Akamai (AKAM) Completes Noname Security Buyout for $450M

Akamai Technologies, Inc. AKAM has completed the acquisition of Noname Security, a top application programming interface (API) security vendor, for approximately $450 million. Announced on May 7, the transaction marks a significant move in the API security landscape and is likely to prove beneficial for the company in the long run.

Transaction Rationale

Noname Security, renowned for its comprehensive API security solutions, will bolster Akamai’s capabilities to meet the escalating demand for robust API protections. APIs are integral to the digital ecosystem, driving functions across various industries such as banking, e-commerce and IoT. Their extensive use makes them prime targets for cyberattacks. Akamai’s data reveals a 109% increase in API attacks year over year, underscoring the urgency for enhanced security measures.

The acquisition will enhance Akamai’s ability to safeguard API traffic across diverse environments and deployments. The deal will leverage Noname’s sales, marketing resources and established alliances, boosting Akamai's reach and impact. The integration aims to create a unified product, Akamai API Security, combining the best of both companies’ technologies.

Industry Perspective

APIs are fundamental to modern business operations, enabling digital transformation and facilitating mobile and IoT adoption. They are pivotal in B2B and B2C interactions, driving the economy at large. However, their widespread use and exposure make them susceptible to sophisticated attacks. The acquisition positions Akamai to address these vulnerabilities more effectively, responding to the growing market need for comprehensive API security solutions.

Web application and API protection (WAAP) platforms, while essential, often lack the depth required to counter all API threats. APIs differ from web applications in their operational logic and exposure, necessitating specialized security measures. Noname’s integration will enhance Akamai’s capabilities in detecting and mitigating these nuanced threats, offering a more robust defense than traditional WAAP solutions.

Significance for Akamai

For Akamai, this acquisition is pivotal in accelerating its growth and reinforcing its position as a leader in the API security domain. The deal aligns with Akamai's strategy to innovate and expand its security offerings, ensuring comprehensive protection for customers’ digital assets. Noname’s expertise will enrich Akamai’s existing API security framework, providing advanced features like machine learning-based threat detection, enhanced visibility of API landscapes and active testing of APIs during development.

The strategic buyout not only addresses current security challenges but also positions Akamai as a pacesetter in the API security industry. The integration process will focus on leveraging Akamai’s vast edge network, enhancing its App & API Protector platform, incorporating advanced threat intelligence and further solidifying its market leadership.

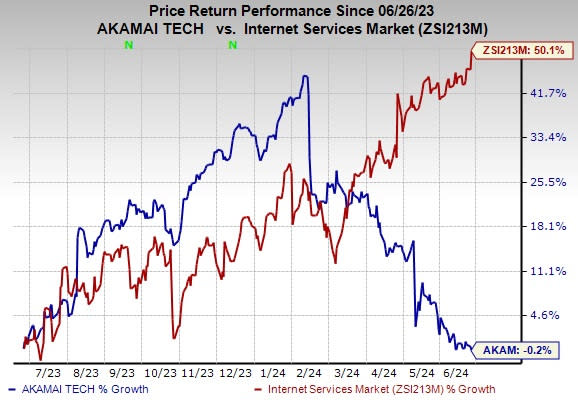

The stock has lost 0.2% over the past year against the industry’s growth of 50.1%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Akamai currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Arista Networks, Inc. ANET, sporting a Zacks Rank #1 at present, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 15.7% and delivered an earnings surprise of 15.4%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed data center segment. Arista is increasingly gaining market traction in 200 and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Harmonic Inc. HLIT, currently carrying a Zacks Rank #2 (Buy), is another key pick in the broader industry. Headquartered in San Jose, CA, the company provides video delivery software, products, system solutions and services worldwide.

With more than three decades of experience, HLIT has revolutionized cable access networking via the industry's first virtualized cable access solution, enabling cable operators to more flexibly deploy gigabit Internet service to consumers' homes and mobile devices. Harmonic delivered an earnings surprise of 5.6%, on average, in the trailing four quarters.

Motorola Solutions, Inc. MSI, carrying a Zacks Rank #2 at present, delivered an earnings surprise of 7.5%, on average, in the trailing four quarters. It has a long-term earnings growth expectation of 9.5%.

Motorola provides services and solutions to government segments and public safety programs, along with large enterprises and wireless infrastructure service providers. It develops and services both analog and digital two-way radio, voice and data communications products, and systems for private networks, wireless broadband systems and end-to-end enterprise mobility solutions to a wide range of enterprise markets.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Harmonic Inc. (HLIT) : Free Stock Analysis Report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance