Alibaba Tumbles After Nixing Cloud Spinoff on US Chip Curbs

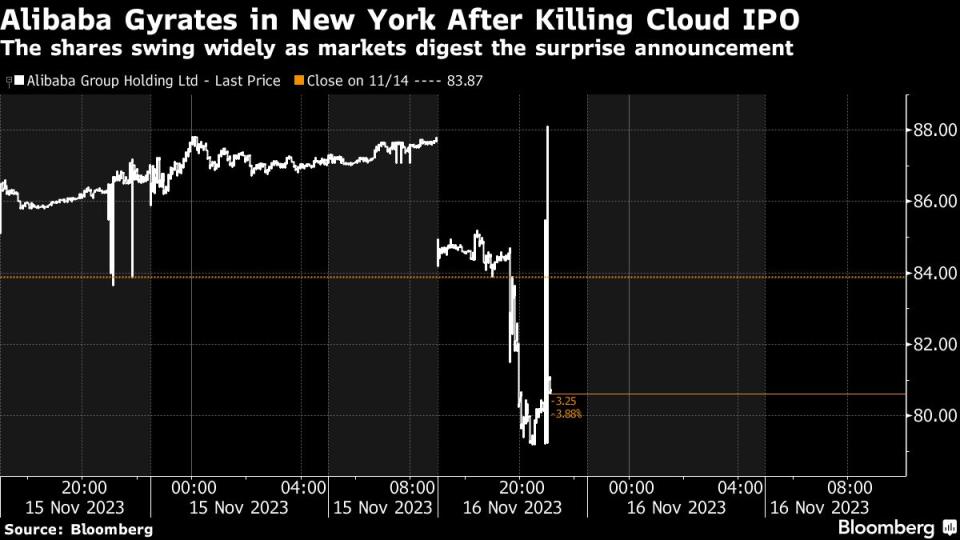

(Bloomberg) -- Alibaba Group Holding Ltd. tumbled as much as 10% after it called off a spinoff of its giant cloud business as a result of tightened US curbs on advanced chips for China.

Most Read from Bloomberg

The Doomed Mission Behind Sam Altman’s Shock Ouster From OpenAI

Citigroup Cuts Over 300 Senior Manager Roles in Latest Restructuring

Nearly All of OpenAI Staff Threaten to Go to Microsoft If Board Doesn’t Quit

Tech Giants Roar as Nasdaq 100 Hits 22-Month High: Markets Wrap

The announcement stunned investors, sending shares down to a low of $78.23 as trading got underway in New York, and casting doubt on a historic overhaul laid out mere months ago.

China’s e-commerce leader said it’s “reset” and decided not to pursue a plan to hive off and eventually list its cloud services division. Instead, it will focus on growing the unit organically and dole out its first-ever annual dividend of $2.5 billion, assuaging shareholders hoping for a big payout from the unit’s debut.

The decision comes as Alibaba tries to stage a comeback from Covid and a tech-sector crackdown. China’s online shopping leader is trying to win back merchants and shoppers that gravitated toward PDD Holdings Inc. and newer entrants such as ByteDance Ltd.’s Douyin, and corporate users that shifted to state-backed cloud services. However, that last effort is complicated by US curbs on artificial intelligence chips, which cloud services need to power datacenters and high-end computing.

The Chinese e-commerce leader joins Tencent Holdings Ltd. in acknowledging difficulties brought about by the US curbs announced last month. The Biden administration’s efforts to prevent the Chinese government from obtaining cutting-edge chips for military applications are now affecting the country’s private sector in unexpected ways.

This “should be a big surprise to the market. This is a big contrast to the previous clear spinoff timetable,” said Willer Chen, research analyst at Forsyth Barr Asia. “Even considering the relatively weak market situation, the suspension still leaves the market scratching its head. The first annual dividend looks like a compensation to shareholders. However, it may not fully offset the shock given the higher value of cloud unit.”

On Thursday, Alibaba also confirmed it was suspending an IPO of grocery arm Freshippo, a lesser but well-known business.

The company announced those decisions along with quarterly earnings. It posted an 8.5% rise in sales to 224.79 billion yuan ($31 billion) in the September quarter, slightly exceeding average projections. It swung to a net profit of 27.7 billion yuan from a year-ago loss.

Alibaba this year unveiled the most radical corporate overhaul in its history. The Hangzhou-based company announced a break-up into six main units, most of which will eventually go public. That maneuver was designed to grant more autonomy to the separate businesses, hopefully rejuvenate them, and create value on markets. Such a split, however, will likely reduce Alibaba’s heft and erode its position as one of the leaders of the Chinese digital economy.

“The recent expansion of U.S. restrictions on export of advanced computing chips has created uncertainties for the prospects of Cloud Intelligence Group,” it said in a statement. “Accordingly, we have decided to not proceed with a full spin-off, and instead we will focus on developing a sustainable growth model for Cloud Intelligence Group under the fluid circumstances.”

Even before Thursday’s announcement, the effort had hit a few bumps. The company put a potential Hong Kong IPO of its Freshippo grocery chain on the backburner amid weak sentiment for consumer stocks. Former Chief Executive Officer Daniel Zhang quit just months after agreeing to lead its cloud division. Logistics arm Cainiao filed for a Hong Kong IPO in late September but it remains unclear what sort of valuation it could command.

With Zhang’s exit, two of Jack Ma’s longest-standing confidants — Joseph Tsai and Eddie Wu — are now tasked with orchestrating the other spinoffs and revitalizing the company as a whole.

One of their big bets is in AI, joining major Chinese tech peers and a host of up-and-coming startups. The company has released its own large language model, Tongyi Qianwen, and is also investing in high-flying startups like Zhipu AI and Baichuan. Tsai said last month the cloud unit now hosts half of China’s generative AI firms and serves about 80% of the country’s technology companies.

It’s unclear how the US sanctions will affect that effort. The cloud division is at the heart of Alibaba’s AI initiatives, and requires the sort of powerful chips that Nvidia Corp. provides to train AI models but that are now mostly barred from Chinese firms.

US sanctions are “not the lone reason for Alibaba not to spin off the unit,” said Daniel Tu, founder and managing director at Active Creation Capital. “Perhaps focusing on the Group’s overall operations efficiency and “resetting” its once-competitive advantages are now priorities over the listing plan for its cloud unit.”

What Bloomberg Intelligence Says

Alibaba’s inaugural dividend payment of $2.5 billion, which works out to an implied yield of 1.1%, based on Nov. 15 market cap, may not be enough to offset the overhang from cloud revenue growth after Alibaba suspended plans to fully spin off the unit, as this suspension may hamper the ability to attract new clients. It’s unclear if Alibaba also plans to instill a dividend policy to commit to a recurring distribution of earnings to shareholders.

- Catherine Lim and Tiffany Tam, analysts

Click here for the research.

Away from the cloud business, Alibaba is also grappling with a tepid consumer economy.

Read More: Alibaba, JD Fail to Inspire in China Discount Shopping Gala

Alibaba and traditional rival JD.com Inc. are coming off a disappointing Singles’ Day campaign. China’s twin e-commerce leaders likely managed only single-digit percentage growth during their signature annual shopping festival, outpaced by smaller but more innovative social media rivals like Douyin and Kuaishou Technology.

Against that backdrop, some companies have managed to perform better than feared. Social media leader Tencent, which has been investing heavily in video, and JD both reported better-than-projected results on Wednesday.

Alibaba itself has taken aggressive measures to boost its e-commerce business. Its Taobao and Tmall have been focusing on content creation to ward off competition from social media platforms, and launched AI-powered tools for merchants. It also cut tens of thousands of staff in past quarters to reduce expenses.

--With assistance from Vlad Savov, Sarah Zheng, Zheping Huang, Peter Elstrom and Lulu Yilun Chen.

(Updates with US share trading)

Most Read from Bloomberg Businessweek

More Americans on Ozempic Means Smaller Plates at Thanksgiving

The Share of Americans Who Are Mortgage-Free Is at an All-Time High

Inflation Raging in Triple Digits Is Pushing Argentina Down a Radical Path

At REI, a Progressive Company Warns That Unionization Is Bad for Vibes

The Impact and Cost of Musk’s Endorsement of Antisemitism on X

©2023 Bloomberg L.P.

Yahoo Finance

Yahoo Finance