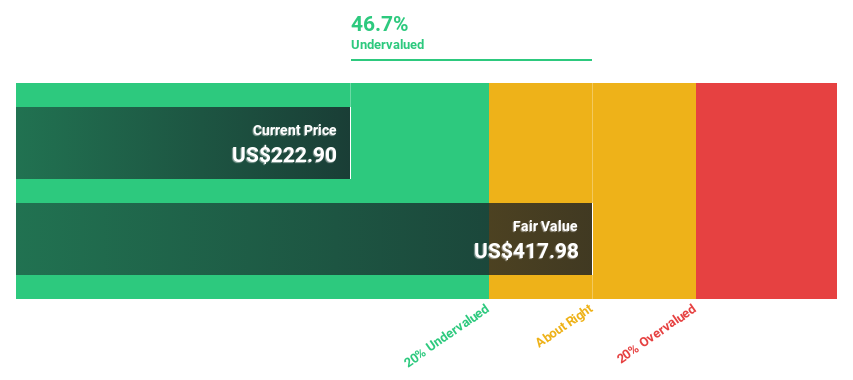

Estimated Discount To Fair Value: 48%

Alnylam Pharmaceuticals, currently priced at US$254.74, is significantly undervalued based on DCF analysis with a fair value estimate of US$489.82, indicating it trades below fair value by more than 20%. Recent positive Phase 3 study results for vutrisiran suggest potential future revenue streams and market expansion, supporting its high expected revenue growth rate of 19.5% per year compared to the market's 8.7%. Despite this potential, the stock remains highly volatile and has seen significant insider selling recently.

DoorDash

Overview: DoorDash, Inc. operates a global commerce platform linking merchants, consumers, and independent contractors, with a market capitalization of approximately $44.59 billion.

Operations: The company generates its revenue primarily from internet information services, totaling approximately $9.11 billion.

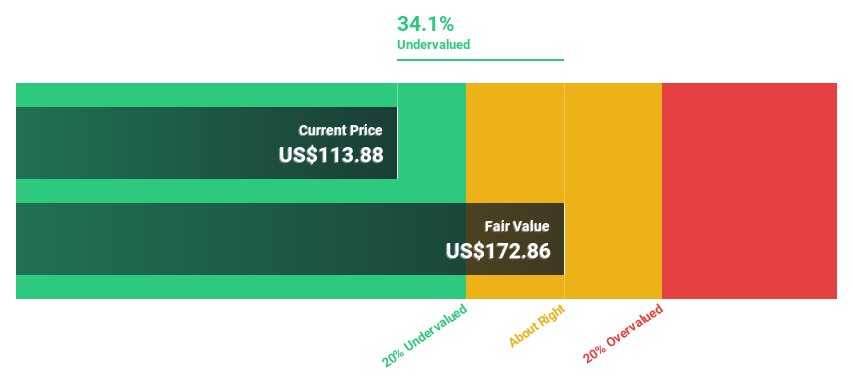

Estimated Discount To Fair Value: 40.4%

DoorDash, currently priced at US$108.95, appears undervalued with a DCF-based fair value estimate of US$182.94, trading below fair value by more than 20%. Recent index adjustments reflect mixed market perceptions, though its addition to the Russell Top 200 suggests some positive sentiment. Despite challenges in finalizing acquisition deals like Deliveroo, strategic partnerships with companies like Academy Sports and Ulta Beauty enhance its service offerings and market presence. Revenue is expected to grow at 12.7% annually, outpacing the U.S market forecast of 8.7%. However, significant insider selling over the past three months could indicate caution among stakeholders.

Zillow Group

Overview: Zillow Group, Inc. operates a portfolio of real estate brands through mobile applications and websites in the United States, with a market capitalization of approximately $10.97 billion.

Operations: The company generates approximately $2.01 billion in revenue from its internet information services.

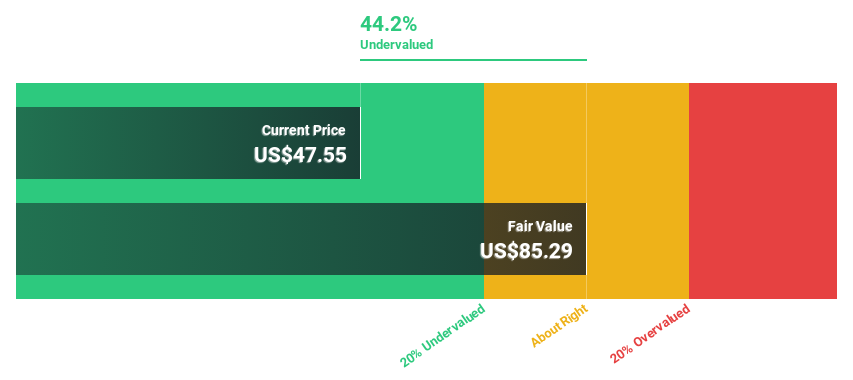

Estimated Discount To Fair Value: 50%

Zillow Group, trading at US$46.35, is significantly undervalued based on cash flows with a fair value estimate of US$92.65. Despite a net loss in Q1 2024, revenue increased to US$529 million from US$469 million year-over-year, showing resilience and potential for growth. The company's strategic initiatives like the Fair Housing Classifier highlight its commitment to innovation and market integrity. Forecasted annual revenue growth of 10.7% outstrips the U.S market average of 8.7%, positioning Zillow for improved profitability within three years.

Where To Now?

Unlock our comprehensive list of 180 Undervalued US Stocks Based On Cash Flows by clicking here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:ALNY NasdaqGS:DASH and NasdaqGS:ZG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance