Allegiant (ALGT) Grapples With Rising Expenses and High Debt

Allegiant Travel Company (ALGT) is being hurt by rising operating expenses. The northward movement in labor expenses is also hurting ALGT’s bottom line by pushing up operating costs. In first-quarter 2024, total operating expenses rose 15.5% year over year.

ALGT’s weak liquidity position is also concerning. At the end of first-quarter 2024, the company’s total unrestricted cash and investments were $853.7 million, much lower than the long-term debt and finance lease obligations (net of current maturities and related costs) of $1,789.6 million. This implies that the company does not have sufficient cash to meet its debt obligations.

For 2024, under airline capex, aircraft, engines, induction costs and pre-delivery deposits are expected to be in the $230-250 million range, despite the economic uncertainty. Capitalized deferred heavy maintenance is expected to be in the range of $80-$90 million. Other airline capital expenditures are expected to be between $160 million and $170 million. Such high capex may hurt the bottom line.

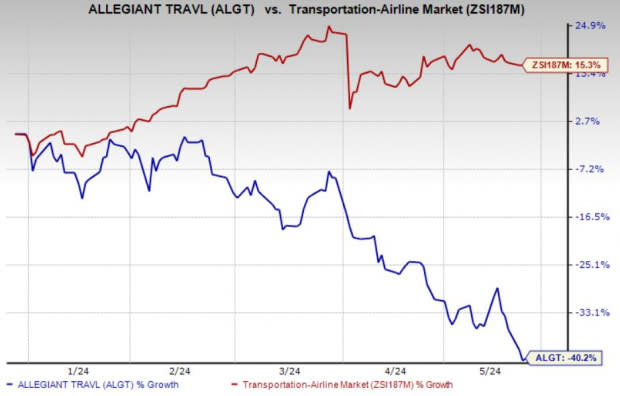

Partly due to these headwinds, shares of ALGT have plunged 40.2% so far this year, underperforming its industry’s growth of 15.3%.

Image Source: Zacks Investment Research

The negative sentiment surrounding the stock is evident from the fact that the Zacks Consensus Estimate for current-year earnings has been revised downward by 45.9% over the past 90 days.

Despite such headwinds, we are impressed by the company's efforts to modernize its fleet. The carrier operates an all-Airbus fleet. Allegiant's fleet size at the end of 2019 was 91 (37 A319 and 54 A320), up from the 2018 reported figure. Despite coronavirus-related woes, the fleet size increased to 95 in 2020. ALGT exited 2022 with 121 (35 A319 and 86 A320) planes in its fleet. The fleet size was 126 at 2023-end. ALGT aims to expand its fleet size to 126 at the end of 2024.

Zacks Rank and Stocks to Consider

Allegiant currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks for investors’ consideration in the Zacks Transportation sector include GATX Corporation GATX and Trinity Industries, Inc. (TRN). Each stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

GATX has an encouraging earnings surprise history. The company has surpassed the Zacks Consensus Estimate in three of the last four quarters (missing the mark in the other). The average beat is 7.49%.

The Zacks Consensus Estimate for 2024 earnings has been revised 3% upward over the past 90 days. GATX has an expected earnings growth rate of 6.79% for 2024. Shares of the company have risen 18.4% in the past year.

Trinity raised 2024 earnings per share guidance to the range of $1.35 to $1.55 (which excludes items outside of the company’s core business operations) from $1.30 to $1.50 guided previously.

Over the past 30 days, the Zacks Consensus Estimate for TRN’s 2024 earnings has been revised 2.7% upward. For 2024, TRN’s earnings are expected to grow 8.70% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Trinity Industries, Inc. (TRN) : Free Stock Analysis Report

Allegiant Travel Company (ALGT) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance