Alliance Data (ADS) Misses Q3 Earnings Estimates, Cuts View

Alliance Data Systems Corporation’s ADS operating earnings of $5.05 per share for the third quarter of 2019 missed the Zacks Consensus Estimate by 3.6%. The bottom line declined nearly 6% year over year.

Soft performance of the Card Service and Loyalty segments weighed on the results.

Shares of the company lost 3.2% in the pre-market trading session owing to the lower-than- expected results.

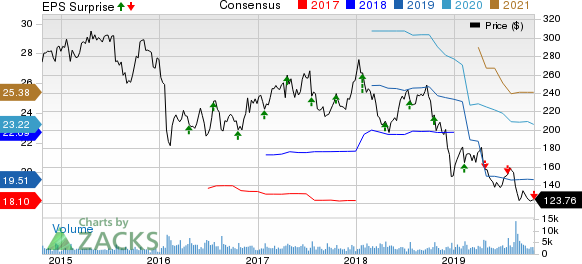

Alliance Data Systems Corporation Price, Consensus and EPS Surprise

Alliance Data Systems Corporation price-consensus-eps-surprise-chart | Alliance Data Systems Corporation Quote

Behind the Headlines

Alliance Data reported total revenues of $1.4 billion, up 1% year over year. The upside was due to higher revenues from Card Services segment. The top line missed the Zacks Consensus Estimate by 0.2%.

Operating expenses increased 20.2% year over year to $1.1 billion. Operating income decreased 36.6% year over year to $304.2 million largely due to higher expenses.

Adjusted EBITDA (net of funding costs) declined 16% year over year to $367 million.

Segment Update

Card Services revenues were $1.2 billion, up 3% year over year. Adjusted EBITDA was $328 million, down 21% year over year. The results reflect performance improvements across several key metrics, including net charge-offs, credit card and loan receivables and credit sales. New business wins contributed 6% to year-over-year growth in reported credit sales.

LoyaltyOne revenues totaled $246 million, down 6% year over year. Adjusted EBITDA decreased 8% to $58 million. AIR MILES reward miles issued remained flat year over year.

The company incurred $42 million in restructuring and other charges owing to initiatives implemented during the quarter to lower operating costs at both the AIR MILES Reward Program and BrandLoyalty.

Financial Update

As of Sep 30, 2019, cash and cash equivalents was $4.5 billion, up 18.2% from Dec 31, 2018-level.

At quarter end, debt level dropped 50.3% from 2018-end to $2.8 billion. Alliance Data retired $2.4 billion of corporate debt, which is expected to yield annualized interest cost savings of approximately $120 million.

Cash from operations decreased 24.4% year over year to $1.5 billion in the first nine months of the year. Capital expenditure at Alliance Data declined 20.2% year over year to $119.2 million in the same period.

Dividend Update

The board of directors approved quarterly dividend of 63 cents, to be paid out on Dec 17, 2019 to stockholders of record as of Nov 14.

Guidance

Alliance Data estimates core EPS in the range of $16.75 to $17.00 in 2019, down from $19.50 -$19.75 estimated earlier.

Accounting for the full-year effect of lower share count, debt retirement and company-wide expense reductions, the company projects core EPS in the range of $20.50 - $20.75.

The company estimates low-single digit revenue growth in 2020 and mid-twenties to high-twenties year-over-year improvement in core EPS.

Enterprise-wide expense reduction program is expected to generate more than $100 million of incremental annualized savings.

Business Update

Alliance Data successfully completed a "modified Dutch Auction" tender offer, buying back 5.1 million shares for $750 million, exclusive of fees and expenses related to the tender offer. It expects to opportunistically allocate the remaining net proceeds of $350 million based on management's assessment of potential investments to accelerate organic growth, its cash requirements, and the benefit from additional share buybacks.

Zacks Rank

Alliance Data currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

FleetCor Technologies FLT is slated to release third-quarter earnings on Oct 29. The Zacks Consensus Estimate for earnings is pegged at $3.05.

Cardtronics CATM is set to report third-quarter earnings on Oct 30. The Zacks Consensus Estimate for earnings is pegged at 70 cents.

Green Dot Corporation GDOT is set to report third-quarter results on Nov 6. The Zacks Consensus Estimate for earnings is pegged at 2 cents.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardtronics PLC (CATM) : Free Stock Analysis Report

FleetCor Technologies, Inc. (FLT) : Free Stock Analysis Report

Alliance Data Systems Corporation (ADS) : Free Stock Analysis Report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance