Akamai (AKAM) Beats Q1 Earnings Estimates, Top Line Rise Y/Y

Akamai Technologies, Inc. AKAM reported healthy first-quarter 2023 results, with the bottom and the top line beating the respective Zacks Consensus Estimate. Portfolio expansion through product innovation and solid demand in Security and Compute verticals led to the top-line growth year over year. The company’s acquisition strategy is also enhancing the robustness of its portfolio and driving commercial expansion.

Net Income

On a GAAP basis, net income in the reported quarter was $97.1 million or 62 cents per share compared with $133.4 million or 82 cents per share in the year-ago quarter. Despite net sales growth, higher operating expenses induced a year-over-year decline.

Non-GAAP net income in the quarter was $218.3 million or $1.40 per share compared with $224.8 million or $1.39 per share a year ago. The bottom line surpassed the Zacks Consensus Estimate by 8 cents.

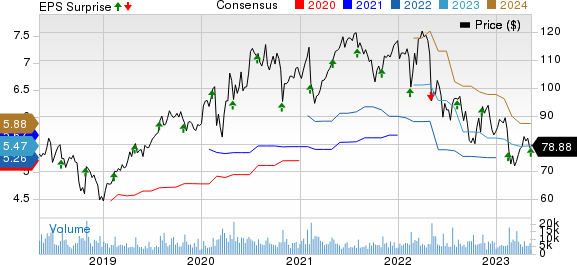

Akamai Technologies, Inc. Price, Consensus and EPS Surprise

Akamai Technologies, Inc. price-consensus-eps-surprise-chart | Akamai Technologies, Inc. Quote

Revenues

During the quarter, Akamai registered revenues of $915.7 million, up from $903.6 million reported in the prior-year quarter. Net sales growth in Compute and Security businesses supported the top line. The company’s strategy of portfolio expansion through innovation and strategic acquisition boosted the top line. Revenues beat the Zacks Consensus Estimate of $910 million.

By product groups, Security Technology Group revenues were $405.6 million, up 6% year over year, driven by solid performance from Guardicore and high demand for lab solutions. Revenues from Delivery amounted to $394.3 million, down 11% from $444.1 million reported in the year-ago quarter. Compute revenues increased 49 % year over year to $115.8 million from $77.9 million in the prior-year quarter, owing to the growing demand for various cloud computing services. The acquisition of Ondat Technology, a U.K.-based cloud storage company, increased the robustness of its portfolio and supported the gains from this segment.

Region-wise, U.S. revenues were $473.8 million, down 1% year over year. International revenues were $441.9 million, up 5%. Foreign exchange fluctuations had a negative $21 million impact on revenues on a year-over-year basis.

Other Details

Non-GAAP operating margin fell to 29%, down 1% year over. Adjusted EBITDA was $375.7 compared with $391.3 million in the year-ago quarter, with respective margins of 41% and 43 %. In the March quarter Akamai’s total operation expenses rose to $789.1 million from $730.3 million reported in the prior year quarter.

Cash Flow & Liquidity

In first-quarter 2023, Akamai generated $233.5 million in cash from operating activities compared with $222.5 million in the prior-year quarter. As of Mar 31, 2023, the company had $298.8 million in cash and cash equivalents with $735.8 million of operating lease liabilities. During the reported quarter, Akamai repurchased approximately 4.6 million shares for around $349 million.

Outlook

For the second quarter of 2023, Akamai expects revenues between $923 million and $937 million. Management expects a non-GAAP operating margin of 28.5%. Non-GAAP earnings are envisioned in the range of $1.38-$1.42 per share.

For 2023, Akamai expects revenues between $3,740 million and $3,785 million. It expects a non-GAAP operating margin of 28-29%. Non-GAAP earnings are expected in the band of $5.69-$5.84 per share.

Zacks Rank & Stocks to Consider

Akamai currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

InterDigital, Inc IDCC, carrying a Zacks Rank #2 (Buy), delivered an earnings surprise of 170.89%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 579.03%.

It is a pioneer in advanced mobile technologies that enables wireless communications and capabilities. The company engages in designing and developing a wide range of advanced technology solutions, which are used in digital cellular as well as wireless 3G, 4G and IEEE 802-related products and networks.

Meta Platforms Inc. META, sporting a Zacks Rank #1, delivered an earnings surprise of 15.46%, on average, in the trailing four quarters. Meta Platforms is the world’s largest social media platform. The company’s portfolio offering evolved from a single Facebook app to multiple apps like photo and video sharing app Instagram and WhatsApp messaging app owing to acquisitions.

Meta is considered to have pioneered the concept of social networking, which is why it enjoys a first mover’s advantage in this market. As developed regions mature, Meta undertakes measures to drive penetration in emerging markets of South East Asia, Latin America and Africa.

Workday Inc. WDAY, carrying a Zacks Rank #2, delivered an earnings surprise of 7.67%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 11.24%.

Workday is a provider of enterprise-level software solutions for financial management and human resource domains. The company’s cloud-based platform combines finance and HR in a single system that makes it easier for organizations to provide analytical insights and decision support.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Workday, Inc. (WDAY) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance