Allegiant (ALGT) Shares Fall In Spite of Rosy September Traffic

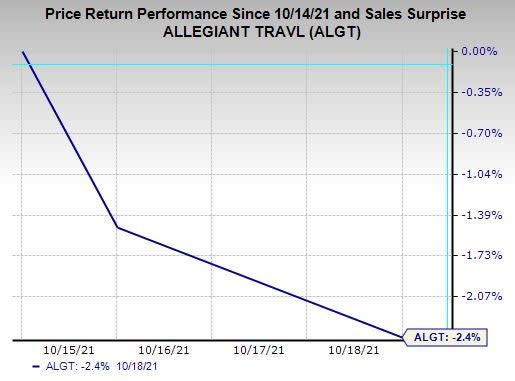

Allegiant Travel Company ALGT reported impressive traffic numbers for September as air-travel demand recovers in the United States from Delta variant-led woes. With more Americans getting vaccinated, the picture is rosier on a year-over-year basis as well as on a year-over-two-year basis. However, the upbeat traffic results failed to impress the market as shares of Allegiant dropped 2.4% since the date of traffic release (Oct 14).

Image Source: Zacks Investment Research

The downside was probably caused by an increase in fuel costs. With oil prices shooting up, Allegiant is witnessing a rise in fuel cost per gallon. The metric is now expected to be at $2.20 per gallon (previous expectation: $2.19 per gallon) for the third quarter (detailed results will be out on Oct 27). Due to higher-than-anticipated irregular operations costs, the company trimmed its third-quarter guidance for adjusted EBITDA margin. Adjusted EBITDA margin for the quarter is estimated to be approximately at 15.5-16.5% (previous guidance: 16-18%). Excluding heightened levels of irregular operations costs, adjusted EBITDA margin would have been nearly 24%.

Coming back to its September traffic report, scheduled traffic (measured in revenue passenger miles) surged 70% from September 2020 levels. Capacity (measured in available seat miles) for scheduled service increased 38.5% from September 2020 readings.

With the traffic surge outweighing capacity expansion, load factor (% of seats filled by passengers) in September expanded 13.1 points to 70.5% from the year-ago period’s levels. For the total system (including scheduled service and fixed fee contract), Allegiant carried more passengers in September 2021, up 71.5% from the September 2020 levels.

Compared with September 2019 levels (pre-COVID), traffic and capacity surged 7.8% and 26%, respectively. However, the load factor tanked 11.9 points to 70.5% as the increase in traffic was less than capacity expansion. For the total system, the airline carried 3.7% more passengers in September 2021 from September 2019 levels.

The carrier expects its September-end quarter’s total revenues to be up approximately 5.3% now (previous expectation: up 3-5%) from third-quarter 2019 levels.

Zacks Rank & Stocks to Consider

Allegiant currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Transportation sector are Landstar System LSTR, C.H. Robinson CHRW and Schneider National, Inc. SNDR. All the stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1(Strong Buy) Rank stocks here.

Long-term (three to five years) expected earnings per share growth rate for Landstar, C.H. Robinson and FedEx is projected at 12%, 9% and 17.9%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

C.H. Robinson Worldwide, Inc. (CHRW) : Free Stock Analysis Report

Allegiant Travel Company (ALGT) : Free Stock Analysis Report

Landstar System, Inc. (LSTR) : Free Stock Analysis Report

Schneider National, Inc. (SNDR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance