Airbus Plus Two Additional Stocks Considered Undervalued On Euronext Paris

Amidst a backdrop of political stability and easing monetary policies, the French market, as reflected by the CAC 40 Index's recent gain of 1.67%, shows promising signs for investors looking for value opportunities. In such an environment, identifying undervalued stocks like Airbus can be particularly compelling as they may benefit from broader economic tailwinds and sector-specific dynamics.

Top 10 Undervalued Stocks Based On Cash Flows In France

Name | Current Price | Fair Value (Est) | Discount (Est) |

Vente-Unique.com (ENXTPA:ALVU) | €15.15 | €29.86 | 49.3% |

Airbus (ENXTPA:AIR) | €148.58 | €218.22 | 31.9% |

Kaufman & Broad (ENXTPA:KOF) | €27.40 | €52.96 | 48.3% |

Lectra (ENXTPA:LSS) | €27.90 | €43.17 | 35.4% |

Wavestone (ENXTPA:WAVE) | €53.10 | €88.63 | 40.1% |

Vivendi (ENXTPA:VIV) | €9.79 | €15.52 | 36.9% |

MEMSCAP (ENXTPA:MEMS) | €5.46 | €8.56 | 36.2% |

Tikehau Capital (ENXTPA:TKO) | €22.05 | €32.43 | 32% |

Thales (ENXTPA:HO) | €156.60 | €254.73 | 38.5% |

Groupe Airwell Société anonyme (ENXTPA:ALAIR) | €3.88 | €6.72 | 42.3% |

Here we highlight a subset of our preferred stocks from the screener

Airbus

Overview: Airbus SE operates globally, specializing in the design, manufacture, and delivery of aerospace products, services, and solutions with a market capitalization of approximately €117.45 billion.

Operations: The company's revenue is primarily generated from three segments: €48.82 billion from its core aerospace activities, €11.60 billion from its Defence and Space division, and €7.20 billion through Helicopter operations.

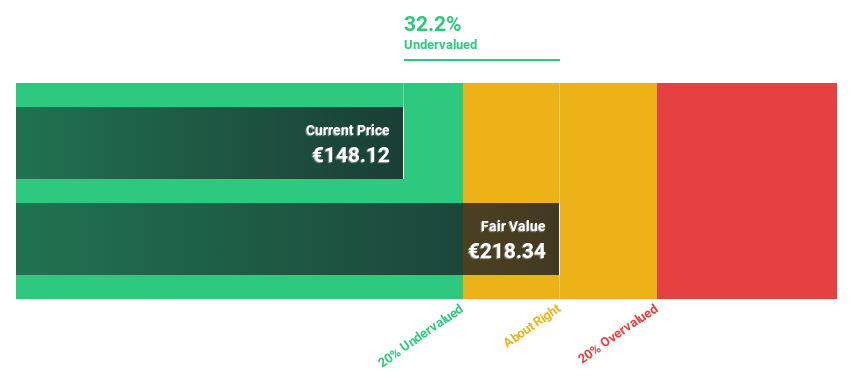

Estimated Discount To Fair Value: 31.9%

Airbus SE, priced at €148.58, is trading significantly below our fair value estimate of €218.22, marking a potential undervaluation based on discounted cash flow analysis. With earnings growth forecasted at 17.5% per year—outpacing the French market's 11%—and revenue expected to increase by 10.3% annually, Airbus demonstrates robust financial health relative to the broader market. Despite these positive indicators, it's crucial to note that Airbus' earnings growth isn't classified as 'significant,' hinting at moderate rather than exceptional future profitability increases.

The analysis detailed in our Airbus growth report hints at robust future financial performance.

Take a closer look at Airbus' balance sheet health here in our report.

Thales

Overview: Thales S.A. is a global company offering a range of solutions in defense, aerospace, digital identity and security, and transportation sectors, with a market capitalization of approximately €32.36 billion.

Operations: Thales generates revenue across several key sectors, with €10.18 billion from Defense & Security (excluding Digital Identity & Security), €5.34 billion from Aerospace, and €3.42 billion from Digital Identity & Security.

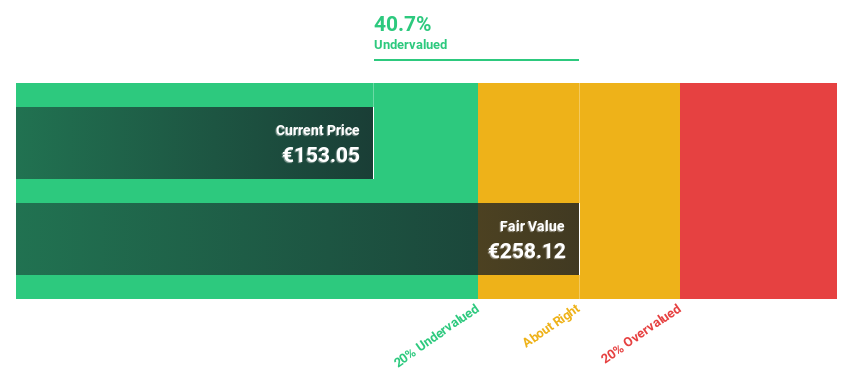

Estimated Discount To Fair Value: 38.5%

Thales, valued at €156.6, appears undervalued by 38.5% against a fair value estimate of €254.73 based on cash flow analysis. Recent strategic alliances and product innovations underscore its proactive market stance, potentially bolstering its forecasted annual profit growth of 15.1% and revenue growth of 6.3%. However, concerns linger over its high debt levels and unstable dividend track record, which could temper investor enthusiasm despite these positive projections.

Vivendi

Overview: Vivendi SE is a France-based entertainment, media, and communication company with operations spanning Europe, the Americas, Asia/Oceania, and Africa, boasting a market capitalization of €10.03 billion.

Operations: Vivendi's revenue is primarily generated through Canal + Group (€6.06 billion), Havas Group (€2.87 billion), Lagardère (€0.67 billion), Gameloft (€0.31 billion), and Prisma Media (€0.31 billion).

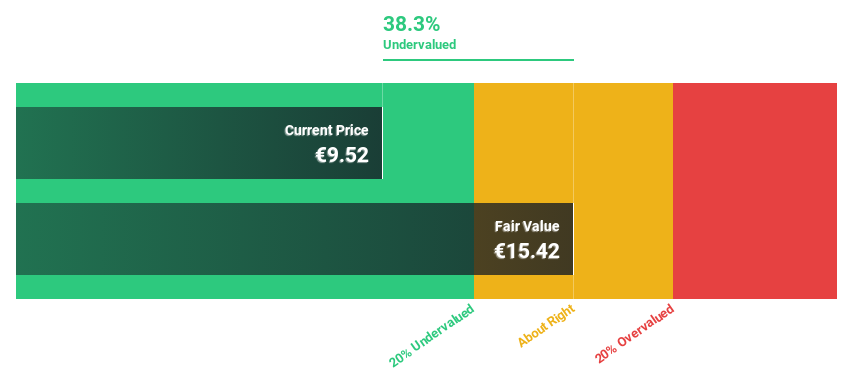

Estimated Discount To Fair Value: 36.9%

Vivendi, priced at €9.79, trades 36.9% below its fair value of €15.52, signaling potential undervaluation based on cash flow metrics. Despite a shaky dividend history, recent approval of a €0.25 per share dividend and a significant revenue jump to €4.27 billion in Q1 2024 highlight strengthening financials. Analysts expect robust earnings growth at 29.3% annually over the next three years, outpacing the French market significantly, although projected low return on equity at 6% suggests caution.

Next Steps

Explore the 14 names from our Undervalued Euronext Paris Stocks Based On Cash Flows screener here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:AIRENXTPA:HOENXTPA:VIV and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance