Allstate's (ALL) Q1 Earnings Beat on Solid Segmental Results

Allstate Corporation’s ALL first-quarter 2018 operating earnings per share of $2.96 surpassed the Zacks Consensus Estimate by 15.2%. Moreover, the bottom line soared 80.5% year over year, fueled by a decreased auto accident frequency, lower catastrophe loss and lowered tax incidence.

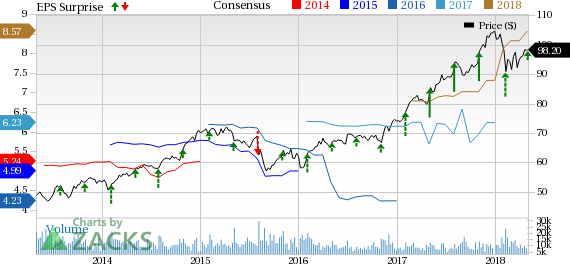

Price, Consensus and EPS Surprise

Price, Consensus and EPS Surprise | Quote

Allstate generated total revenues of $9.9 billion, outpacing the consensus mark by 19.4%. The top line also improved 6.5% year over year. This upside was driven by premium growth and an increase in net investment income.

In the quarter under review, total expenses dipped 1% year over year to $8.5 billion on lower property and casualty insurance claims and claims expense.

Solid Segmental Performance

Property-Liability insurance premiums written amounted to $7.8 billion, up 2.5% year over year. Net investment income of $45 million also increased 9.4% year over year. Underwriting income of $959 million surged 75% year over year, fueled by lower catastrophe loss, increased premiums earned and a lower auto accident frequency. Combined ratio improved 490 basis points year over year to 88%.

Service Businesses’ total revenues were $313 million, up 26.7% year over year. This upside was led by Square Trade acquisition, which was closed last year. Policies in force increased 11.7 million to 46.5 million.

Allstate Life’s premium and contract charges of $327 million inched up 1.9% year over year, driven by growth in traditional life insurance and lower levels of reinsurance premiums ceded. Adjusted net income of $69 million improved 16.9% year over year owing to higher premiums and contract charges plus lower taxes.

Allstate Benefits’ premium and contract charges of $286 million were up 6.3%, backed by 7.4% growth in policies in force. Adjusted net income of $28 million was 27.3% higher than the prior-year quarter figure on the back of higher premiums and contract charges plus a lower tax rate.

Allstate Annuities’ premium and contract charges of $3 million remained flat year over year. Adjusted net income of $35 million grew 20.7%, attributable to higher performance-based investment income.

Capital Position

As of Mar 31, 2018, total shareholders’ equity was $23.3 billion, up 3.2% year over year.

Total assets were $113.3 billion, up 0.8% from the level at 2017-end.

Long-term debt of $6.8 billion increased 7.8% from 2017-end level.

Book value of $58.64 per share improved nearly 12% year over year.

Return on equity of 15% expanded 310 basis points year over year.

Cash inflow from operating activities totaled $626 billion, down nearly 27 8% year over year.

Capital Deployment

Allstate returned $465 million in the first quarter via share buyback ($333 million) and dividend payments ($132 million).

As of Mar 31, 2018, Allstate had $935 million remaining under its $2-billion share repurchase authorization.

Zacks Rank and Performance of Other Insurers

Allstate carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other insurers that have reported first-quarter earnings so far, the bottom line of AXIS Capital Holdings Limited AXS, The Progressive Corporation PGR and RLI Corp. RLI surpassed the respective Zacks Consensus Estimate.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana. Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

The Allstate Corporation (ALL) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance